Introduction

Over the last decade, the banking sector has undergone nothing short of a revolution. A combination of technology developments, altering consumer preferences, and a broader push toward digital transformation has resulted in a significant shift away from traditional banking and toward digital platforms. While normal banking tasks used to need actual trips to local banks, lineups, and tedious paperwork, today’s consumers are increasingly reliant on online platforms that offer fast access, round-the-clock availability, and easy use.

This transformation, however, is more than just a platform change; it means an important shift in how customers view and interact with their financial environment. The shift to online banking allows an opportunity to reimagine what banks can do for their customers. A massive pool of data and intricate insights emerges from beneath the surface as the banking sector undergoes a digital revolution. Every transaction, click, and user interaction produces a digital trail that documents customers’ habits, preferences, and actions. When this data is collected and evaluated, it can reveal patterns that were previously inaccessible in the analog banking sector. It provides a detailed breakdown of an individual’s financial decisions and spending actions.

How we got there

Upon reflecting on the prompt, it struck me how my banking habits and those around me have dramatically shifted towards online platforms. Since the onset of COVID-19, my physical visits to the bank have become exceedingly rare, limited to the occasional cash withdrawal. The pandemic has further nudged most of us, including my traditionally inclined parents, towards embracing digital banking due to its convenience and safety. This change makes me wonder about the larger impact on our relationship with financial institutions and how they’ll adapt to these evolving preferences.

