The general task that was given to me was to help Huntington re-imagine day-to-day banking. After conducting co-design research methods such as experience mapping, daily logs, surveys, interviews, conceptual mapping, and plenty of reading, my research has had two breakthroughs –

1. Prices are generally increasing at a rate greater than our income.

2. People far underestimate (3.8x) how much they spend, even though they believe we are in an economic recession, and they intend to increase their spending – experiencing little to no buyer’s remorse.

Problematic: How can emerging technology help us to be more aware of our irrational spending habits?

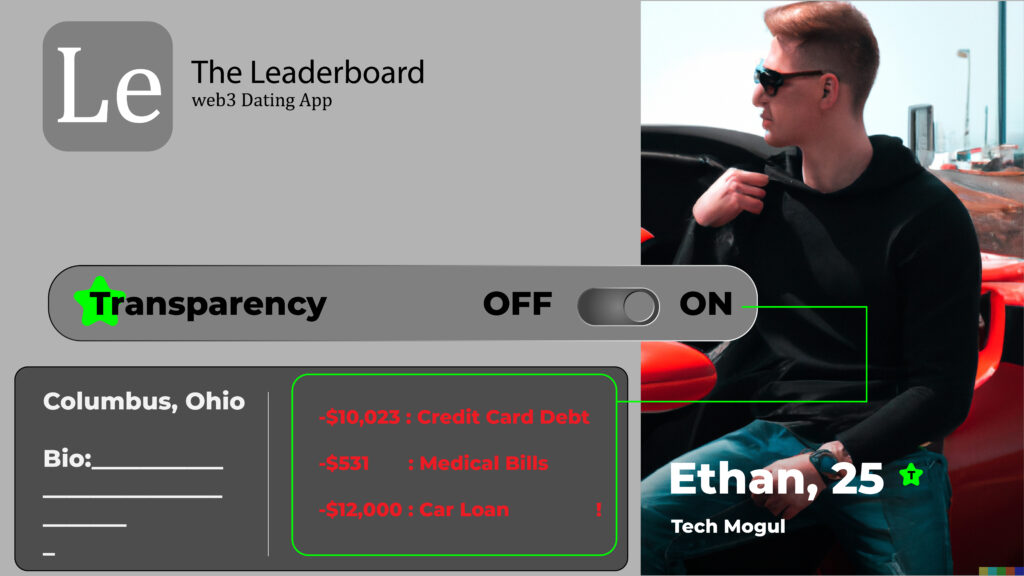

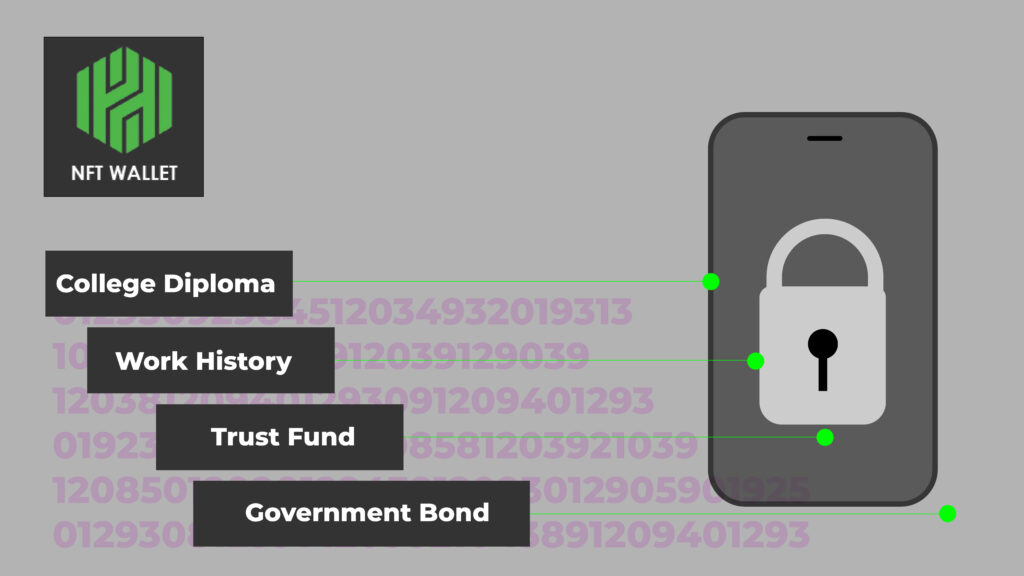

Prototyping: Ideating through conjectures was very impactful as it helped me explore ways to merge auxiliary worlds with finance. Among them “The Leaderboard” stands out. In short, it is a speculative dating app that connects your NFT wallet to your profile. In this world, the NFT is less like trading cards and more like a digital collection of your identity.

