Imagine your week as a student.

Think about everything. The laundry that has to get done on Wednesday, the doctors’ appointment on Friday morning at 9 am, winding your hours away doing work in your classes, and studying for that exam next Monday. That week fills up pretty easily without much thought or planning. Can you get through it without help from friends or family motivating you, or without a professor probing you to get your assignments in? If we were left completely on our own in this world we would likely lose motivation, and it wouldn’t take long before sinking into a depressive hole. We would just let time pass only to do nothing about it.

Now imagine you’re in this same world, one filled with events and due dates. Now, however, you have to workout every morning before class and are assigned a tutor to meet with everyday to stay afloat in classes. Guess what? You also have a trip to Oregon that you have to leave for on Thursday, so good luck working your schedule around to fit every necessary event in your week. Try doing all of this, and try to stay remotely sane.

Are you stressed out yet? It stresses me out. That’s what a week in a student athletes’ life looks like. It is a proven concern. An “NCAA study found 30% of surveyed athletes feeling extremely overwhelmed, with nearly 25% feeling mentally exhausted. (Lindberg, 2021)” College fans put student athletes on pedestals, even wearing their names on their shirts, yet is this dehumanizing them? Are we ignoring their emotional needs and abilities to manage school and athletics?

What’s interesting about this weekly schedule and mental depravity that I have mentioned, is that I’ve left out a huge piece of daily life: MONEY. Some people are given strong guidance in how to use their money and where to put it, while others are left to fend for themselves. People that have little to no knowledge on their financial matters are known to have little financial literacy or poor financial well-being. Financial well-being is a term used to describe your level of knowledge on “how to manage your money and resources responsibly with an eye toward long-term financial security” (“Financial Wellbeing”, 2022). This lack of financial literacy has been ever apparent in Gen Z as fewer and fewer college students are confident in their financial literacy, and are given outlets that may not be beneficial to their long term financial well-being (Constable, 2024). Given this lack of financial knowledge, we have put ourselves into a hole, since we as a society depend on finances so heavily.

With these issues of lower rates of minimal financial literacy, it only has a compounding effect on student athletes of the modern age.

This focus of financial well-being in the modern student athlete has brought me to a culmination of my collegiate career as much as any topic may. I found interest in this topic as I have been involved with athletics in a variety of capacities throughout my personal life, ranging from slow pitch recreational softball to high school varsity athletics. In my professional life I have worked at summer camps teaching sports to kids and I’ve also held a role at the Columbus Crew working in the operations department seeing everything that goes on behind the scenes. All-in-all, athletics have been an integral part of my life and I want to give back to what has given me so much, and now with my education in design I feel I have the tools to do so.

In my academic career I have pursued my bachelors in industrial design, as well as a minor in business. Design has taught me to create and find solutions in an unconventional way. To contrast, business has shown me that finances are this unimaginable beast, a spider of sorts, that only men on Wall Street can tame. That was only until I really began to understand what I was being taught in my business courses. This was that finances and business in general can be tamed and understood but only if you have the proper guidance and the desire to learn.

This desire to learn for many students unfortunately isn’t the largest barrier, it’s time, and a lack of proper resources. For so many students, especially those in athletics, using time comes at the expense of less time for something else (Tepper & Lewis, 2024). This lack of time can cause compounding issues from lack of sleep to unfamiliarity with their own finances. This ripple effect can reach great heights by affecting the circles surrounding an athlete including coaches, parents, advisors, and friends (Prioritizing Mental Health in College Athletes, 2022).

If these athletes were all able to have reliable financial resources that aided them by focusing on them as both a student and as an athlete, there would be rewards tenfold for long term financial well-being.

People need other people.

Although technology has encouraged less face to face human interaction, it only works until it doesn’t. You may run into a technical issue, and the only solution is through human interaction. Society as a whole is reaching for comfort and ease of use in everything that they do from a day to day basis, but we do not grow in comfort, rather in discomfort. AI robots and driverless Waymo’s have given people opportunities to live life “free of awkward” and “uncomfortable” situations. (when things are received with ease they are given with ease) (Velazco et al., 2024). These shortcuts in technology have been influenced and and spearheaded by businesses focused on speed and ease of use (Going cashless. And cardless) (Picoult, 2023). In light of these innovations, I created a conjecture with ease of use and little focus on human interaction. The images in the conjecture were also AI generated in Midjourney.

People need other people.