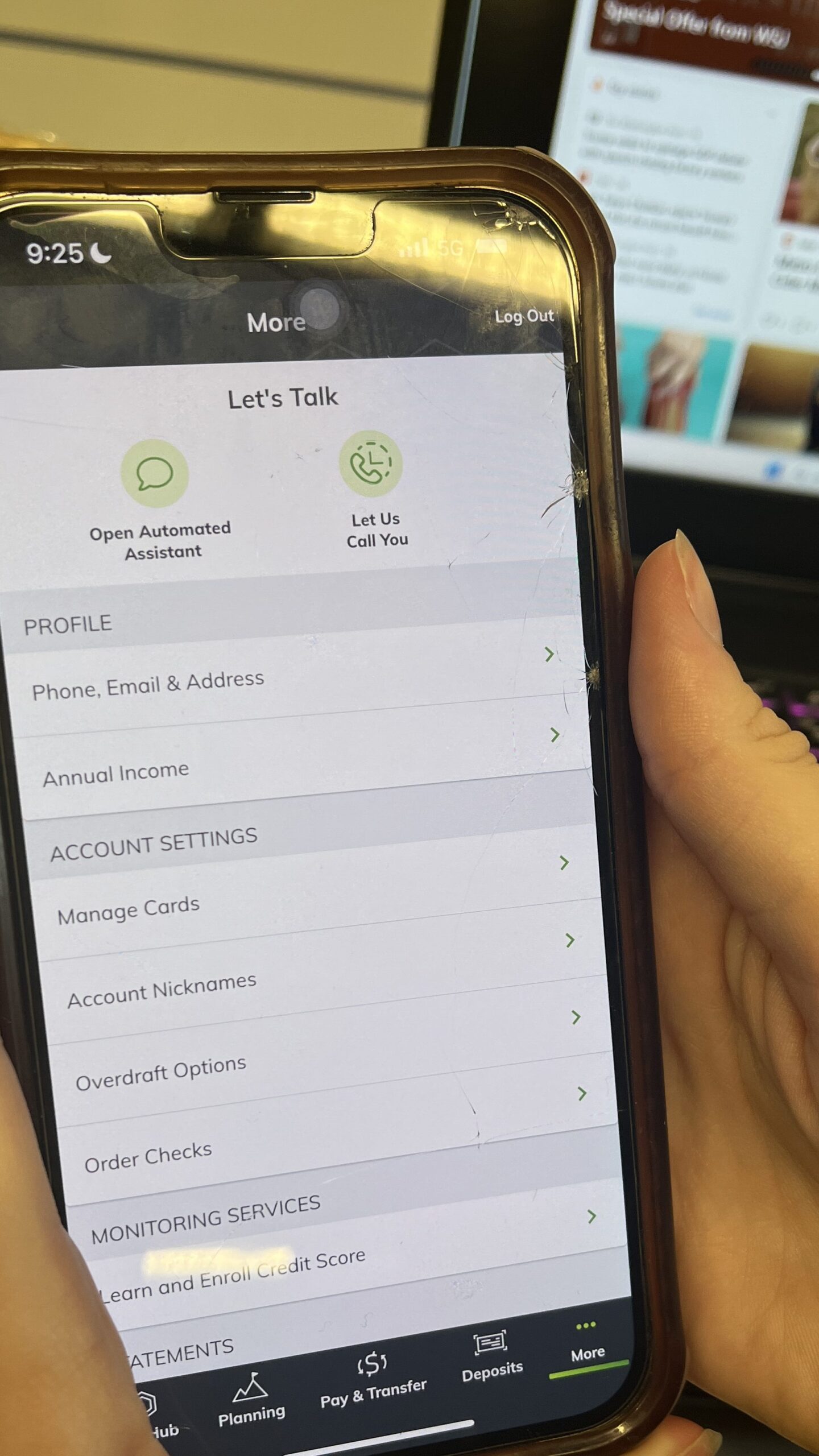

To understand the shift in banking habits, I used social media to distribute an online survey about banking preferences. Given my social media connections, I expected most respondents to be around my age. However, I kept the survey open to all ages to get diverse feedback. The survey results were clear. All respondents under 41 used online banking as their primary method. Furthermore, 86% of these individuals preferred banking through mobile apps, highlighting the importance of mobile accessibility in today’s banking world. This data underscores the growing trend of digital banking, especially on mobile platforms, among the younger generations. The key features that people use online banks are to check account balances, transfer money between accounts, and deposit mobile checks. So, with that, I started to think about how we can expand what we can do on a banking app that we couldn’t do in person. How can utilize the amount of data being tracked to help the customer experience?

Heuristic Evaluation

I then looked into what these apps already offer to see how we can expand them. I did this by doing a heuristic evaluation of the Huntington and Chase app. For Huntington, the app provides a comprehensive “spending summary” feature that allows users to view both their pending transactions and historical spending patterns. Moreover, users have the capability to initiate plans that can help them achieve their financial objectives. One of the standout features is the ability to get a holistic view of one’s finances by linking various accounts, ensuring users have a centralized financial dashboard. For detailed insights, users can see the allocation of their expenditures, such as rent payments, travel expenses, entertainment costs, and more. These spending categories are elegantly visualized through a circle chart, making data interpretation both intuitive and visually appealing.

The Chase app offers a variety of financial management features designed to enhance the user experience. It can display net income and spending, providing a comprehensive view of one’s financial health at a glance. Furthermore, the app offers tools related to spending and budgeting, allowing users to track how much money they’ve spent each month, giving a clear understanding of their monthly financial habits. To further assist in financial planning, users have the capability to set budget and spending goals, encouraging prudent financial behavior. In addition to these functionalities, the app delves deeper into credit card management, offering features related to credit card points and rewards, ensuring users can maximize the benefits of their card usage.

During my review of both apps, I noticed they mainly prioritize budgeting and tracking financial health. Essentially, these apps aim to help users manage their finances, ensuring they adhere to their budgets. In today’s digital age, with countless transactions, having such an app to guide financial behavior is undeniably useful. While these apps are great for budgeting and tracking, they lack features to help users make informed financial decisions. They don’t offer clear advice or insights for choices like investments, major purchases, or loan evaluations. This gap highlights an opportunity for these platforms to evolve, meeting the growing need for tools that both monitor and advise on finances.

Interviews

With this understanding of the gaps in financial apps, I sought deeper insights by meeting with a financial advisor, Jeff Gilbert, especially to comprehend the broader industry implications as banking continues its significant tilt towards online platforms. The conversation proved to be very interesting, shedding light on aspects that may not be immediately apparent to the casual observer.

One of the standout revelations from our discussion was the difficulty people have in following a budget. Jeff emphasized that, in practice, many find it challenging to meticulously jot down projected expenses or maintain a strict tab on their spending. While the idea of budgeting might seem straightforward, its execution often collides with human nature and the unpredictability of daily life.

Building on this point, he shared a piece of advice that resonated strongly with me. Instead of getting entangled in detailed budgeting, a more effective approach might be to allocate oneself a fixed, reasonable sum of money each month. This acts as a spending cap, ensuring financial discipline without the stresses of tracking every penny. Any residual amount left at the end of the month can then be funneled into savings. Such a strategy not only simplifies financial management but also encourages a healthy saving habit, striking a balance between present expenditures and future financial security.

Upon realizing the challenges many face with traditional budgeting, I started to question why do individuals, particularly those in my age range, seem to not budget. To dig deeper into this conundrum, I embarked on a small but focused research journey, interviewing six individuals roughly within my age range.

The findings were both surprising and telling. Astoundingly, none of the individuals I interviewed practiced formal budgeting. Instead, they seemed to rely on a more intuitive approach to manage their finances. Most kept mental tabs on their expenses, using credit card statements as a rough gauge to track and review their spending habits over a month. This approach, though less structured, seemed to resonate with the lifestyle and financial rhythm of many young adults.

