What I have learned about the banking business is that some changes are going to be unavoidable. While I would like to give every bank teller back their job and keep all bank branches open, it just isn’t realistic. That is not to say that innovation can’t be done to make the in-person banking experience more desirable and attractive to both bank companies and customers, but here I would like to take a different approach. As I have learned from the many articles, I have read about changing business models in banking, a majority of banks are transitioning their products and services to be available completely online. Many companies are also partnering with fintech companies and adopting different technological processes and data capturing methods to make digital banking more desirable and convenient. My concern here is that the older population is being excluded from this transition – if they do not know how to utilize certain technologies, and if they do not understand how digital banking can be used to personalize their financial experience and give them banking suggestions and tips, how will they want to make that transition? As research has shown, many older adults refrain from digital banking out of fear of making a mistake or lacking the security they have with in-person banking. What if banks could better inform their older customers about how to bank online, and what banking technology consists of?

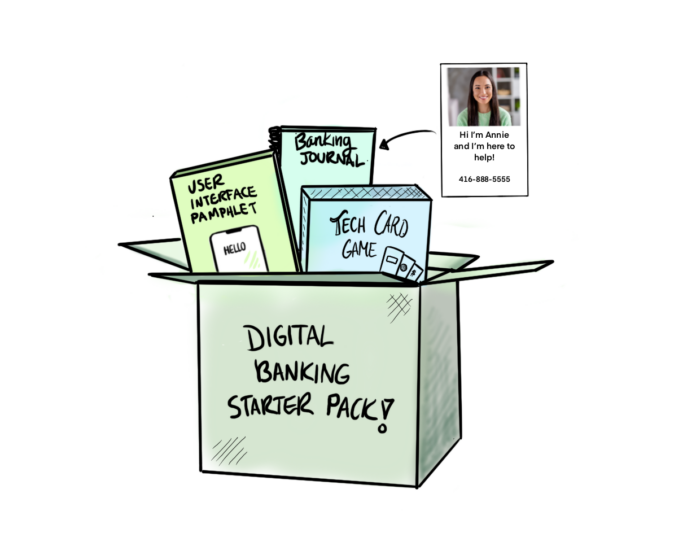

The Digital Banking Starter Pack seeks to empower older adults and teach them how to utilize digital banking. It is especially useful for people needing to make the transition to digital banking because they no longer have the ability to go in-person to the bank. It comes with a user interface pamphlet that will visually explain the different functions of banking websites and apps. It will instruct them on how to carry out desired functions, such as depositing a check, or asking for assistance. It also comes with a technology card game, so customers can visualize, memorize, and understand what technology their bank is using, such as data-capturing methods to analyze spending habits. Finally, in their Digital Banking Starter Pack, customers will receive a banking journal where they can organize their thoughts and questions and share with who they please. Within the journal comes profiles of bank employees who customers can contact based on specific needs. For instance, if having trouble with mobile deposits, they will find Annie’s profile which shows her picture and a description of herself, so people can put a name to a face and better get to know who they are speaking with over the phone. Overall, I believe the Digital Banking Starter Pack will help those looking or needing to switch to digital banking, by giving them fun, visual tools to expand their knowledge and seek assistance with.

Analysis: In looking at the Digital Banking Starter Pack from a critical lens, I believe more research needs to be done to figure out what the true components of the package will have. For instance, what type of game will be the most exciting and effective way to learn about technology, is it really a card game? I also question the operational ways of getting these packs out to customers, should they have to apply for them, or should everyone making an account get one? In sharing this concept with older adults, they really enjoyed that they would be able to digest and redigest information whenever they want in an organized, fun way. But many of them expressed a desire to learn in a more collaborative manner with other people.