In the world of art, paintings can be viewed as absurd or unsettling (Selvin, 2020). That is until a person learns from the artist what the intentions of the painting were. In that sense, art is a collaboration with the artist and the viewer. I find it to be where people are authentically themselves, and is a great tool to learn about others’ realities (Where we belong art project brings community together, 2024). This is exactly how many people view finances in their lives. Finances can create a “notion of entrapment” (Selvin, 2020) when you don’t understand it. With the help of others, you can understand it, and you’re able to find how powerful it can be (Where we belong art project brings community together, 2024). I then created a design conjecture with the focus being on creating a collaborative, yet unnerving environment, to inspire growth.

People need other people.

Finances can be detrimental to oneself if you don’t have access to proper resources (Sands, 2019). Finances are used in gambling or in ‘day trading’ which can cause a dopamine rush. Many times these are gamified to the point where your mind may not process that you’re losing money and instead, you focus only on the possible reward (Game over: Robinhood pays $7.5 million to resolve “gamification” securities violations: Insights: Vinson & Elkins LLP 2024). How people will begin to mitigate these ‘gamification’ tactics used in applications is by first acknowledging the problem, which can start from support from friends and family. (Game over: Robinhood pays $7.5 million to resolve “gamification” securities violations: Insights: Vinson & Elkins LLP 2024). I then created a design conjecture highlighting the negatives of ‘gamification’, in this easy to use ‘dating app’ for stock investing.

