Featured photo courtesy of Mary Ann Coss

In our post-pandemic world, global exploration is more popular than ever. In 2021 alone, over 18 million Americans traveled overseas (SSW, 2022). Travelers go abroad for a multitude of reasons – business, visiting family, tourism, etc. The world is in a constant state of motion as people cross the globe every day. With travel comes some incredibly amazing experiences – visiting iconic monuments, trying new cuisines, and gaining exposure to new cultures and world views. It’s an incredibly exciting experience for those who take the leap.

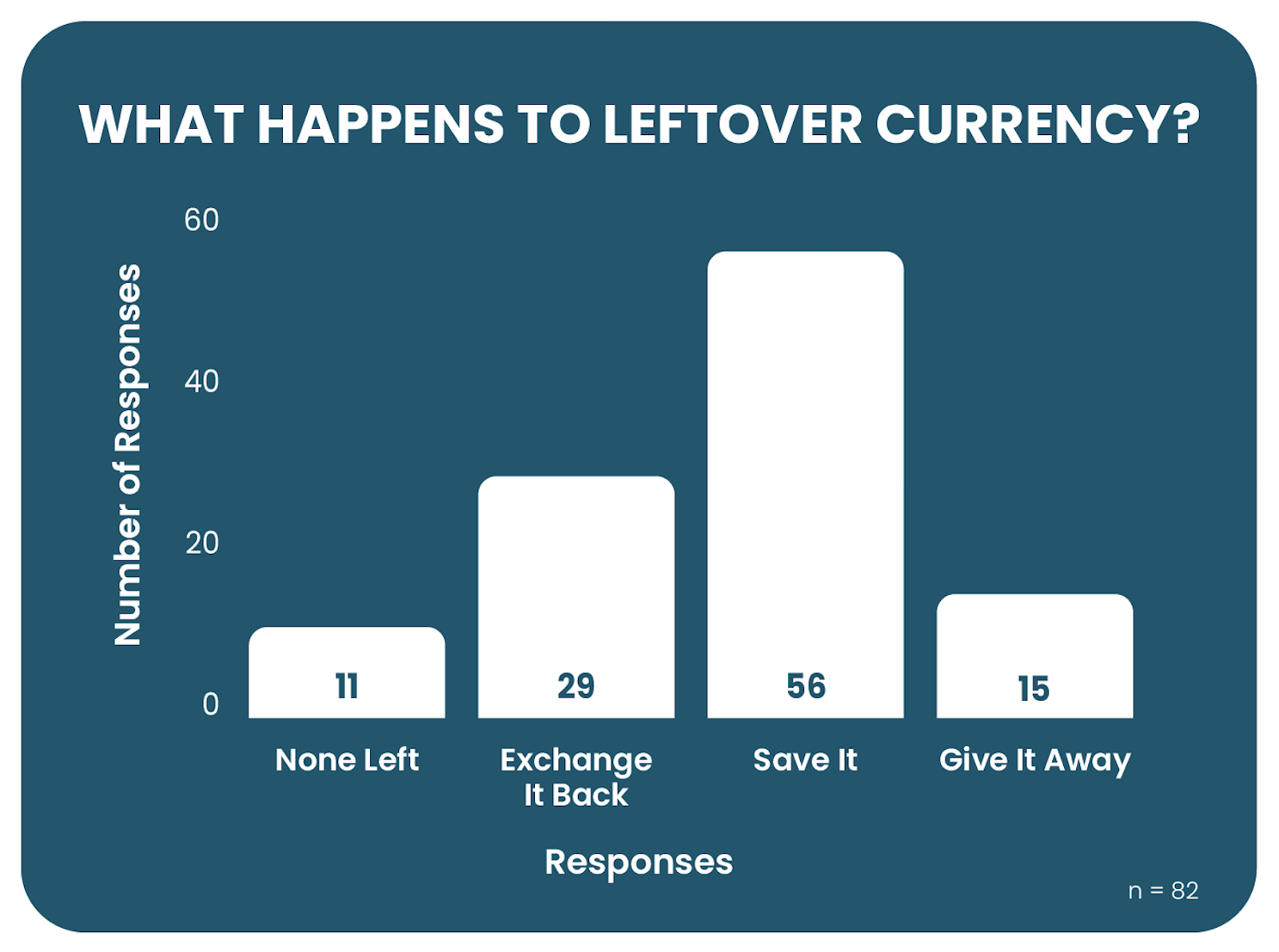

However, traveling is not without its troubles. Especially when it comes to spending! There are over 162 official currencies in the world, so there’s a good chance that whenever you travel abroad, you’re going to spend money in a different currency (WorldDataInfo, 2023). This often leaves travelers with foreign cash in hand as they hop across the pond, cash they are actively trying to get rid of their entire trip, because when they return to the States, it has no use. Banks and third-party companies do offer exchange services to trade currency, normally used at the beginning of a trip abroad, but such services aren’t utilized as frequently post-trip. Most often, any leftover currency gets saved as a souvenir, a financial loss for the traveler. In fact, via a survey sent to people who have traveled abroad recently, 68% of people revealed that they keep their currency as souvenirs or for potential future use rather than exchange it back.

Why don’t travelers utilize foreign exchange services when they’ve returned from their journeys abroad? Banks and third-party services don’t necessarily make the process easy. First and foremost, this process is usually done in person. Anyone wishing to exchange currency back physically goes into a brick and mortar location. These errands could range from being 5 minutes down the road all the way to a 30 minute drive into the city to be able to exchange. More often than not there are minimum values for an exchange to occur, so if you have less than what is required, you’re left with foreign cash you can’t use. And don’t forget about the fees! For example, Huntington Bank currently charges $8.00 to exchange currency, on top of the conversion rate of the day (2023 Huntington Bancshares…, 2023). If you have 20 euros you’d like to change back to US dollars, the current exchange rate would give you $21.00, however the processing fee would bring it down to $13.00. It is understandable that paying $8.00 to be able to have $13.00 isn’t too enticing to the average person.

