The demand for non-face-to-face environments will undoubtedly increase in the digital world, and it is already emerging. In today’s digital environment, data security is always a concern. Banks and Fintech firms are collaborating to establish a digital asset custody service.

In the realm of technology, virtual reality is a prevalent topic, but what does it have to do with banking? Everything. The term “metaverse banking” relates to the management of financial transactions in virtual environments. This implies you can teleport from your living room to any bank in the world and conduct business without ever leaving your home!

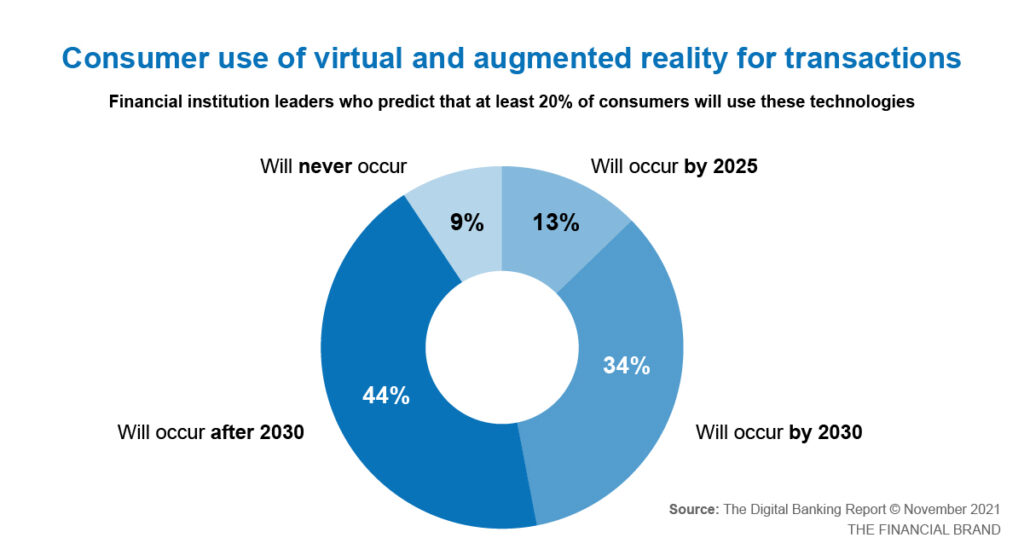

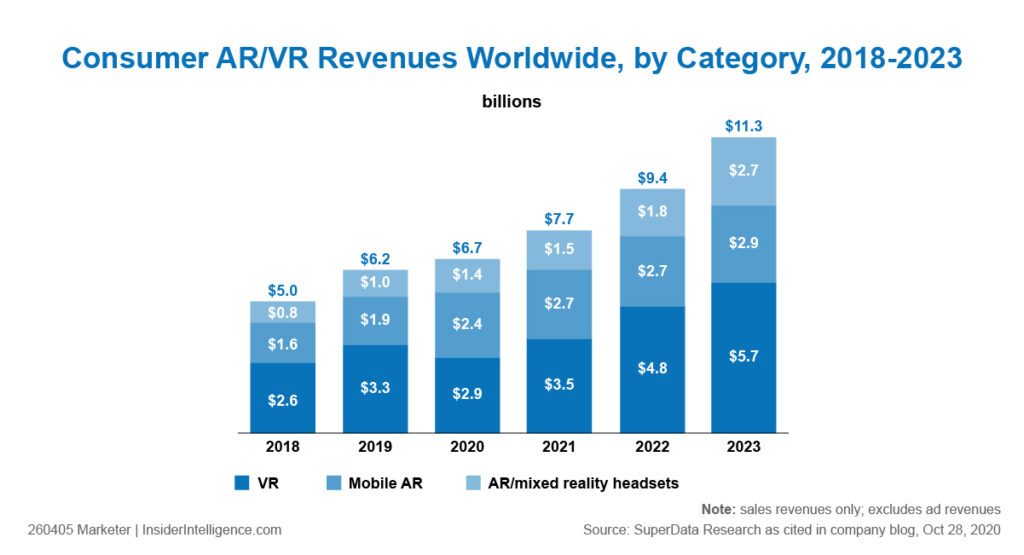

Banks have been using virtual reality for years, but now that VR headsets are becoming more inexpensive, this technology has the potential to revolutionize the way we think about banking forever.

Virtual reality is the future of digital banking. With metaverse, financial transactions can take place in this virtual world which will create an unparalleled customer experience. Banks are looking at virtual reality because it has the potential to change the way people bank and interact with their money. Banks will increasingly adopt virtual reality (VR) technology as they explore immersive technologies that could offer up new ways to engage customers via mobile devices or PCs, provide a better understanding of complex data, and even better educate personnel.

Analytics will play a big role in the metaverse. Fintechs and banks need to use analytics to understand how customers are using virtual reality banking services. As simple as identifying skill gaps and giving targeted follow-up coaching and tailored counsel to teammates through real-time analytics to help them enhance their performance. Customer interactions are the most obvious illustration of how the “metaverse” may affect banking. As previously stated, providing clients in virtual environments could be the next logical step in the digital customer experience.

This data can help them improve these services and make sure that they are meeting customer needs. Additionally, analytics can be used to identify new opportunities for virtual reality banking. For example, if a bank sees that many customers are using its virtual reality service to transfer money, it may decide to offer more products and services that cater to this trend. By using analytics, fintech and banks can better serve their customers in the metaverse and continue to stay ahead of the curve in this rapidly evolving industry.

Banking in the metaverse is quickly becoming a reality. For example, CBM Bank in the US is already working on an immersive virtual world experience for its customers – metaverse solutions will be available through augmented reality glasses and even smartwatches. The other bank’s examples include: Members of MetaVRse are collaborating to create a financial ecosystem based on blockchain technology that can also provide innovative solutions such as user-controlled digital identities, registration services, and KYC compliance via crowdsourcing mechanisms. This project has set out to deliver an open metaverse infrastructure platform with increased levels of privacy protection compared to existing public blockchains by using advanced cryptography and AI technologies.

Analysis: This reading on how virtual reality is being used to innovate the banking industry was very impressive. It offers an alternative banking solution that merges the qualities of a virtual and in-person experience. In utilizing big data with VR, banks will be able to improve their services and make sure they are meeting customer needs based on aspects like the frequency they use a banks virtual services and for what specifically. It can allow for those who cannot go in person to the bank to have a more interactive experience than one would have just scrolling on a mobile app. I can see how VR could be used to strengthen a bank’s relationship with their clients, allow for more empathy to be demonstrated, and to create a unique way to handle difficult conversations, but I do have some questions. How will a bank go about informing users on how to use VR? How will they afford this and allow customers to afford the VR headsets? I worry that if banks are not empathetic and inclusive enough, older adults will not gain anything from this new technological service, and it is important that they are included!

Citation:

Banking in the metaverse: Future of banking. profinch. (2023, February 12). https://profinch.com/banking-in-the-metaverse/#:~:text=Virtual%20reality%20is%20the%20future%20of%20digital%20banking.,way%20people%20bank%20and%20interact%20with%20their%20money.