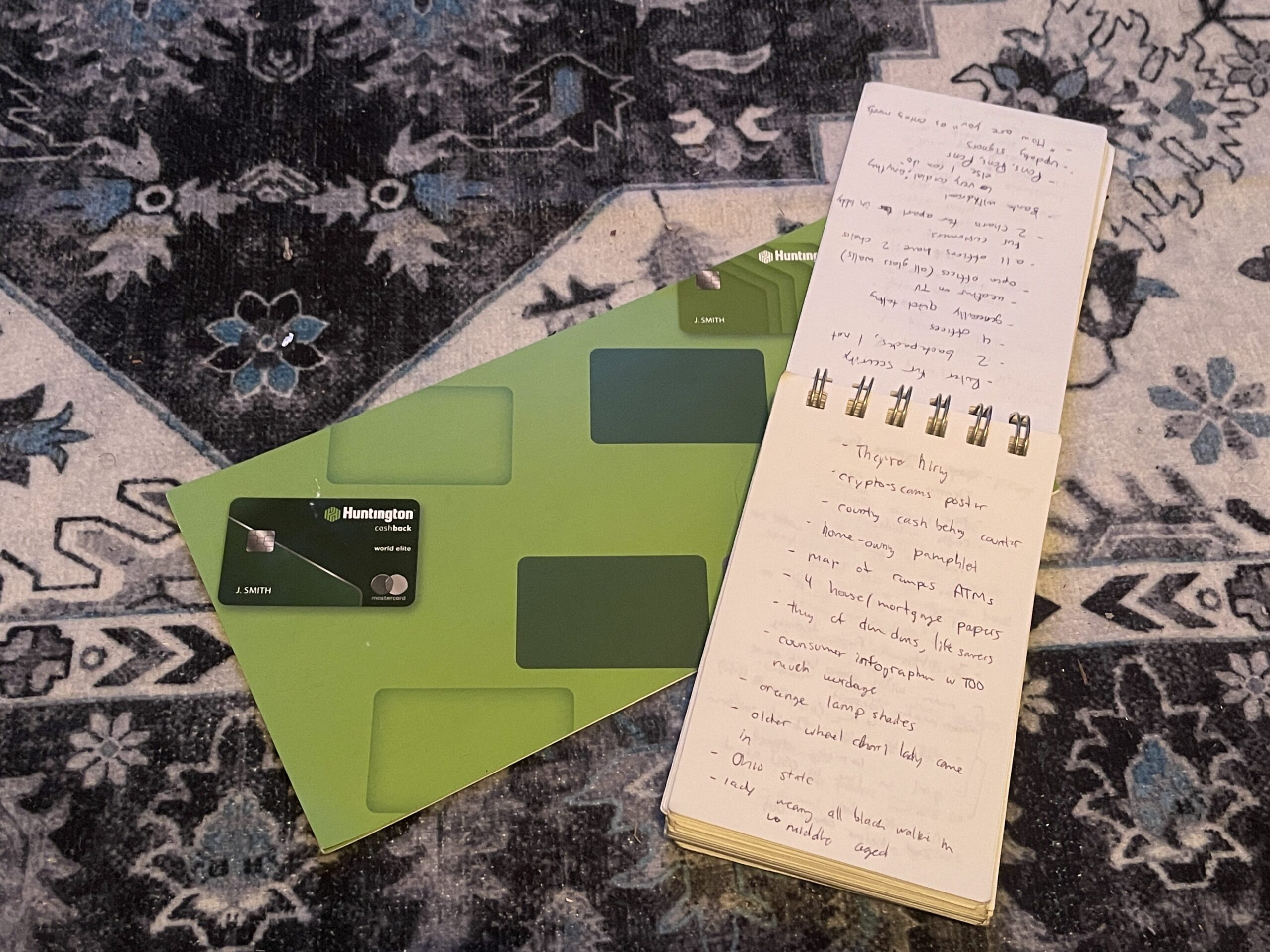

One of the financial related experiences that I believe will be a continual effort throughout the semester is learning where current financial institutions thrive and where they fall short. During the duration of this research experience I have done various ethnographic and auto-ethnographic style ventures. The first of these taught me about my partner, Huntington Bank, and how they position themselves in the market. I took a trip to the Huntington branch right next to OSUs’ campus to observe and take notes. I focused on the various interactions I saw and noted how personable and timely employees were for all of their customers. With this branch specifically being catered towards the college population at The Ohio State University, my observations gave insight to how Huntington may interact with my target demographic.

I’ve found that some of my greatest learning experiences happen when I position myself into uncomfortable situations. This is exactly where I put myself in two instances, one intentional and one not so intentional. In the first of these I positioned myself as a prospective customer at a Fifth Third branch. I went through the entire process of opening a checking account to understand how I felt I was valued through the process. Recognizing my discomfort in the waiting area, and feeling very stressed through the process of opening an account, gave me great insights on some possible pain points. I hope to continue to find insights on the market with my future auto-ethnographic style endeavors going to other branches and comparing past experiences.

As I continue my different research efforts throughout the semester I hope that my focused research is able to take the front seat. Thus, I have begun research on student athletes here at The Ohio State University. I have been using various methods including but not limited to a survey, interviews, and a planner style effort to understand student athletes better.