During an ethnographic-style observation at a local Columbus bank, it was revealed that this process is also time-consuming, and often doesn’t even take all your currency back. For example, banks won’t take any foreign coins. Europe is especially fond of its coins, which can be worth up to 2 euros, and travelers interviewed have commented that the rich coin culture leaves them with lots of leftover metal at the end of a trip. By refusing coins, banks leave travelers with notable amounts of useless currency that have the potential to add up to a lot of trapped money. Six 2 Euro coins is around $13.00, which could get travelers two morning coffees whenever they have an early flight. Banks won’t accept less common currencies, either. For example, one interviewee, Kramer Horning, who was forced to leave the Kingdom of Tonga suddenly due to the pandemic, was unable to exchange his remaining currency back into US dollars before he left. Now he has about T$125.00 worth of Tongan money, Paʻanga, that he can’t do anything with, because that rare and niche currency isn’t widely accepted in the States: “I had T$125 in Tongan Paʻanga that was still good to use, that could still be exchanged, and I could get $50-60 bucks for it, but there was nowhere to exchange it. Who’s gonna take Tongan Paʻanga?”

Because of this barrier to returning foreign currency after a trip is completed, travelers often find themselves overspending with their cash at the end of their trips, simply because they want to get rid of it before heading back to the States. In interviews, travelers have confessed to buying random snacks and souvenirs at the airport with their remaining cash, as well as using their cash on purchases that would have been perfectly fine with a credit card, from meals to souvenirs. Some have increased their tip amounts closer to the end of their trips, giving tour guides and drivers whatever cash they had left. Tob Coss and family, who toured multiple European countries this summer, would give whatever cash they had left away as tips just to not have it on them anymore: “When we left Greece it was the same thing. We gave our tip to the driver and that was the last of our money.” Their goal was to get rid of it entirely.