When you buy a new car, you receive an NFT, when you receive a loan, you receive an NFT, when you attend a concert you also receive an NFT. The Leaderboard is not supposed to be an achievable or even a preferred future. Rather it is a discursive design project that asks us to think about our own spending behaviors. It asks –

How much of our irrational spending comes from trying to “look the part”?

What would your dating profile look like? Would you still pose with your sports car if we knew it was still financed?

Creating the conjecture was an exploration of myself. I reflected on my own habits and irrational expenses. Why do we purchase Gucci? It’s a critique on the entire concept of celebrity endorsements and high fashion. There is enough design dedicated to asking more of consumers, I think it is refreshing to think about designing for less.

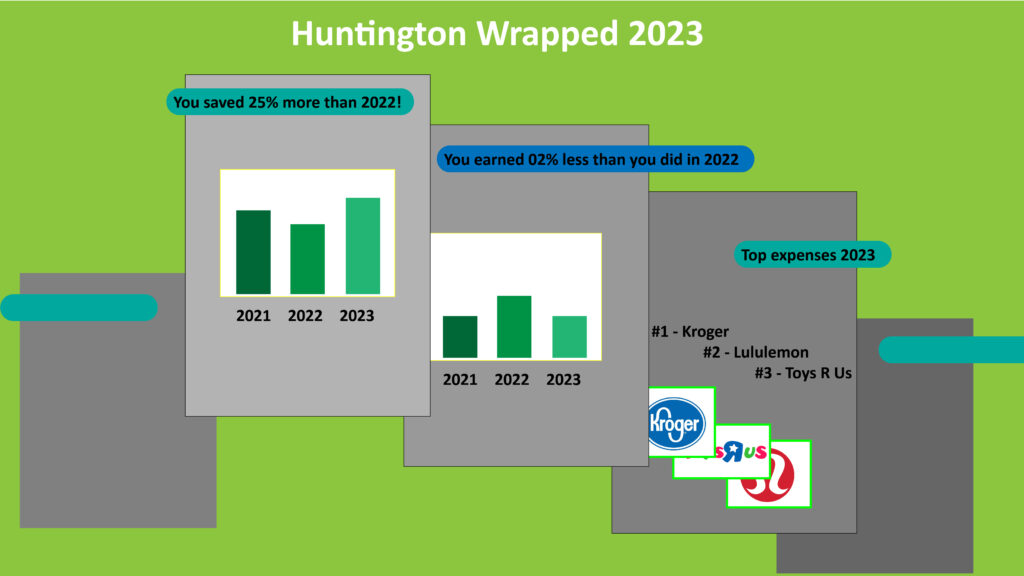

Another conjecture that was crucial to discovering the brief was Huntington Wrapped 2023. It is a spin-off of the Spotify Wrapped event. The idea is that annually you will be given a breakdown of where your money went in the last year. Income earned, top new places you’re spending at, and it would compare your new statistics to last year. The takeaway is that you are faced with your habits in a transparent way – and that users might not enjoy that. I empathize with the idea of being scared to check your bank account after a shameful weekend. In this conjecture, I find that transparency is an underutilized mechanic that gives users autonomy over their assets. I believe that it is underutilized by design. Why is there no IRS Wrapped 2023 that shows you every type of tax that you’ve spent? Probably because limited transparency is a mechanic used to keep the questions to a minimum.

Brief: How can we use design to integrate our finances into our online identity; to address how commercialism is influencing us to maintain an appearance and lifestyle we cant afford?

Primary Research:

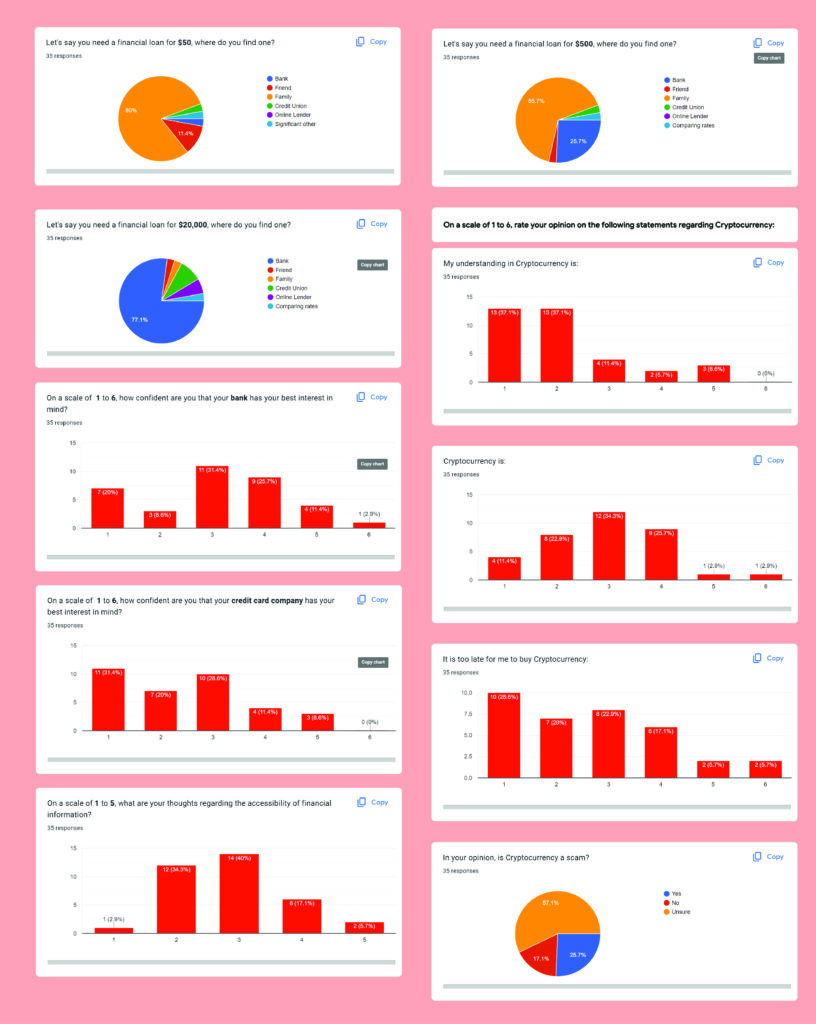

Survey –

My survey questioning was a method of searching for areas of interest. I was not confident in one topic or another, so I threw a mixed bag of questions out to see what stuck. My survey consisted of questions ranging from confidence to crypto to spending, loans, and information accessibility. I received 35 answers by method of convenience sampling, the results were not necessarily helpful on their own, but they are supportive of my research booklet findings.

