Personal finance and well-being are things that we all deal with directly or indirectly, but what does it mean to actively try to improve your financial well-being? Does it mean using budgeting apps? Does it mean becoming financially literate? Does it mean just hoping that everything turns out all right?

What if actively trying to improve your personal finances and financial well-being actually meant improving your community’s financial well-being?

“Community well-being is the combination of social, economic, environmental, cultural, and political conditions identified by individuals and their communities as essential for them to flourish and fulfill their potential” (Delagran). An individual lives within a community and “when communities don’t thrive, individuals don’t thrive” (Roy, et al., 2022). In this context, it only makes sense that the success of an individual relies on the success of their community.

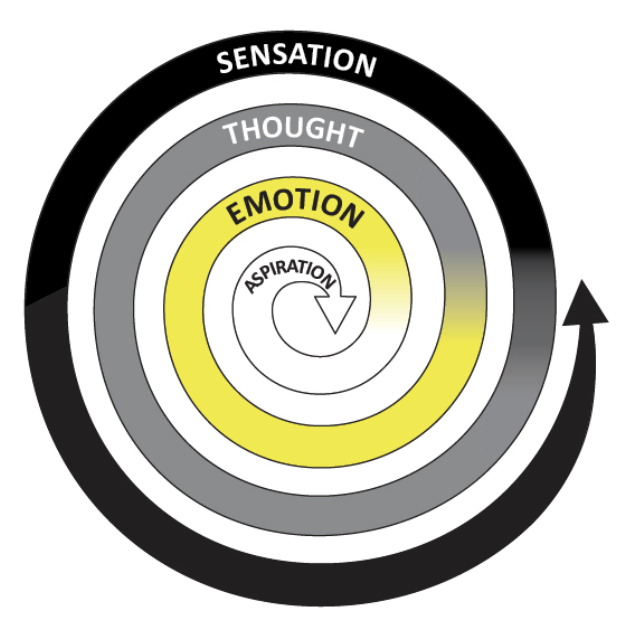

To begin to understand why communities have such an effect on the individual, one has to see how an individual is an essential part of a community. An individual has aspirations that eventually lead to sensations through emotions and thoughts (Walther, 2020).

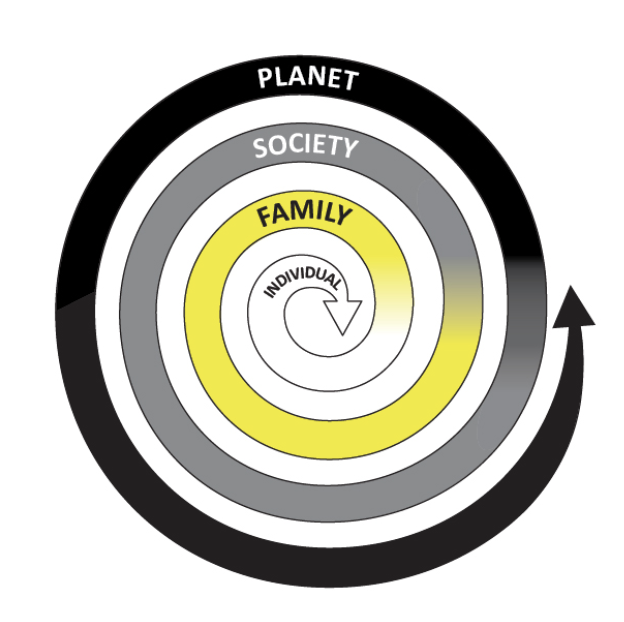

These internal sensations eventually have to interact with the external world which automatically connects you to a family. This family then connects you to society, and this society connects you to the broader planet (Walther, 2020).

“Internally, the interaction between our aspirations, emotions, thoughts and sensations influences who and how we are, what we do, and how we interact with our environment. Externally, the mutual interplay between individuals and institutions shapes the society that we evolve in, and the individuals in it” (Walther, 2020).

If we begin to lay this framework into the concept of personal finance and well-being, you can start to see that personal finance is not personal at all. You put your money into a bank. You pay for goods in the store. You get paid for your job. Your money circulates through many different places within the larger financial system until one day it may or may not return back to you. The list of stakeholders within financial systems is endless and they range from individual customers to corporations to laborers to entire governments. The entire concept of personal finances is built upon the interaction you have with wider financial systems like the consumer market, so how can we say that you are personally responsible for improving your financial well-being?

The responsibility lies within both the individual and the financial systems that influence how we interact with our finances. “A Bank is one of the most common factor among human beings, societies, industries, and countries. We all are related to Banks directly or indirectly…whether it is a common person, private organization or government organization, [they] are dealing with banks. Therefore, the responsibility of banks increases and we need to understand the role of banks in the Global Economy of 21st century” (Goyal, et al., 2011). Banks need to evolve for the modern era and understanding how they work within communities is the first step to having banks be able to support their consumers in the way that consumers need.

