Background

Primary and secondary research reiterates that the #1 source of financial knowledge on any topic comes from your parents. From my group interview, every participant relied on their dad, and expected to rely on him more in the future for their financial advice. There was an expected amount of distrust in financial and educational systems to receive help in financial literacy growing up or when making financial decisions. This is scary considering that these participants are in extremely privileged situations, they can’t even imagine how women without financially stable families or college educations would feel about the topic. An estimated 45% of working women aged 25-44 will be single by 2030, up from 41% in 2018. Women need to feel confident in their knowledge of financial topics so that they are actively planning and making smart decisions.

Context

The most in-depth resources for research on women and their finances come from studies conducted by Fidelity Investments. Fidelity was able to recognize that women are held back by their aversion to talk about the subject (identifying various reasons) and the reasons why women are less likely to be investing their money, saving for emergencies, and making other important long-term financial decisions. They also studied women’s potential for investing, the skills that help them get higher returns than men when they do invest, and the importance of women to be at an equal or greater understanding of personal finances because of their changed role in society.

Women and their finances

While single women may be thinking about their long-term goals…, most still aren’t preparing to meet these challenges by taking steps to curb their spending, reduce their debt, and prepare for a job loss. In fact, when it comes to day-to-day budgeting, nearly half (48 percent) admit they tend to spend without thinking about the long term. Furthermore, single women are the least likely demographic (28 percent) to have a comprehensive financial plan in place to help them set savings goals and navigate paying down debt. And, while they worry about unexpected financial hurdles, nearly half (47 percent) have not put an emergency fund in place to cover three-to-six months of essential expenses.

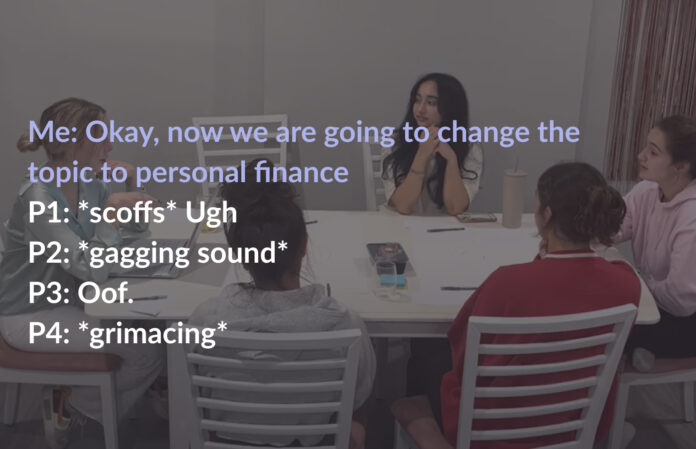

Women discussing finance

The following four main points come from a Fidelity study, but were echoed almost verbatim in the group interview:

Women are socialized not to talk about money because it is ‘too personal’ “56 percent of respondents who have refrained from discussing finances with friends or family kept mum because money was “too personal,” while 35 percent didn’t want to share financial information with those they were close to, and 27 percent were raised not to discuss finances.”

Women are not used to talking about money – “In addition, 32 percent of women feel uncomfortable discussing money, and 16 percent feel that the issue is taboo. 26 percent claim that the topic never comes up in conversation.”

Women are averse to social conflict – “We worry that talking about money will make us vulnerable, make someone feel bad, or simply cross a tacit societal boundary”

Women often have difficulty talking about money because they assume they do not know enough about the subject. “14 percent of respondents worry that talking about money would be a waste of time and 10 percent feel as though they do not understand finances well enough to talk intelligently about it.”

Women, gender, and confidence

The lack of confidence seems completely unfounded, but is completely real. Studies show that at an early age, girls are objectively ‘smarter’ than boys. They take more science and math classes and get higher grades. However, girls lose confidence significantly starting in seventh grade, self-confidence drops every year continuing into college. In college, women in STEM majors question ‘if they really belong there’. When asked to indicate their gender before a math test, women will perform 20% worse. When told ‘men are better at this task’, a woman’s confidence in her own skills plummets.

I chose to look into this in my survey and the group interview. The survey was open to everyone, but I only chose to analyze the data by comparing the answers of 18-25 year old men to 18-25 year old women. The survey mimicked the research that fidelity investments had conducted on men and women’s confidence; men felt more confident than what their skills suggested, women, less. In the group interview, the women noted that there a sense of arrogance about the subject in men their age. In comparison, they are absolutely uninterested and uninformed about the entire ‘culture’ of finances. They agreed that men are more comfortable talking about it with their friends because it is a common interest, they talk about it to their dads, and they are more comfortable gambling with their money.