In all my research about spending while abroad, I’ve encountered lots of concern about fraud, backup plans, and security around credit cards. There are a lot of plans currently in place that help travelers protect their funds and allow them to spend freely while abroad, however they all sort of fall into the “don’t forget to do this,” or the “it might be a good idea to,” category. There are a million things to keep track of when you travel, and while the 50 things surrounding finance are incredibly important, things can very easily get lost in the chaos.

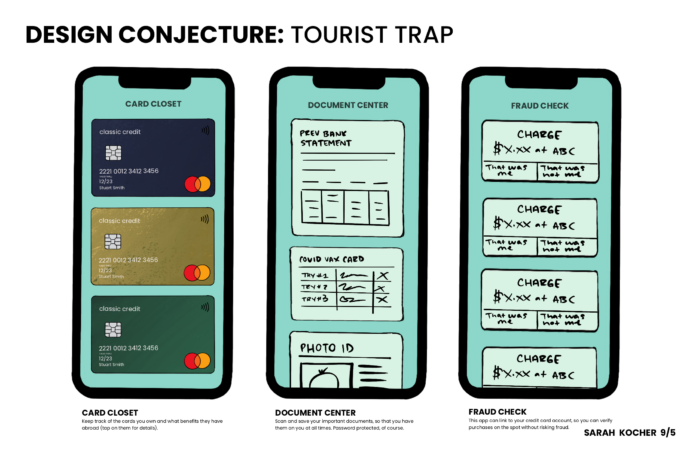

My conjecture, Tourist Trap, is an app that consolidates all this advice into one spot. In the app you can plan the financial side of your trip in one place, thus making is hard to miss steps in the planning process, and leaving travelers more secure and confident that they’ll be spending safely while abroad. In the app, you can keep track of what credit cards you’ll be taking with you and what their international fees are (or aren’t). You can also track their customer service lines and hours and anything else important to know about what your card can and can’t do. You can scan and save your most important documents in the Document Center, so should your card need to be replaced, you have all the documentation to do it. Plus, in the Fraud Check section, any charges that pop up on your credit cards that are flagged as fraud will appear and await your approval. If you say it’s you (with your phone verifying your location), then the charge will pass. If not, then your card freezes and the company will go from there. Other features in the app include an ATM guide, trip planning, conversion rates, anything and everything that a traveler might need when they go abroad and are unsure about how to safely spend their money.

Ideally, this is a feature that a bank can include as an add-on in their virtual banking experience. So, the wire framing can be incorporated into the bank’s own virtual app and website, or everything can stay separate and the bank can refer traveler’s to this extra service.

Are there problems with this design? For sure. I don’t know if credit cards can be uploaded to other finance apps, or how banks and credit cards might work together in one spot since they’re not quite of the same realm. Plus, would including all these features be overwhelming for a traveler? And how does physical currency fit into this? All this requires more research!

Takeaways

My biggest takeaway from this conjecture is that traveler’s need a LOT of help when it comes to making the overseas spending experience more convenient. I have my work cut out for me! Developing this conjecture in particular helped me realize that because there are so many points that I could address in the process, I might fare better by focusing on just one issue, rather than addressing them all at once. Food for thought.