You might be thinking, why not just use a credit card instead? Other people think that too! In fact, 51% of travelers use a credit card while abroad, while 41% of travelers use their debit card (Pokora, 2023). Virtual money is converted by credit card companies or banks after the purchase (therefore you get the best exchange rate), plus you don’t need to try and get rid of it because those same cards can be used in the States! The top advice across several travel planning sites agrees: cashless is what you should be aiming to do. You automatically track your spending and should anything happen to your card, you can always cancel it and protect your money. Companies even have travel-specific cards with rewards geared towards flights and hotels, combined with no foreign transaction fees to get the most use.

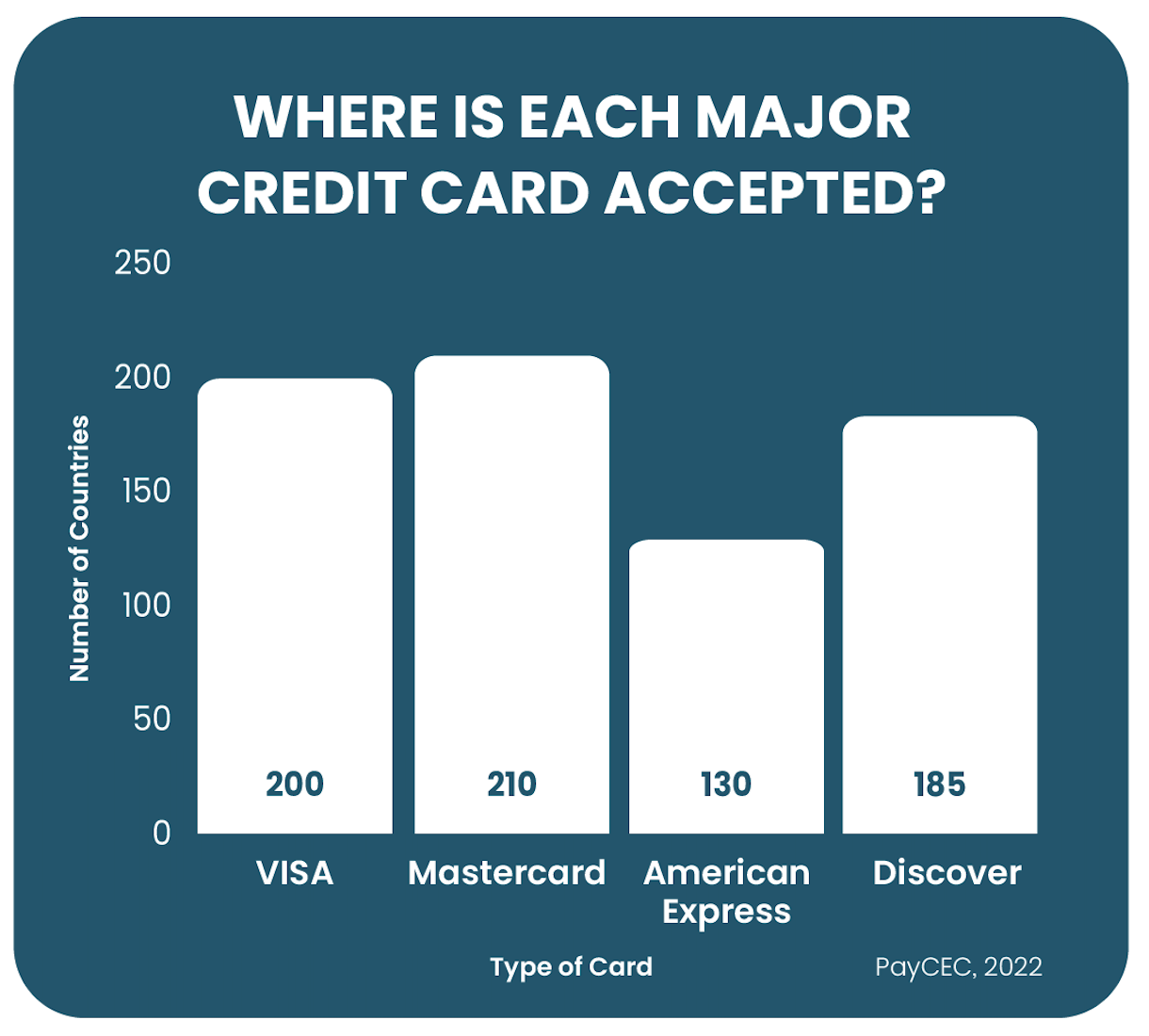

Most interviewees agree that the cards are a better method of spending, and stick to mainly using cards while abroad. But not everywhere can keep up with such a change. Contemporary society might be transitioning into a cashless state, but less developed parts of our world still heavily rely on cash, meaning tourists have a fine line to navigate between what type of spending they can do. Cash is still incredibly common in less contemporary places. Small shops might not have the desire to invest in POS devices or pay the credit card merchant fees. What’s more, certain credit cards might not work in different parts of the world. Visa and Mastercard are generally accepted everywhere, but Discover and American Express vary per location. Even if cards are accepted, not every credit card is blessed with no foreign transaction fees on purchases. That extra 3% can add up very, very quickly.

Travelers need physical money for taxis, tips, even for making purchases from small street side vendors. Interviewees agreed that it is smart to keep at least a little foreign currency on you at all times when abroad, because you never know what’s going to happen. If you lose your credit card or it gets flagged for international use, then whatever cash you have on you is all you have to spend. If you lose your debit card, then you’re cut off from ATM access for the rest of the trip. If you’re in an area with no internet connection and need to move money into your checking account to be able to take out cash with your debit card, you’re out of luck. For the time being, it’s smart to have physical cash on hand when you go into an unfamiliar place.