One quote from an interviewee encapsulated a sentiment that was echoed, in varying degrees, by others: “I don’t have enough money to make a budget. I try to just save whatever I have left.” This statement reflects the financial realities many young people face, where fluctuating incomes and unpredictable expenses can make stringent budgeting feel both challenging and redundant.

This entire exploration struck a chord with me. It made me ponder beyond just the numbers in financial management. It drove home the idea that, in today’s digital age, there might be alternate ways to engage with and manage one’s finances, which deviate from traditional models but align better with modern consumers.

Statistics of Shopping

In the consumer landscape, payment preferences have undergone significant transformations, reflecting broader societal shifts and technological advancements. 81% of shoppers now favor card payments over traditional cash transactions. This preference is shown in financial data. In fact, credit card transactions account for a whopping 70% of all retail sales dollars nationwide. Such figures are indicative of a society that increasingly values the convenience and security associated with cashless transactions.

2022 marked yet another milestone in the realm of shopping habits. Globally, online shopping represented 21% of all shopping endeavors. Diving further into this digital inclination, my research surfaced another intriguing insight: an overwhelming 88% of individuals have utilized mobile apps for shopping. Smartphones and the ease of app-based shopping experiences have undoubtedly contributed to this trend, bridging the gap between brick-and-mortar stores and the digital marketplace.

With this digital transition, certain age-old consumer habits remain. For instance, 31% of respondents emphasized the importance of comparing prices during their shopping journey. Regardless of the platform, be it in physical stores, online websites, or mobile apps, the value proposition remains paramount. Shoppers are keen on ensuring they get the best bang for their buck, emphasizing that while modes of shopping evolve, the innate desire for value remains consistent.

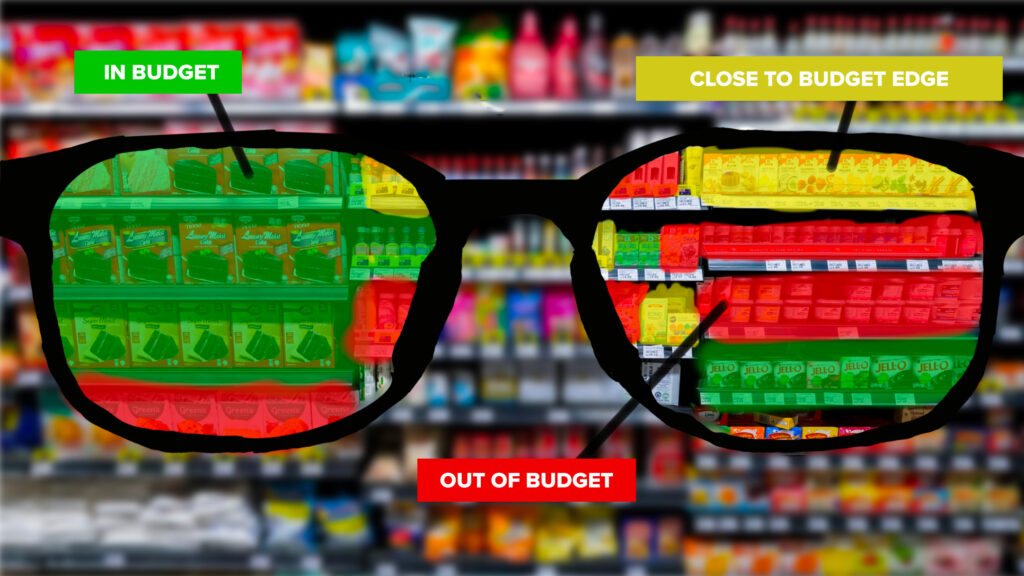

Design Conjectures

One conjecture is the Interactive Loan Simulator, designed to aid potential borrowers. This tool lets users adjust variables like loan amount, term, and interest, offering an immediate overview of projected payments and accrued interest. What sets it apart is its ability to compare up to four loan options concurrently, guiding users to the most suitable choice for their circumstances. Another conjecture is the Transaction Map. This map showcases users’ spending locations, granting them a unique geographical perspective on their expenses. Such a tool is invaluable for tracking regular costs and understanding spending behaviors in different locales, promoting wiser budgeting decisions. For the Financial Fitness Challenges App, the platform breaks down financial tasks into digestible challenges, merging education with task completion. As users navigate these challenges, they not only inch closer to their financial milestones but also acquire critical financial management skills. Lastly, the Augmented Reality Budget Shopping Glasses are poised to redefine the shopping experience. Once activated in-store via voice or touch, these glasses sync with the user’s financial data to provide real-time budgetary insights. Employing 5G technology, they can instantly scan item prices, color-coding them based on the user’s budget: green for affordable, yellow for borderline, and red for beyond budget. Together, these conjectures show a shift towards more intuitive, informed, and immersive financial experiences, tapping into the full potential of digital advancements.