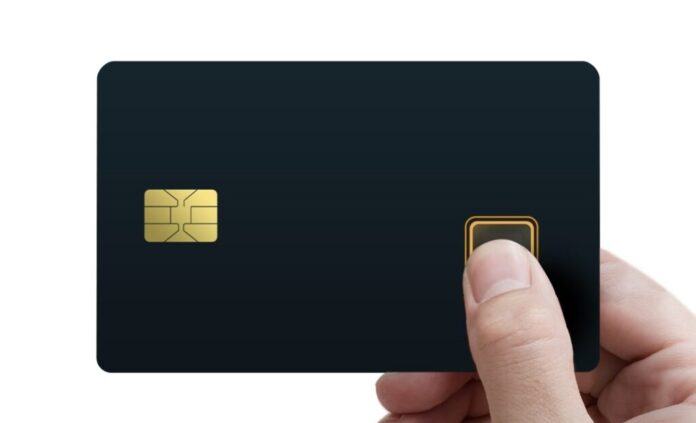

Payment cards are gaining new capabilities as Visa has launched a pilot of a new dual-interface (chip- and contactless-enabled) biometric payment card with Mountain America Credit Union and Bank of Cyprus. This will be the first pilot in the U.S. to test an on-card biometric sensor for contactless payments.

The card will test the use of fingerprint recognition as an alternative to PIN or signature to authenticate the cardholder during a transaction. The pilot is being managed through the Visa Ready for Biometrics program, a new offering to support the growing demand for biometric technology in the payments category.

Here’s how it works. The cardholder enrolls the fingerprint, which is securely stored on the card. When he or she places the finger on the card’s sensor during a transaction, the card senses whether the scanned print is the same as the print stored in the card. A green or red light on the card indicates a successful or unsuccessful match.

Biometric payment cards offer several benefits beyond ease of use:

- Strong security: Fingerprint biometric is stored only on the card to ensure that a cardholder’s data is protected.

- Hardware Upgrades Unnecessary: The biometric card is designed to be compatible with existing payment terminals that accept contactless- or chip-based payments around the world.

- Self-charging: The biometric sensor is powered by the payment terminal, ensuring there is no embedded battery or need to re-charge the card.

Consumers are interested in letting their fingerprints do the walking—or authenticating. In a recent survey of 1,000 Americans about perceptions of biometric authentication, Visa found that consumers are as likely to want to use fingerprint recognition for in-store scenarios as they are for online payment scenarios. Of all the biometric authentication techniques queried, fingerprint recognition ranked the highest (50 percent) in terms of desired payment authentication for in-store usage.

“The world is quickly moving toward a future that will be free of passwords, as consumers realize how biometric technologies can make their lives easier,” said Jack Forestell, head of global merchant solutions, Visa Inc. “As electronic payments expand dramatically around the world, Visa is committed to developing and investing in emerging capabilities that deliver a better, more secure payment experience.”

The pilot is being conducted in partnership with Fingerprint Cards, Kona-I and Gemalto and will begin in early 2018 to assess the cardholder experience and the technology of the biometric cards in different retail environments.

Analysis

Payment and banking security is extremely important these days, with eyes lurking around every corner to snatch your card numbers and passwords whenever you happen to be looking the other way. Visa’s new biometric payment card has the potential to solve a lot of these security problems by placing those numbers and passwords behind a lock that can only be opened using something entirely unique to every individual: a fingerprint. Now, there are most definitely pros and cons here. What if a parent gives their kid their card to use? What if a person loses their finger? If a hacker happens to make it past the fingerprint wall, will they have access to literally everything that fingerprint had been protecting? There are lots of possibilities, but plenty of kinks to work out as well.

Source

Visa. (2023). Biometric payment card. Visa. https://usa.visa.com/visa-everywhere/security/biometric-payment-card.html