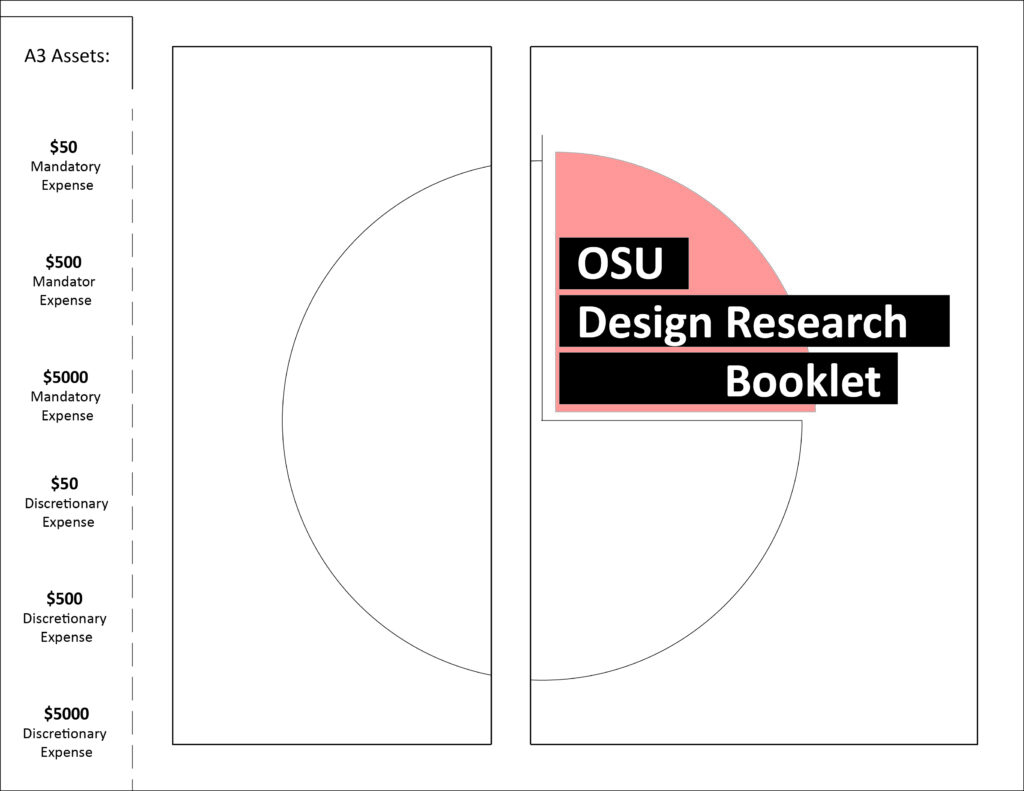

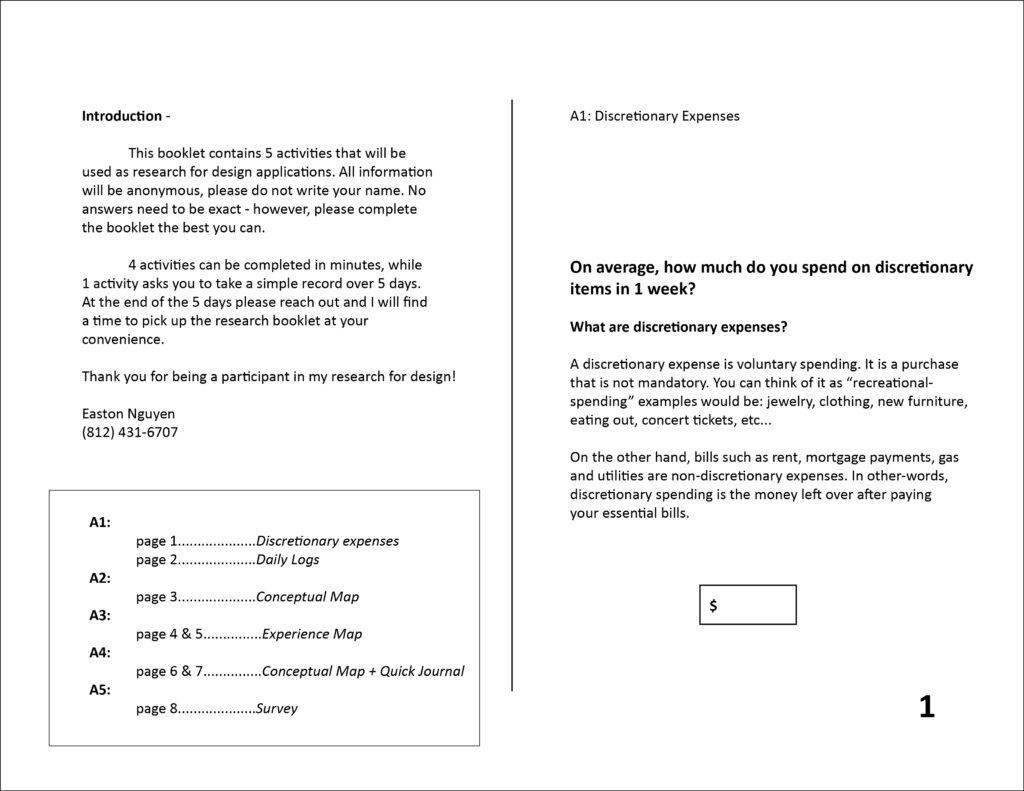

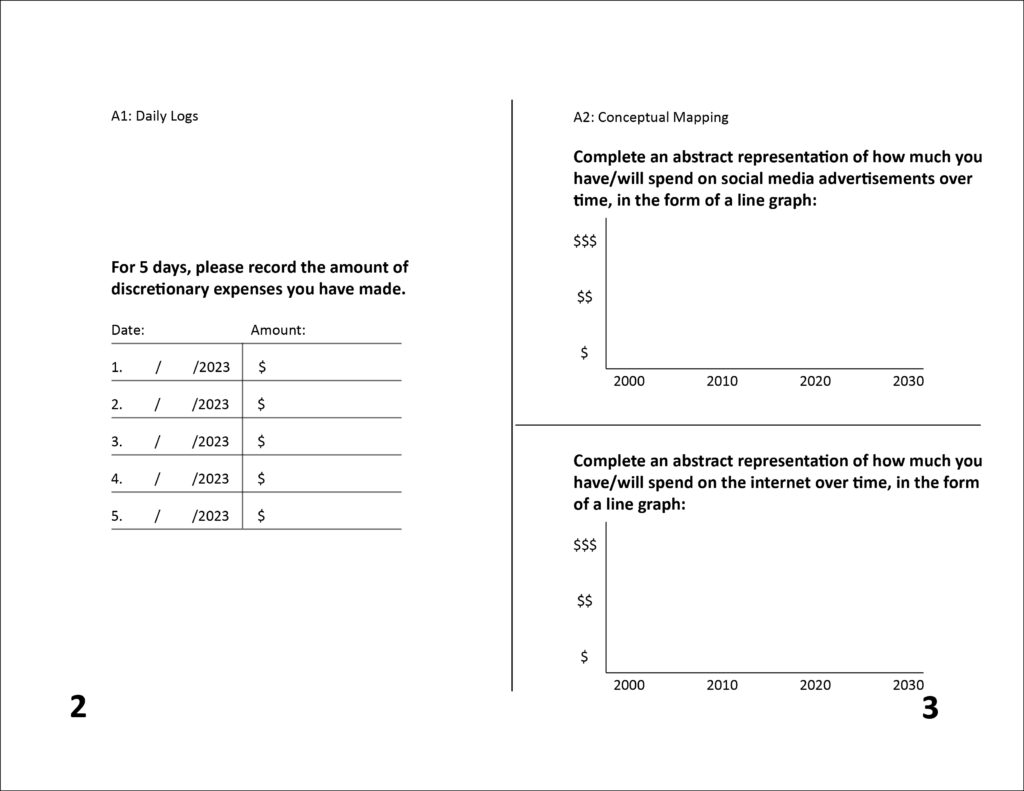

Research Booklet –

I ended up creating a research booklet to hand out to people in my life from ages 25 to 45. I only got a total of 8 booklets done, as I overestimated people’s interest in doing charity work. If I were to do this again, I would try to make the booklet a one-sitting activity. The issue was that I wanted to see how much people spend vs. how much they think they spend so I had them track that number over 5 days.