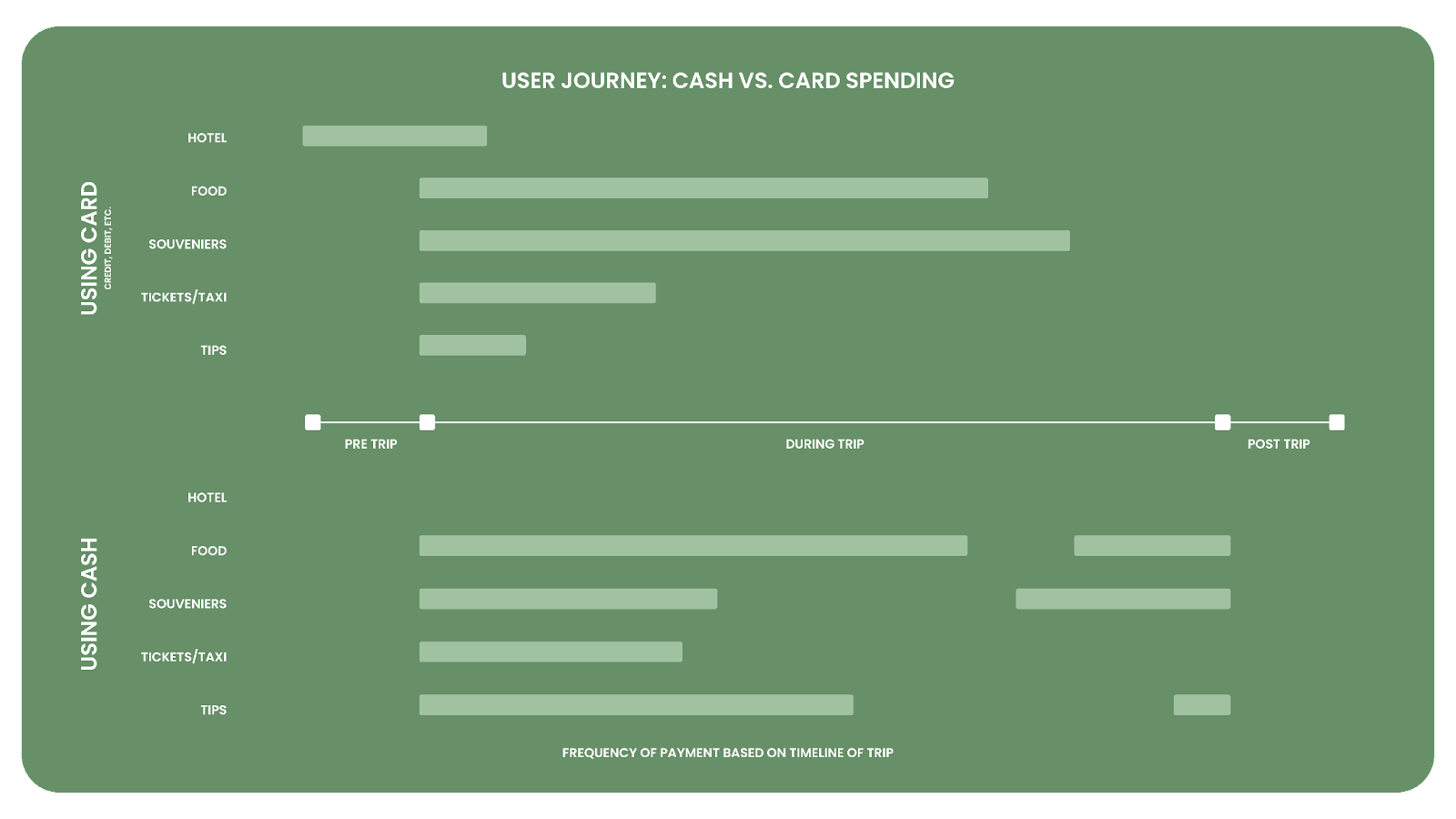

What comes out of this cash versus card debate is a balance. Many travelers travel with a card and a little bit of foreign cash on them. Cash is used for smaller purchases that don’t need to be tracked as much, while cards are directed to larger purchases. Tourists use the card at the beginning of their trip, avoiding using up their cash in the event of an emergency, and then in the last few days of the trip start spending it down in an effort to rid themselves of it. Whatever doesn’t get spent becomes a burden in the States.

This inability to easily return foreign currency affects multiple groups. First and foremost, people who travel internationally using both cash and card will cross paths with a bank or exchange service either before, during, and/or after their trip, either to convert or return currency. User experience teams at banks who design these services want to create a system that benefits both sides of the transaction. Also consider bank tellers, the employees carrying out the transaction, as well as the friends and families of travelers, either traveling with them or helping to track their spending and troubleshooting from home, like a parent would if a child went abroad. And we can’t forget about travel companies or travel agents who are sending people overseas, they have to give advice about how to spend money. And lastly, overseas vendors who are accepting either cash or card will be affected by how their customer chooses to pay.

Despite the push for cashless, cash isn’t going away anytime soon. It’s too much of a safety measure in the event that technology fails, which it has before and will again. Therefore, travelers need a more convenient way to handle cash when they go abroad. How can they easily get rid of what they brought without stressing about using it up, without overspending? And what role might a bank be able to play in this dichotomy, where it can step up with a new service to make this process easier for its customers while also benefiting?