People are starting to become more and more aware of the integral part that banks and their investments play in the decisions of what “our economy, industries and planet look like now and into the future” (Carlile, 2023). In an age of increasing activism and consumer demand for sustainable and ethical practices, many systems within our societies are being pushed towards reform and revolution in order to improve personal well-being and begin to break the systematic barriers that marginalize so many communities.

Social media and the digital sphere are playing a large part in giving individuals the power to create the change they want to see in the world. The “#deinfluencing” trend on TikTok is forcing mainstream influencers and general audiences to change their consumption patterns because “influencers’ practices are deeply rooted in consumption” (Bainotti, 2023). The “digitine” movement allows Gen Z to “wield their cultural collective power online to hold celebrities accountable for their actions and silence” internationally on political, social, and moral issues (Clements, 2024). Not only is social media being used to create cultural shifts, it is also being used to create political shifts. “Nearly half of social media users have been politically active on social media in the past year” which shows how integral activism and social change have become in our lives (Bestvater, et al., 2023).

Social media is not the only tool used in creating social change. Museums are starting to address systematic racism by expanding the understanding “of how racism has blighted today’s world and threatens to poison the future” through exhibitions and the sharing of knowledge. Art is being used to get Americans to “open their minds” and “give all Americans equal rights, equal opportunities and equal access to the American dream” (George, 2021). As many marginalized communities come from Black, Indigenous, and People of Color (BIPOC) communities, there is a demand that art institutions “actively listen to [their] BIPOC staff” as they are “not here to fulfill a quota or to melanate the flyers” (Emelife, 2020). We must begin to give Diversity, Equity, and Justice (DEI) more than just a name because there must be action.

These efforts to change cultural mindsets and break systematic barriers in their own respective fields can influence how individuals, banks, and financial institutions go about tackling these issues. They can draw inspiration from tools like social media, art, education, and active community building. They can also draw inspiration from what builds community health. There are three aspects to community well-being and those are connectedness, livability, and equity. In connectedness, communities must offer social engagement and trust. In livability, communities must offer infrastructure that allows people to participate and flourish like housing and transportation. In equity, communities must be “supported by values of diversity, social justice, and individual empowerment” (Delagran). Design conjectures situated within personal finance and well-being in Huntington can be inspired by how other fields are respectively breaking systematic barriers and the knowledge behind what makes a community successful.

To begin to explore these concepts, designing concepts with flaws is essential. For example, to brainstorm within the idea of art being a language, The Huntington Gallery was created. The Huntington Gallery is an immersive exhibition space that helps one discover what it means to be a Huntington customer. From interactive budgeting tools to a gallery of Huntington’s investments, one can understand what it means to be a Huntington customer. Art is becoming an incredible tool for education and experience as “it transcends language, cultures and politics in a most succinct way” (Lukova, 2018). The creative display of finances and banking could potentially help people learn more about their finances on a broader scale and help them connect with the greater Huntington community. However, the concept of an art gallery itself is impractical because where would it even be and who would take time out of their day to go to an art gallery about a bank? With this being said, the underlying concept of art being a tool for communication is essential.

If we want to explore a way where customers can directly communicate and impact the future of Huntington, the Huntington Let’s build the future together social media campaign is a good place to start. This campaign focuses on allowing customers to give direct feedback to Huntington so that Huntington can match the values and demands of the customers.

Social media is giving people a strong voice and it is helping “circulate knowledge,” “mobilise the stakeholders involved and, ultimately, drive action to shape more equal societies” (Wealth Inequality Initiative). Social media creates a direct line of communication between Huntington and their customers which helps create relationships between the two. These relationships can then help customers relay their demands to Huntington, but it also demands people to be active on social media with Huntington bank which is impractical with Huntington’s current engagement with customers on social media. However, understanding the importance of a direct line of communication and visible efforts to change based on communication is an important aspect of working with such a broad scale of customers.

These design conjectures focus on underlying concepts of education, community building, and consumer power. It is incredibly important to focus on improving financial well-being and focus on creating a space that allows people to take an active role in their finances if we want to see a sustainable financial future. Techniques that can help create this change include creating a support system, making resources accessible, providing education, and using budgeting tools. These techniques were repeated by Master’s of Social Work students in a survey conducted to learn about personal finance and well-being through the perspective of social work.

