This case study presents insights from customer research with TymeBank clients that bolsters CGAP’s hypotheses around how digital banks can support the mission of financial inclusion. As a fully digital South African bank that disproportionately serves low-income rural customers, TymeBank has created a suite of basic products that cater to the essential financial needs of those customers, namely a low-cost transactional account and a high-yield savings account. Judging from product uptake and client testimonials, these products add to a compelling value proposition that not only resonates with customers but improves their lives.

TymeBank’s distribution network, which is based on its partnerships with the nationwide Boxer and Pick n Pay (PnP) grocery store chains, helps to keep operational costs low and passes cost savings onto customers in the form of more affordable services. A clear majority of the bank’s customers cite affordability as a key source of value and the reason they opened a TymeBank account. The distribution network also extends the bank’s reach to areas that are underserved by traditional players. The affordability and accessibility likely explain why underserved segments, such as low-income women and rural customers, are over-represented in TymeBank’s (active) customer base as compared to the overall banked population in South Africa.

Despite having access to other banking options, TymeBank customers overwhelmingly see no compelling alternatives in the market. Crucially, the value customers see in the bank appears to be inversely related to income, with poorer customers reporting higher levels of satisfaction.

Context

In today’s high-tech financial services landscape, which is often dominated by headlines about fintech startups and tech giants, it is easy to overlook the role banks can play in advancing financial inclusion. The high cost of running brick-and-mortar branch networks has traditionally inhibited banks from serving less profitable client segments, including the low-income groups that are the focus of financial inclusion. Banks have also been slow to adapt the digital innovations that have helped some newcomers reach these segments at lower cost. It is no surprise that some observers have questioned whether banks are even relevant to financial inclusion.

However, there are reasons to believe that banks can play an important role in financial inclusion if they overcome the challenges of their legacy systems and processes and digitize operations. In fact, banks have advantages over other types of financial services providers (FSPs) that may allow them to have an outsized impact on financial inclusion – if they are willing to expand down- market. Most importantly, banks do not face the same regulatory constraints as other providers. Whereas mobile money providers and fintechs generally cannot provide a wide array of financial products (ranging from savings to credit), banks can. License to intermediate retail deposits further plays to a bank’s advantage in the arena of digital credit. Banks can fund their lending portfolios with retail deposits that are typically cheaper than the other funding sources pure lenders use, which further reduces the cost of reaching low-income customers with credit.

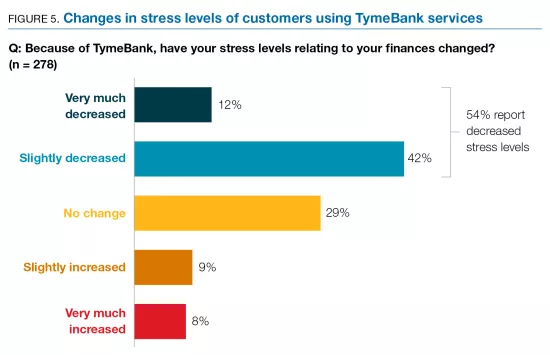

Analysis: In looking at South Africa’s banking business, TymeBank is disrupting the traditional banking industry by utilizing retail partners to better serve low-income rural customers, and therefore making banking more inclusive. I am impressed and intrigued by this business model of simple, affordable products, with low operational costs, on a completely digital platform. It is clear that this company has empathized with their end user to increase customer satisfaction with their banking experience, along with putting an emphasis on improving quality of life for those in underserved communities. I am inspired by this business model and its ability to help customers better save and utilize their money in troubled times and prevent them from situations of distress. I also wanted to note that I was surprised to see the largest desired improvement for customers would be the presence of physical branches. This is important to think about for overall user experience and how to create a more personable banking experience for customers both in person and digitally. Overall, this is a great public health centered business model to reference as I continue my research with Huntington.

Citation:

Jenik, I. (n.d.). Tymebank case study: The customer impact of inclusive digital banking. CGAP. https://www.cgap.org/research/publication/tymebank-case-study-customer-impact-of-inclusive-digital-banking#:~:text=CGAP%20previously%20presented%20three%20emerging%20business%20models%20in,marketplace%20banks%2C%20and%20Banking-as-a-Service%20%28BaaS%29%20%28see%20Box%201%29.