“

We recently surveyed approximately 4,000 consumers regarding how they think and feel about a variety of different banking channels and activities. We compared the results to similar surveys we’ve conducted over the past six years to see how the landscape is evolving.

Q. What did you learn about how people choose their banks?

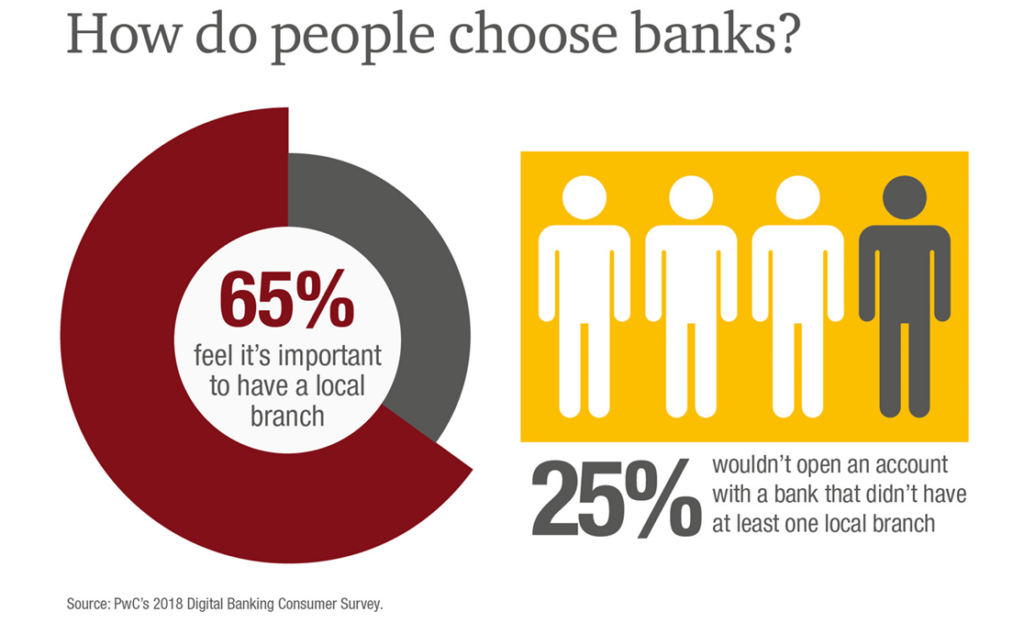

A. When picking a primary bank, survey takers across all age groups particularly value attributes like convenient in-person banking, referrals from family or friends, or a positive previous experience. More than 60% of traditional bank primary customers say it’s important to have branches in close proximity

Q. What types of transactions are people still doing in branches?

A. We found that a number of transaction types are still “branch dominant”: situations where people would rather go to a branch than go online or use a smartphone, contact a call center, etc. Applying for a new loan? Odds are, you’ll do this in a branch (59%). Applying for a new checking or savings account? Again, you’ll probably turn to a branch (58%) before any other channel (see Figure 3). People also like branches when applying for a new brokerage/ investment account (43%) or using financial advisory services (37%). So, clearly, branches aren’t going away. These transaction types all are, or may appear to be, fairly complicated transactions. Consumers still value the ability to ask for help and be guided through the process, if necessary.

Q. If consumers “want it all,” does this mean they’re now paying more attention to financial services?

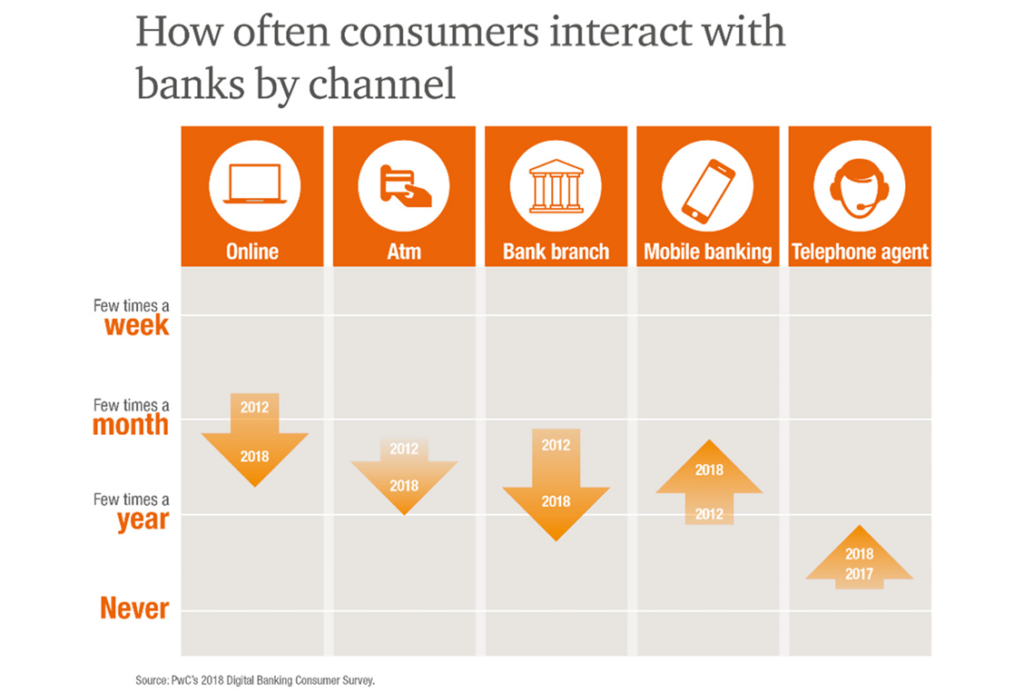

A. In some ways, the trend seems to be moving in the opposite direction. But it depends heavily on the user and, sometimes, on the financial institution.

Based on our survey and usage statistics reported by some firms, we believe that usage is increasingly splitting into two camps. Some customers may use a service once a month, without much thought. Others are highly connected, looking at their phone several times a day to check balances and conduct transactions.

“

Analysis – “Although the article is nearly 6 years old and the data even older, there are still useful takeaways that are presumably still true and valuable to know.

- People prefer to bank based on proximity. Even though interactions with branches is declining it is still important for a branch to be local so that users may be able to interact with their banks if needed.

- There are some tasks that people will only do at a bank – “People also like branches when applying for a new brokerage/ investment account or using financial advisory services”.

It seems to me, that users will choose a bank out of proximal convenience and although they may not use all of a bank’s services, they want the ability to interact with a bank physically if they need to.

This poses the question as to why even though we are going digital, why is it that certain tasks are preferred to be dealt with in person. My intuition tells me that it is because:

- Users would have questions about these processes and would rather interact in a way that they can interact with dialogue.

- Digital channels may seem a security risk.

- Digital channels may be too difficult to.

” – Easton Nguyen