In a design research workshop that focused on understanding people’s choices and emotions in different financial situations within poverty, nine participants were asked to play SPENT, a simulation game. They were asked to record their emotions during the game and almost all of the participants recorded feelings of “stress” and ideas that being in this position would put an incredible strain on their mental health. One participant even went out to mention how she understands why people commit suicide because of financial circumstances. These emotions directly parallel the importance of improving our financial well-being because “the world is facing serious issues of poverty, income instability, and poor economic status and global financial crisis” causing “more and more people” to be “trapped” in situations of financial stress (Hassan, et al., 2021). This stress has then been seen to be a major factor in reduced mental health (Hassan, et al., 2021). The mental health crisis along with the poverty crisis creates an intersectional struggle in improving personal finance and well-being as both affect each other in the individual and the community.

This intersection between individual well-being and the broader community is important because it allows people to have the power to make the changes they want to see in their communities and be able to play an active role in that. “People are expressing themselves not only with their voices, but with their wallets” and the power of the wallet is an incredibly impactful way in which people can change their communities (Taylor, 2022). “A quarter of Americans are boycotting a product or company they had spent money on in the past (Taylor, 2022), and divestment campaigns are being used to “engage with the institutions” and demand a changed future (Apfel, 2015). People are taking their future and the future of their communities into their own hands, and it is time for banks and financial institutions to recognize that customers will continue to demand change until they are able to collectively have a future that is secure and sustainable.

For these reasons, it is incredibly important to understand that personal finance and well-being is not personal and it does not rely only on the individual, but also the communities that these financial institutions are meant to serve. An individual’s success is only as successful as the system in which the individual lies, so designing systematic change within financial education and information to improve personal finance and well-being within the individual and collective is the next course of action in ensuring financial success through Huntington within the Columbus, Ohio community.

References:

Apfel, D.C. (2015). Exploring Divestment as a Strategy for Change: An Evaluation of the History, Success, and Challenges of Fossil Fuel Divestment. Social Research: An International Quarterly, 82(4), 913-937. http://www.jstor.org/stable/44282147

Bainotti, L. (2023). TRENDING RESISTANCE: A STUDY OF THE TIKTOK #DEINFLUENCING PHENOMENON. The 24th Annual Conference of the Association of Internet Researchers. https://spir.aoir.org/ojs/index.php/spir/article/view/13392/11514

Bestvater, S., Gelles-Watnick, R., Odabas, M., Anderson, M., & Smith, A. (2023 June 29). #BlackLivesMatter Turns 10. Pew Research Center. https://www.pewresearch.org/internet/2023/06/29/blacklivesmatter-turns-10/

Carlile, C. (2023, January 20). What makes banks unethical? Ethical Consumer. https://www.ethicalconsumer.org/money-finance/what-makes-banks-unethical

Clements, O. (2024, June 12). Block Party – how Gen Z fans punished stars over perceived ethical inaction. Pulsar. https://www.pulsarplatform.com/blog/2024/genz-activism-block-influencers-analysis

Delagran, L. What Is Community Wellbeing? University of Minnesota. https://www.takingcharge.csh.umn.edu/what-community-wellbeing

Emelife, A. (2020, June 26). What Does a Social Justice Curator Do? The Bronx Museum’s Jasmine Wahi on Why Every Art Institution Should Have One. artnet. https://news.artnet.com/art-world/jasmine-wahi-interview-1890449

George, A. (2021, November 4). Why Museums Are Primed to Address Racism, Inequality in the U.S. Smithsonian Magazine. https://www.smithsonianmag.com/smithsonian-institution/why-museums-are-primed-address-racism-inequality-us-180978992/

Goyal, K. Joshi, V. (2011). A Study of Social and Ethical Issues in banking industry. International Journal of Economics and Research, 49-57.

Hassan, M., Hassan, N., & Kassim, E. (2021). Financial Wellbeing and Mental Health: A Systematic Review. Studies of Applied Economics, 39(4). DOI:10.25115/eea.v39i4.4590

Lukova, L. (2018, July 22). Designing justice: Fighting economic inequality through art. The PuLSE Institute. https://thepulseinstitute.org/2018/07/22/designing-justice-fighting-economic-inequality-through-art/

Roy, B., Prabhu, M. (2022, December 2). Yale Experts Explain Collective Well-Being. Yale Sustainability. https://sustainability.yale.edu/explainers/yale-experts-explain-collective-well-being

Taylor, C. (2022, June 29). Boycott Nation: How Americans are boycotting companies now. Reuters. https://www.reuters.com/markets/us/boycott-nation-how-americans-are-boycotting-companies-now-2022-06-29/

Walther, C. (2020). From Individual Wellbeing to Collective Welfare: A New Perspective of Being and Becoming in a Post-Pandemic World. The Humanitarian Leader. https://doi.org/10.21153/thl2020volno0art1014

Wealth Inequality Initiative. About the Wealth Inequality Initiative. https://www.wealth-inequality.net/about-wealth-inequality-initiative