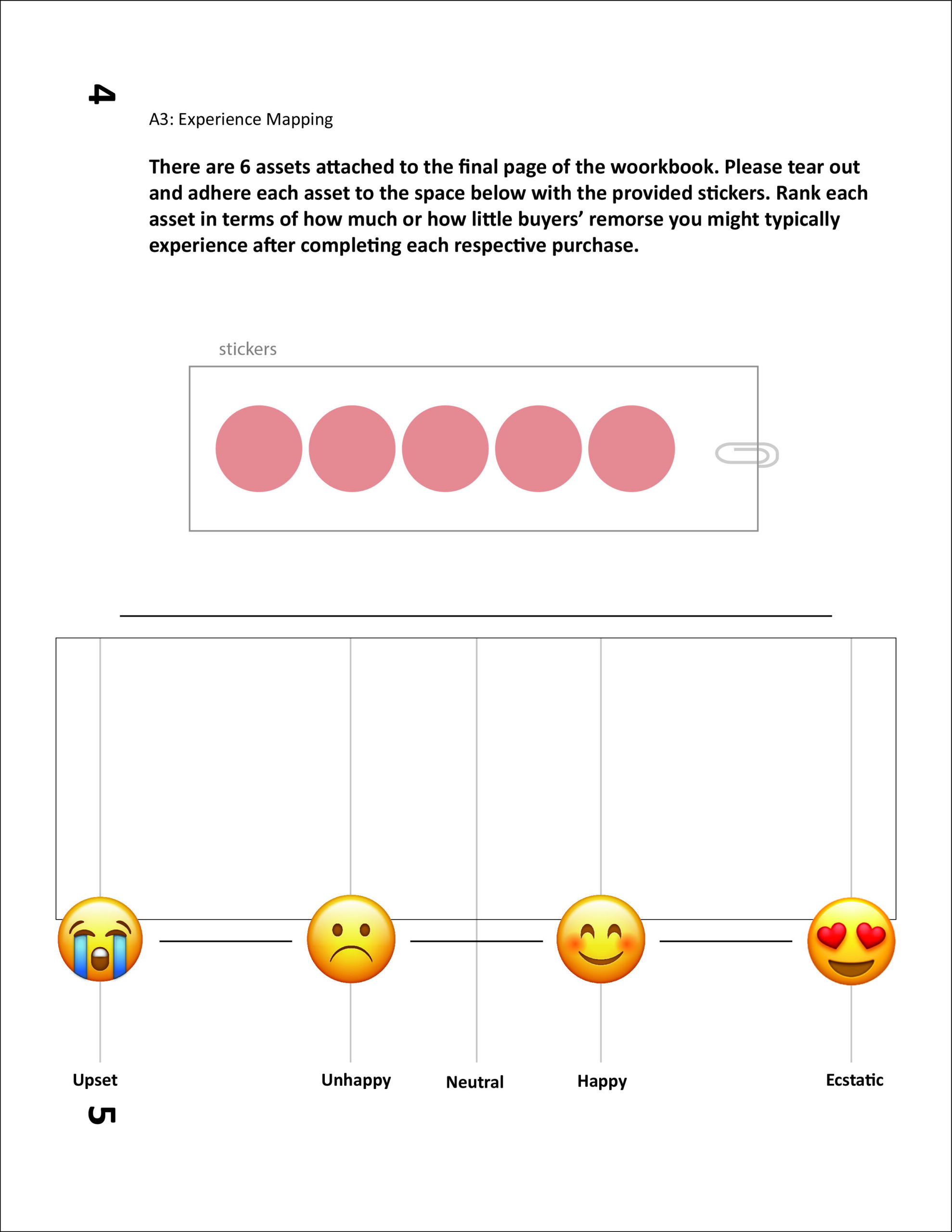

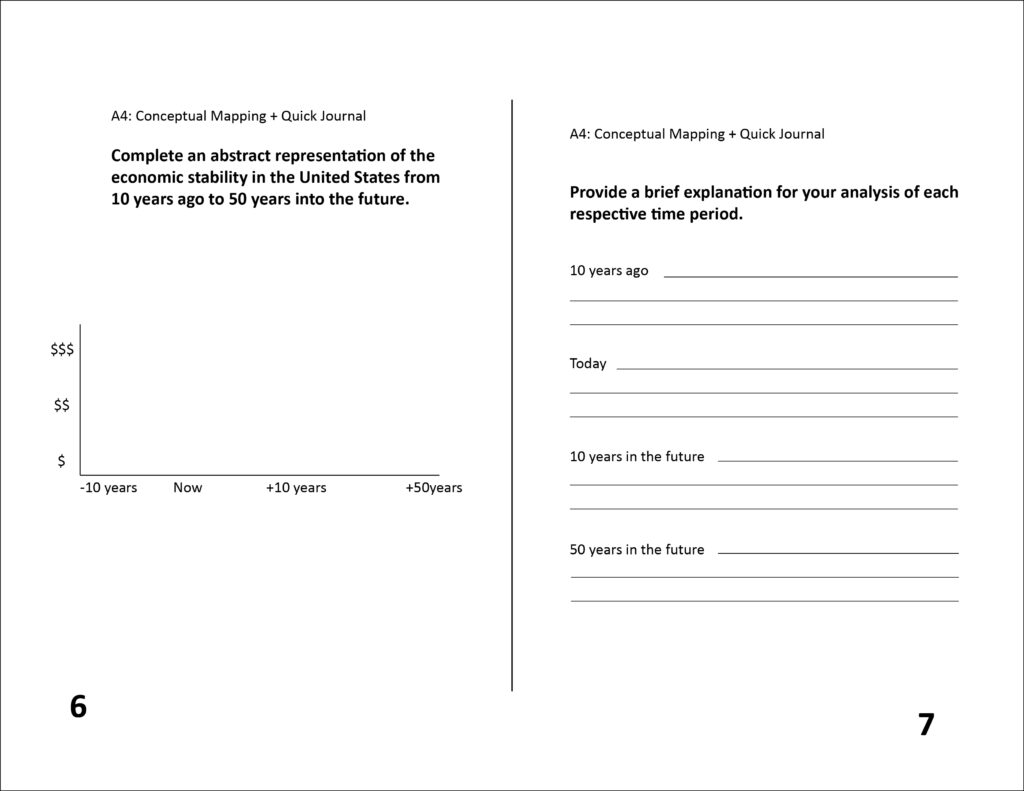

The booklet was a big success though, the findings were fascinating after I had gotten a few back and saw congruencies. My Numbers section does a better job of seeing the data compiled, but the findings were as follows:

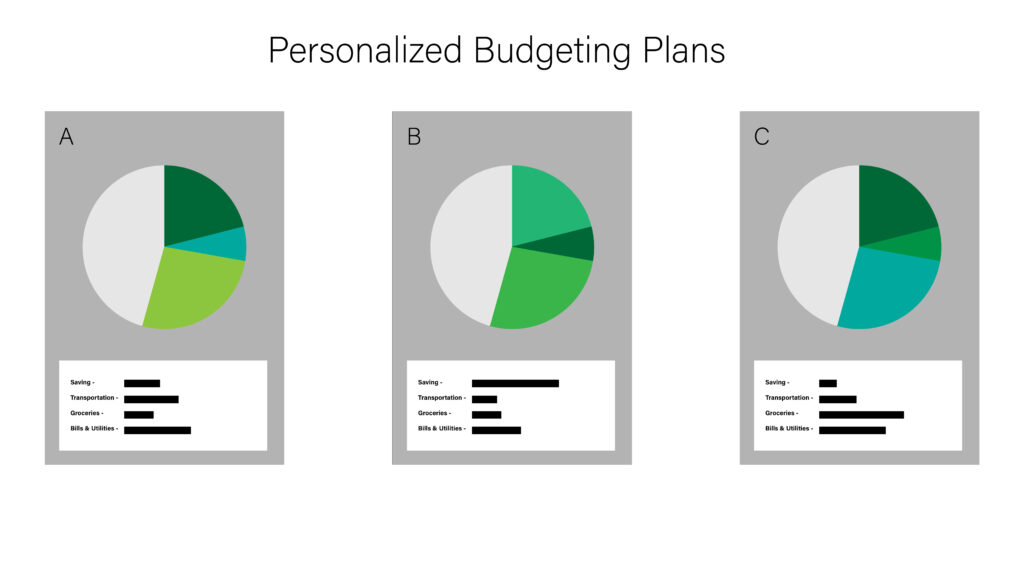

- People spend 3.8x more on discretionary expenses in 5 days than they expect.

- People expect to increase their spending habits through social media advertisements and online.

- People believe we are in a recession.

- People are optimistic about our economic stability in the next 10 to 100 years.

- People are unhappy spending money on mandatory expenses.

- People are happy spending money on discretionary expenses.

Once the findings were combined two conclusions I came to were that

- Although people believe they are in an economic recession, they still find joy in spending.

- Although people believe they are in an economic recession, they expect to continue spending money and they are far underestimating how much they currently spend on discretionary expenses.

Interviews –

In the contemporary world of finance, there are two competing economic models that seem to not be able to stand each other – the world of decentralized finance (DEFI) and the world of centralized finance (CEFI), which is what we operate on today. I spoke with one individual from each respective ideology to get a sense of what they think about each other. The takeaways from the interview were not all that surprising. Sam, who is an investment banker was not as useful in telling me about the disadvantages of decentralized economics because he just was not familiar with the territory. Even though not familiar with it, he still had a distaste for it. He said that DEFI is a false promise and that in the office it is somewhat taboo to talk about. This is not the first time in my research that I have heard or felt the talk of crypto treated as a “bad word”, it will continue in the section below where I talk with Huntington, our client.

Parth is the second person I interviewed, he is a close friend of mine who is running a crypto start-up business that aims to become an insurance provider for users’ assets using blockchain. He gave me 2 interesting facts; that it only takes $35,000 to launch a bank, and in El Salvador there were 4.4 million people who were completely bankless until a crypto helped them establish one. The key takeaway from the conversation was really his insight into the banks’ purpose. He said that they are necessary no matter what because they hold the trust of the people. Society will always need banks as a regulating and organizing body. My Huntington NFT Wallet conjecture was a result of this conversation.

Huntington –

1st meeting: I asked the question “A contemporary solution to traditional banking seems to be in decentralized finance, is that something that should be on the table?”. My response was to “make the case for it.”.

2nd meeting: When sharing our topics of interest I noted that I was interested in crypto, the response given to me is that “No one has been able to crack the nut.”. What does that mean? No one can find a single utility for it, or we can’t accept it? I am not even trying to crack said “nut”. My goal has never been to solve mass adoption of cryptocurrency. In silence, I was offended by the shortsighted response to my area of interest.

3rd meeting: When I told one of the Huntington researchers about my topic of interest he responded by saying that I should be careful with doing research because much of it is crypto businesses that have their best interests in mind by trying to inflate themselves for monetary value. I found this answer a little bit demeaning and not very helpful. The researcher did not ask or know in what way I planned to utilize blockchain but assumed that my direction involved currency, which is not at all where I plan to go.

Crypto is a landmine, Crytpo is a bad word – “Make the case for it”, “no one has been able to crack the nut” and “Be careful with the fake news” are all quite negative reactions that I’ve gotten when bringing it up. I will say that my imagination could just be acting up here or that these interviews were not long-formatted enough to start an actual conversation to see where they were coming from. My interview with Sam and my interviews with Huntington all seem to tell me that crypto is very taboo when talking to certain people about it, but it is what I expected when talking to people who work for a bank. Not once did someone ask about which utility of blockchain I was interested in, but nor did I dare to share. Ironically, blockchain is a progressive technology but it’s also canceled.