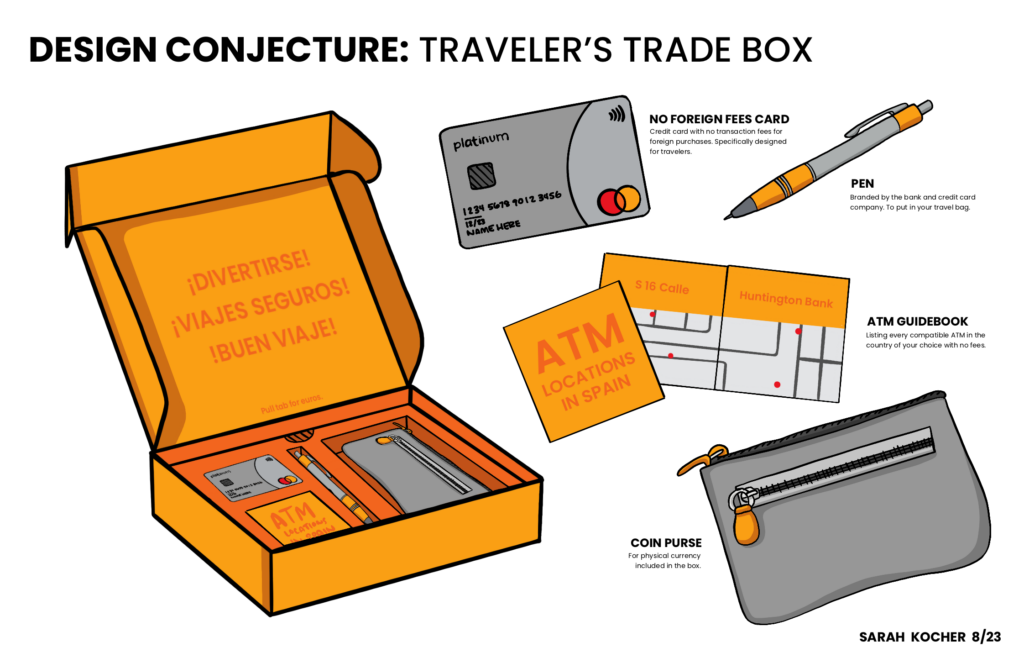

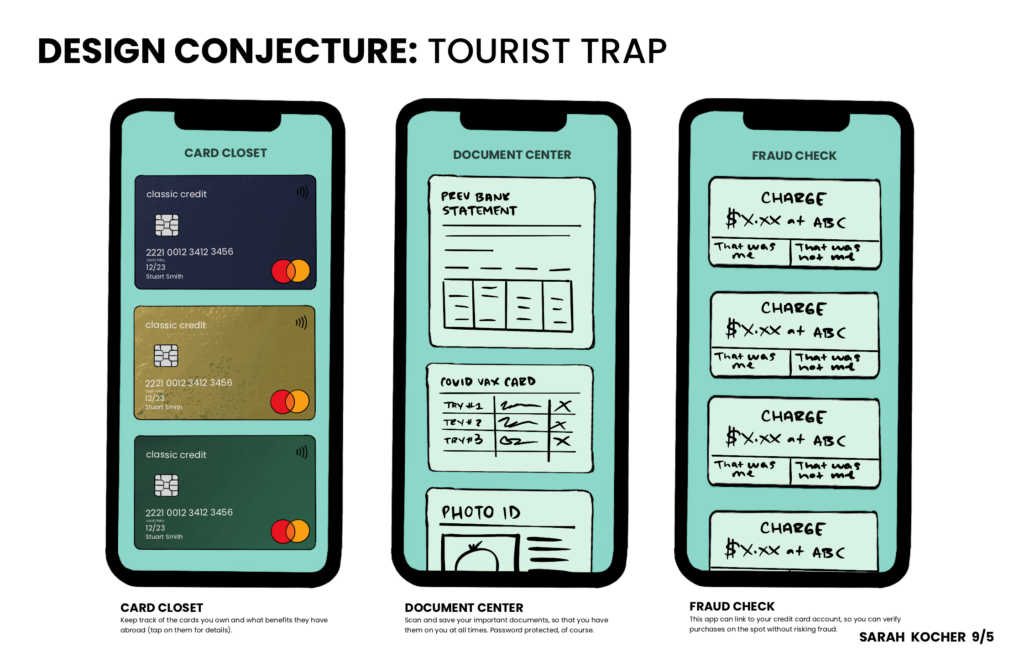

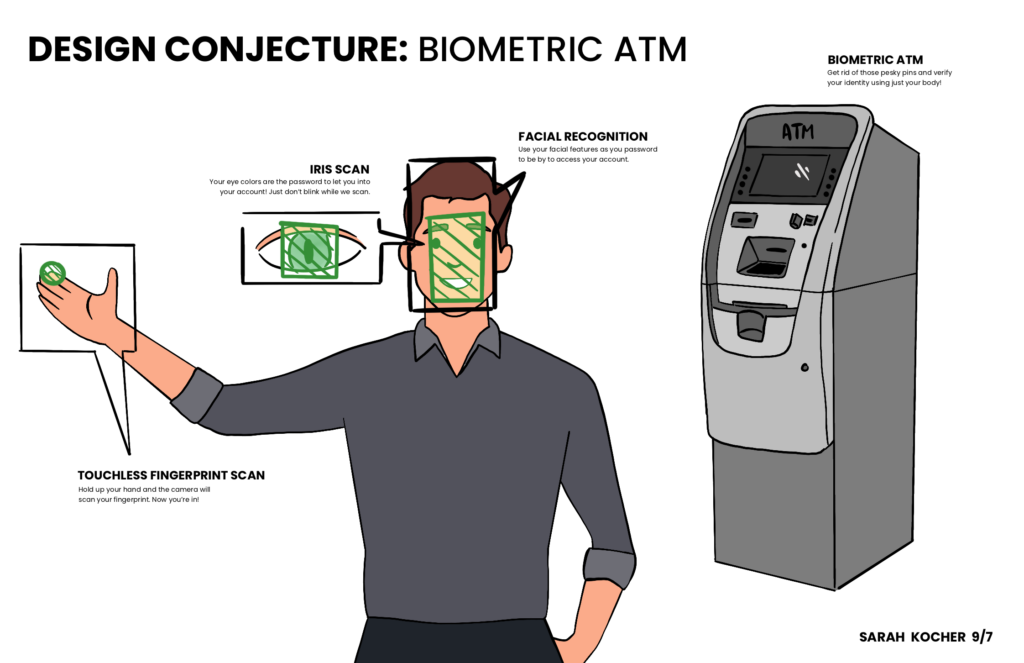

Several avenues have been considered. Secondary research has been conducted in the realms of business, focus, science & technology, as well as the arts to better understand the world of travel spending. Conjectures such as currency subscription boxes, biometric ATMs, and apps designed to safely track card use while traveling have been proposed to fuel research, exploring how to improve overseas spending. Future designs should focus on making the post-trip exchange process smoother, so travelers don’t find themselves spending any more money than they need to. This will help them save up for their next trip abroad, as well as slow any worrying about what to do with foreign currency upon returning to the states. By taking one stressor away from planning and experiencing a vacation, travelers can focus on what truly matters: their experiences abroad and the memories they made along the way.

Sources:

2023 Huntington Bancshares Incorporated. (2023). Foreign Currency Exchange Services.

Huntington Bank. https://www.huntington.com/Personal/foreign-currency

PayCEC. (2022, March 23). Differences between Visa Mastercard discover and Amex. https://www.paycec.com/us-en/news/differences-between-visa-mastercard-Discover-and american-expressamex#:~:text=American%20Express%20and%20Discover%20are,

which%20is%20typically%20a%20bank.

Pokora, B. (2023, August 16). Travel trends 2023: 49% of consumers plan to travel more in 2023. Forbes. https://www.forbes.com/advisor/credit-cards/inflation-has-not-deflated-

americas-travel-plans-2023/#:~:text=49%25%20of%20Americans%20Plan%20To%20

Travel%20More%20in%202023&text=This%20is%20especially%20true%20among,

or%20more%20times%20in%202022.

SSW. (2023, January 11). Travel statistics. SSW. https://samseesworld.com/travel-statistics/ WorldData.info. (2023). List of all currencies worldwide.

Worlddata.info. https://www.worlddata.info/currencies/#:~:text=All%20currencies

%20of%20all%20countries,euro%20with%20a%20constant%20rate