A survey (linked here) was conducted with Master’s of Social Work (MSW) students at The Ohio State University. This survey collected answers from 35 students on the topic of personal finance and well-being. This information is supplemented with statistics in the article “Financial Literacy Education Could Help Millions of Americans” from TIME Magazine.

This survey focused on MSW students because of their unique position in understanding both theories of well-being, public policy, and their goal of helping individuals and communities grow in many ways. I found this population particularly interesting because they focus on promoting different dimensions of wellbeing and I wanted to focus on tools and information based on wellbeing in personal finance. I recruited students for my survey by sending out an email to one MSW student and by attaching my survey to the MSW email list. This helped me gain 35 responses.

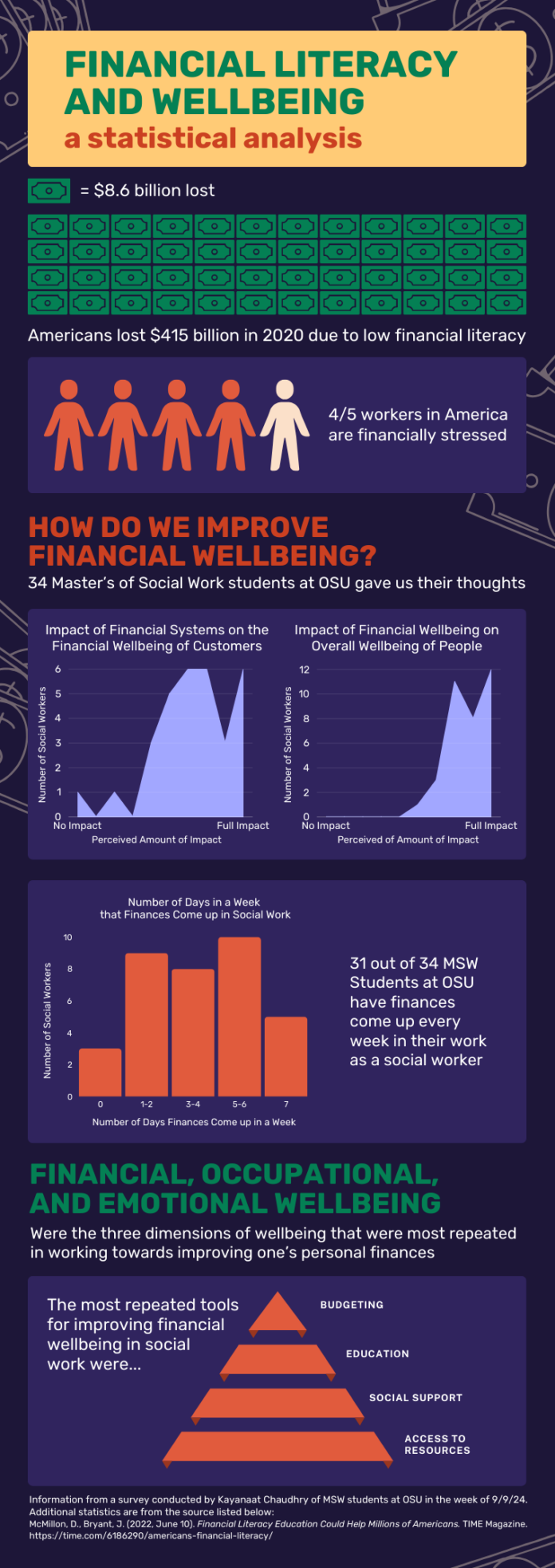

To gain perspective on the importance of financial well-being, I looked towards other articles to understand how dire of a crisis financial well-being and literacy is. In TIME’s article, I found that the lack of financial literacy is making Americans lose $415 billion dollars. (McMillon, 2022). The importance of accessible financial knowledge to be financially well was apparent. For this reason, I went on to ask social workers how to start to fix this issue. The survey demonstrates that financial institutions affect financial wellbeing which in turn affects one’s overall wellbeing. This pathway is a direct line to decreased well-being if your financial institutions are not valuing it. In addition to this, finances came up every week for most of the social work students meaning that finances are a recurring issue over many different kinds of work. Knowing this, social workers emphasize the importance of focusing on financial, occupational, and emotional well-being to improve one’s personal finances. Within these dimensions, four main techniques were repeated within the survey that can help develop financial well-being. These include social support, access to resources, education, and budgeting. With this information, we can start to have a basis for designing a way to improve personal finance and well-being within the context of Huntington Bank.

References:

McMillon, D., Bryant, J. (2022, June 10). Financial Literacy Education Could Help Millions of Americans. TIME Magazine. https://time.com/6186290/americans-financial-literacy/