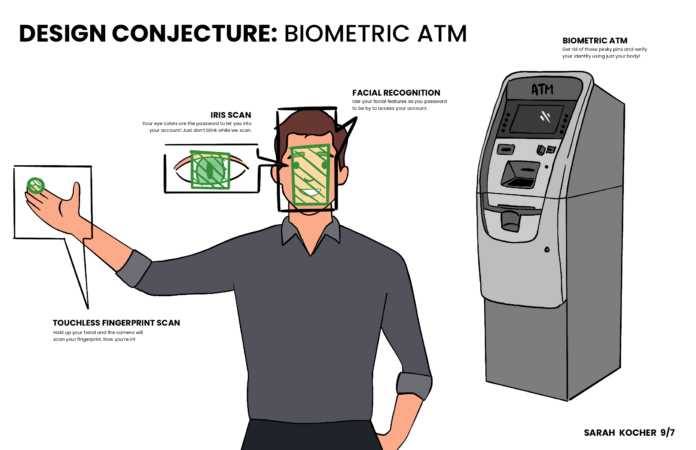

For my Science and Tech conjecture, I wanted to focus in on Biometrics. It’s a category of technology that I have a feeling will start to become more and more prevalent as society becomes cashless. The best way to identify ourselves as ourselves is with our own flesh and blood, because nobody else has it!

In my research related to travel, one of the biggest fears of people spending money abroad is that they’ll end up as victims of fraud. This is especially dangerous for people who solely use debit cards, because they’re not as protected as credit cards. Fraud happens when your card numbers are taken and used to make purchases, even if you still have your physical card. One way to reduce your chance of fraud is by going contactless. Tap transactions do not pass enough information through the machine to allow a fraudulent card to be made, thus making the spending safer.

Another element of travel spending my research has revealed is that ATMs can be unruly. Sometimes people don’t feel safe using them if they’re in a not-so-safe environment. Sometimes they’ll reject a card if they can’t recognize it. Sometimes they won’t accept your PIN number even though you know that it’s the correct PIN and even though you just called your card company to reset the PIN and the system resets it immediately, they still refuse to accept you pin, and you have absolutely no way to acquire cash in the middle of a remote island in Greece. That last one comes from personal experience.

The idea of the Biometric ATM covers the fraud worry as well as the safety and convenience issues. Users need not worry about feeding the machine their card. In fact, it won’t even leave their hands! These ATMs are capable of tap transactions. In this way, you can guarantee your chances of fraud are incredibly low. Additionally, the biometric features of this ATM can identify you as you walk up, either through facial recognition, iris scanning, or distance fingerprint scanning (all technologies I’ve researched). This ATM can easily and quickly verify that you are indeed you, so there’s no need to have to prove who you are with a PIN. And if it knows who you are, then it knows what cards/accounts you have, and be able to tell you whether or not it will accept your transaction. These features combined also speed up the entire ATM experience, so if you happen to be in a not-so-safe place, you can get out of there quicker.

Takeaways

Learning about identification technologies was a lot more interesting than I initially thought it would be! And the thought of being able to incorporate these biometric capabilities into future banking practices is exciting because we’ll never have to worry about passwords or PINs again! Talk about convenience.

However, this conjecture has its dangers. If biometrics take over, then what’s stopping black market thieves from cutting off people’s fingers to make fake accounts? I know that’s morbid, but humans are capable of much worse. Or think about what hacking might turn into! If you need a face, or an eye…. I’m not sure I quite want to think about what lengths people would go to in the name of crime.

My biggest takeaway from this conjecture is that we as a society are prepared to go cashless should we need to, even if we don’t want to. We have ways of keeping our accounts secure, proving our identities with our own features, and transferring money with low risk of fraud. The tech is there, it’s just up to us to see what we can do with it.