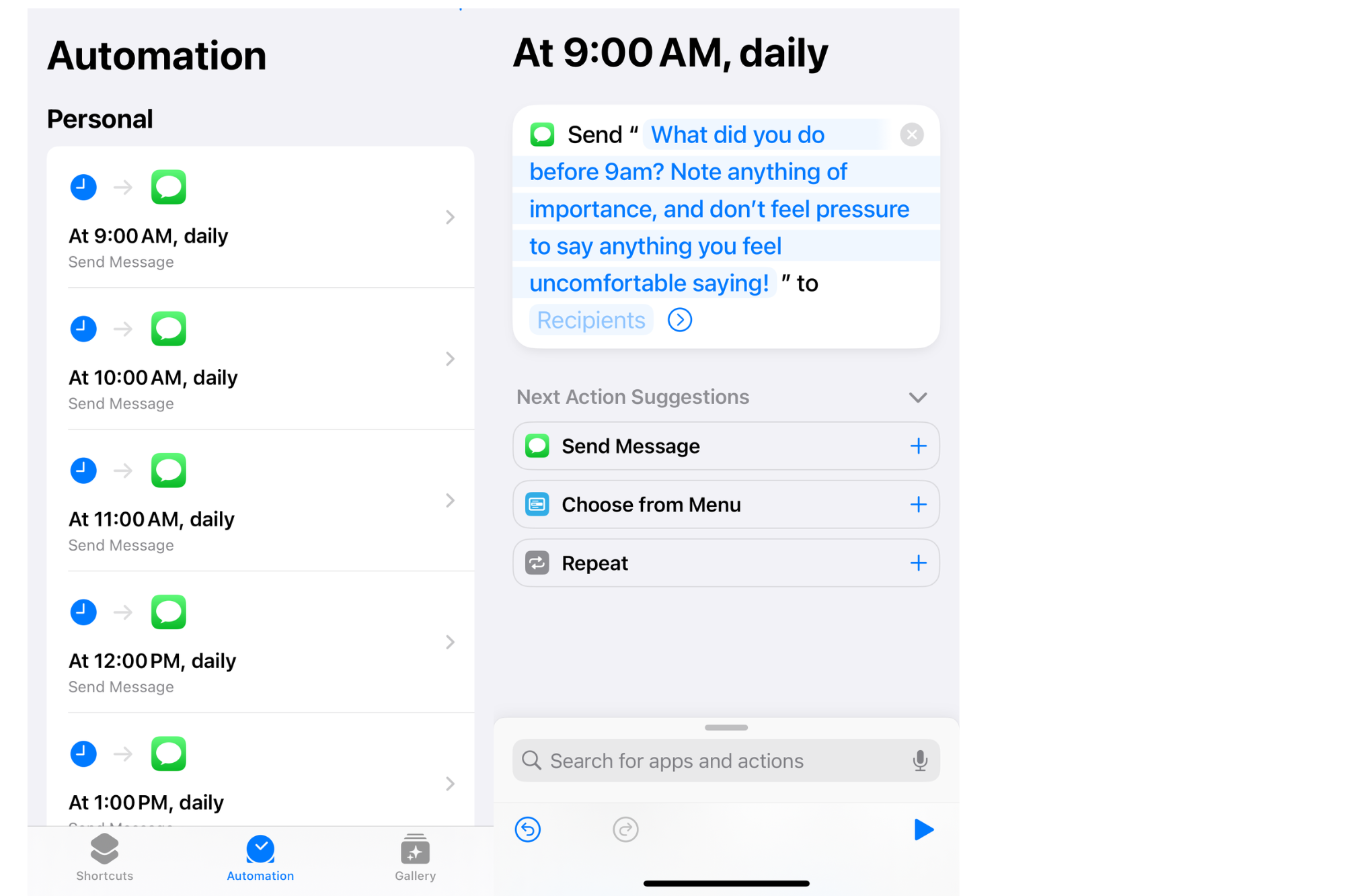

Although I have found and continue to find insights in the survey and interviews I want to focus my discussion here about my planner style research method I formulated. I created this effort to hopefully better understand the day in the life of a student athlete. After reaching out to an athlete that responded to my survey and finding that he preferred to keep things remote I created this planner ‘assignment’. In doing this, I found a way in which wouldn’t be invasive, but it would allow me to probe responses every hour for the days I conducted the research. I had automated texts sent out every hour from 9am to 9pm, which was based on his daily schedule. This resulted in having substantial material showing just how full these student athletes’ days were.

In receiving this allotment of information I compiled a day into a persona planner. I was able to visualize how little available time there was on a given day. In the example below the student athlete spent his entire day between various commitments. Office hours and training accounted for about half of his day.

I plan on continuing my research focused on student athletes in the coming weeks. This includes, but not limited to, future interviews with a range of stakeholders involved in the life of student athletes, as well as possible further planner research and analysis.

Student athletes have full plates and they need people and resources that care about them to get through their collegiate career. I believe that these institutions need to treat these athletes as students first, and I don’t believe that is always done (Newman, 2023). Given that student athletes are faced with a lack of proper resources and time, how can design promote financial well-being in a way that values care without removing the human relationship?

Sources

Constable, S. (2024, May 27). When tested, most students lack financial literacy, new study finds. Forbes. https://www.forbes.com/sites/simonconstable/2024/05/27/when-tested-most-students-lack-financial-literacy-new-study-finds/

Financial wellbeing. What is Financial Wellbeing | Student Wellbeing. (n.d.). https://www.bu.edu/studentwellbeing/what-is-wellbeing/financial-wellbeing/

Game over: Robinhood pays $7.5 million to resolve “gamification” securities violations: Insights: Vinson & Elkins LLP. Vinson & Elkins. (2024, July 1). https://www.velaw.com/insights/game-over-robinhood-pays-7-5-million-to-resolve-gamification-securities-violations/

Lindberg, E. (2023, September 19). How USC student-athletes strengthen their game through Mental Health. USC Today. https://today.usc.edu/college-athlete-mental-health-usc-sports-psychologists/

Newman, S. (2023, May 31). Student athlete or athlete student?. The Daily of the University of Washington. https://www.dailyuw.com/opinion/student-athlete-or-athlete-student/article_82fb543e-ffe1-11ed-874b-0f18705d28d6.html

Picoult, J. (2023, December 21). A self-checkout that customers love? this company created it. Forbes. https://www.forbes.com/sites/jonpicoult/2023/12/21/a-self-checkout-that-customers-love–this-company-created-it/

Sands, D. (2019, October 1). 5 money lessons from Kendrick Lamar’s “Money trees.” Black Enterprise. https://www.blackenterprise.com/kendrick-lamar-money-trees-finance-lessons/

Selvin, C. (2020, May 20). Louise Bourgeois’s iconic spider sculptures have a surprising history. ARTnews.com. https://www.artnews.com/art-news/artists/louise-bourgeois-spider-sculptures-history-1202687603/

Tepper, S., & Lewis , N. (2024, July 18). Research: People still want to work. they just want control over their time. Harvard Business Review. https://hbr.org/2024/07/research-people-still-want-to-work-they-just-want-control-over-their-time

Trine University. (2022). Prioritizing Mental Health in College Athletes. Trine University. https://www.trine.edu/academics/centers/center-for-sports-studies/blog/2022/prioritizing_mental_health_in_college_athletes.aspx

Velazco, C., Jimenez, A., & Abril, D. (2024, September 12). Waymo vs. uber and lyft: How cost, speed and experience differ – The Washington Post. The Washington Post. https://www.washingtonpost.com/technology/2024/09/12/waymo-vs-uber-lyft-cost-speed-robotaxi-rideshare/