4th meeting: The 4th meeting with Huntington was quite useful, they provided us with many slides of data. My key takeaways from it were that Huntington had an issue with customer retention, their users would often open up a second bank account with a competitor and end up transferring and keeping their money with them. They pointed out that Huntington had the upper hand in being personal and having trust, but having higher fees and less security than a bigger bank. My intuition was that Huntington should leverage transparency and trust by providing an honest service like my Huntington Wrapped 2023 conjecture, which a bigger bank might not be able to do. It was a thought. I noted that when people switched bank accounts they would leave their Huntington account open, I then asked why they wouldn’t close the account. The answer provided was upsetting, people end up keeping money in their account even though they do not use it because Huntington purposefully places barriers in an attempt to keep them in their network. I am reminded once again that our partner is in the business of making money, which is priority number 1.

Secondary Research:

Confidence – Confidence and banking is a tricky question because I feel that people may associate a general lack of confidence in bureaucracy with banking. However, according to Gallup Polls, they seem to have measured a low but improving confidence from the public’s perspective.

Spending – When creating my Numbers data poster, I wanted to find statistics about the increase or decrease of prices over the last few years. If users are spending more and more frequently, what does that matter if prices are affordable? It turns out that prices are increasing as people are also increasing spending habits. I referred to the U.S. Bureau of Labor Statistics to discover changes in prices over 2021 – 2023 and referred to DQYDJ to find out if our incomes are increasing and by how much are they increasing. It turns out that discretionary purchases are very much rising, while our income is not.

Crypto – My exploration of crypto in secondary research acted as a refresher for what the contemporary topics are. Crypto ceased to be interesting to me after the pandemic when regulating bodies started to destroy the future of DEFI. I no longer believe we will see a decentralized future, but it was fun to think about while it lasted. The research I did instead showed me the world of DEFI is being turned on its head and is being manipulated into the exact opposite of its initial intentions. Articles like Cryptocurrency Regulations Around the World, Decentralized vs. Centralized Finance: Is DeFi the Future?, and Will The U.S. Launch A Digital Dollar? have shown me the contemporary lay of the crypto land. However, China’s social credit system and the current direction of CBDC may be the biggest inspiration for my design brief, as I may be wanting to take a speculative approach.

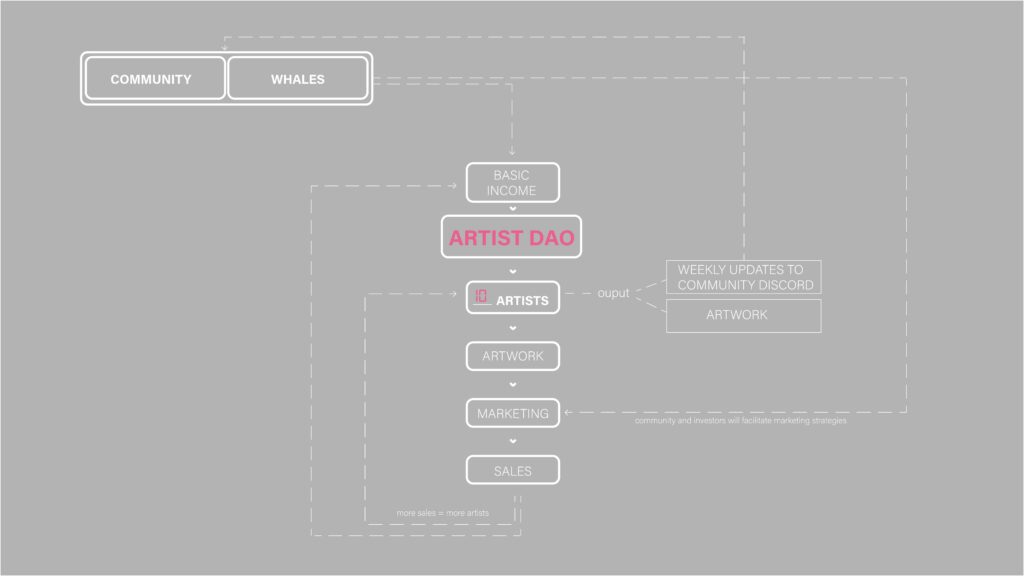

Other – An amazing resource and read I stumbled upon was an article called The Invisible Economy by a community called DADA. This DADA community is a simple artist collective that has a unique and strange ecosystem that seems to be a game of telephone through online artists. They gamify the experience and detail the foundation and fundamentals for how they’ve set themselves up in the articles. The article contains disparate topics such as Basic Income, Incentive Frameworks, Autonomy, Creative Collaboration, Validation, and Art as Currency. The DADA community is also part of the NFT art world, so they have tied economics and banking into their identity. Very interesting read. This article resulted in my Artist DAO conjecture.

Conjectures:

Huntington Wrapped / IRS Wrapped 2023-

The Leaderboard (Web3 Dating App) –