Study: Banking Needs, Digital Banking Trends, and Consumer Priorities

Amidst major banks, credit unions, and online-exclusive banks, consumers have a plethora of banking choices. What drives their decision on which bank to choose? To uncover this, they conducted a survey with 2,000 consumers to determine the significance of various banking features to them.

- Digital Banking: 91% of consumers consider digital banking crucial when selecting a bank. The significance of online banking differs based on net worth. 96% of those with a net worth below $1 million find it essential, whereas it’s 82% for those with a net worth above $1 million.

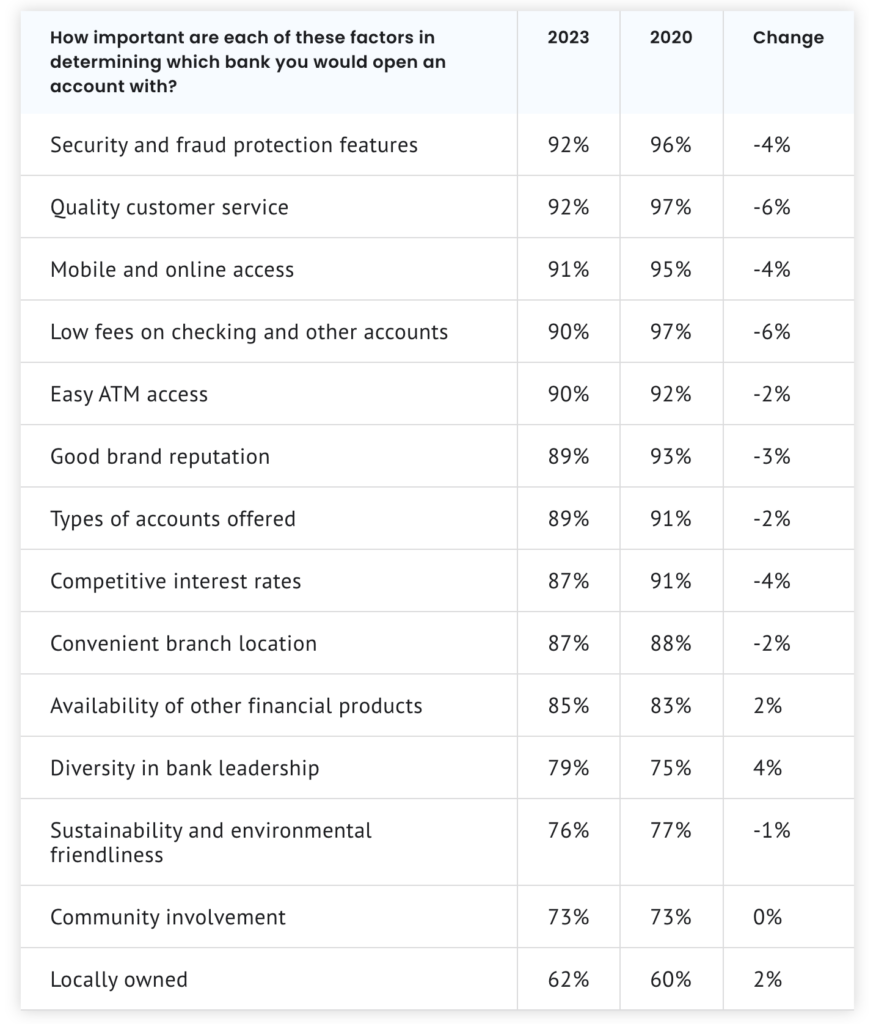

- Security & Service: High-quality customer service, along with security and fraud prevention, stand out as primary concerns for consumers.

- Evolving Preferences: There’s a growing trend among consumers to value diversity in bank leadership and give more weight to savings account interest rates than they did in the past.

What customers want from banks: Digital banking and more?

Banking priorities by wealth

Those with over $1 million in net worth value both online and in-person banking access less than those under $1 million in net worth. 96% of the latter group see online banking as crucial, compared to 82% of the wealthier group. Similarly, 90% of less-wealthy Americans prioritize convenient branch locations, compared to 79% of millionaires. This difference might stem from wealthier individuals having fewer past issues accessing their banks, as they represent a different type of banking customer.

Banking priorities by generation

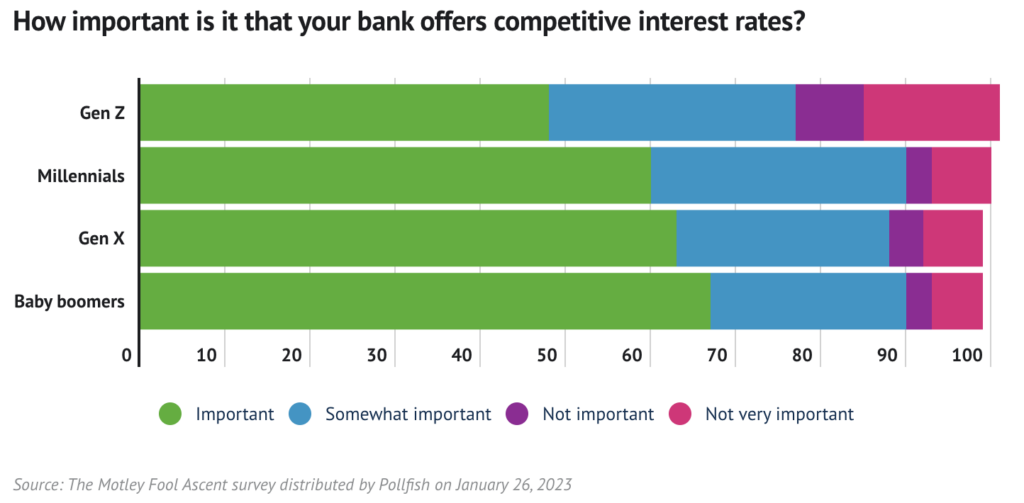

Banking preferences vary by generation, highlighting differences in customer needs. Gen Z is less concerned about competitive interest rates or diverse financial products from their bank. While 76% of Gen Z find interest rates crucial, about 90% of other generations think the same.

Banking trends: Savings rates are most important to consumers.

79% of consumers are likely to switch banks if they find one that better fits their needs.

79% of people would switch banks for one that aligns more with their priorities, a jump from 52% in 2020. This reveals growing consumer readiness to change banks for better benefits like interest rates or lower fees. While millennials are the most open to switching, even 61% of baby boomers are inclined to do so.

Analysis

Digital banking is crucial for 91% of consumers, with 96% of those under $1 million in net worth finding it essential. In contrast, only 82% of wealthier individuals prioritize it, possibly due to fewer past banking issues. Despite the digital trend, customers still value security, fraud prevention, and good customer service. There’s also a growing interest in diversity in bank leadership and better interest rates. Generational differences exist too; Gen Z, being newer to banking, doesn’t focus as much on competitive rates or varied financial products, which may change as they grow older.

Caporal, Jack. “Study: Banking Needs, Digital Banking Trends, and Consumer Priorities.” The Motley Fool, The Ascent by The Motley Fool, 15 Feb. 2023, www.fool.com/the-ascent/research/digital-banking-trends/#:~:text=Security%20and%20fraud%20protection%20features%2C%20customer%20service%2C%20and%20mobile%20and,go%20hand%2Din%2Dhand.