“

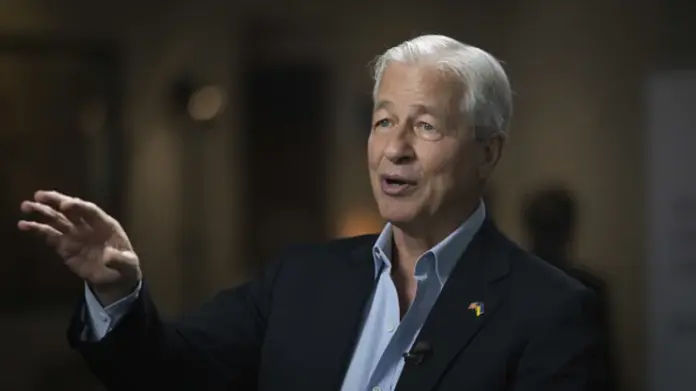

The bank will generate about $84 billion in net interest income this year, New York-based JPMorgan said Monday in slides for an all-day investor presentation.

That’s $3 billion higher than guidance given in April. At the time, JPMorgan raised its net interest income outlook by $7 billion, a move that spurred JPMorgan’s biggest earnings day stock bump in 20 years.

The bank added that “sources of uncertainty” around deposits and the economy could impact its forecast. Net interest income is the difference between what banks earn from loans and investments and what they pay to depositors.

JPMorgan, the biggest U.S. bank by assets, has emerged as a beneficiary of the recent regional banking tumult. It was one of the only banks to see deposits climb in the first quarter as panicked customers sought safety at big institutions; then it won a weekend auction for First Republic, a move expected to boost earnings and advance its push for wealthy clients.

Trading and investment banking revenue in the second quarter is headed for a 15% decline compared with the year-earlier period, the bank said.

“

Analysis –

“The bank added that “sources of uncertainty” around deposits and the economy could impact its forecast.”

“This statement is somewhat upsetting, as JPMorgan Chase made $84 billion in interest income this year. Their business is anticipating making less because of the predicted economic forecast, so unfortunately they won’t be able to make more money off of people’s debts.” – Easton Nguyen