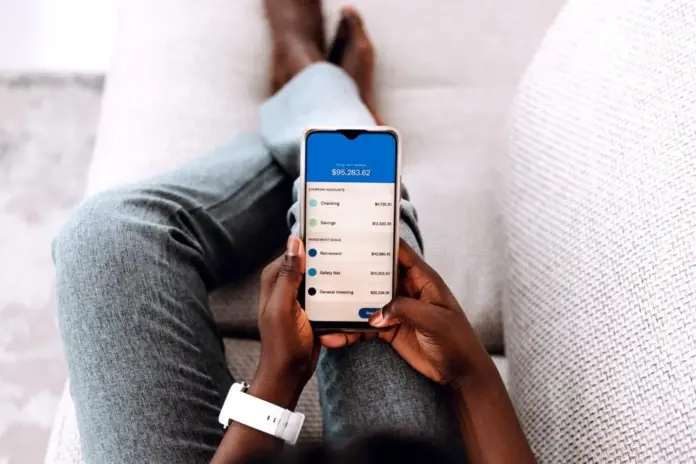

In recent years, there has been a significant trend toward mobile banking experiences in the world of finance. As mobile banking is increasingly preferred by customers globally, a mobile-first strategy is becoming crucial. Over 50% of older Americans and 90% of younger Americans choose mobile banking in the U.S., 66% of users in the UK choose mobile banking, including more than 50% of the oldest surveyed customers. 80% of Canadians prefer using smartphone apps. The epidemic accelerated the trend to digital banking by making customers wary of going back to traditional ways. Nevertheless, putting in place a mobile-first approach is not without its difficulties.

The following are the primary issues:

1. Digital Security: Despite the implementation of sophisticated security measures, concerns about cyber threats persist, necessitating the use of more sophisticated security solutions like biometric authentication.

2. Legacy Banking Systems: Because they are outdated and inefficient, traditional banking infrastructures are open to attack from cutting-edge fintech businesses. Banks can get around this by implementing open APIs, which enable smooth connection with mobile applications from third parties.

3. Customer Experience: Current banking procedures fall short of meeting the demands of modern consumers. The user experience can be improved by mobile apps through data analytics, tailored interactions, and contactless technologies.

Mobile banking must incorporate contemporary developments like 5G connection, wearables, edge computing, and on-demand applications in order to be a successful component of the digital transformation. Banks must concentrate on these platforms as mobile banking continues to grow.

Analysis

What I found interesting was how the innovation of 5G can improve mobile banking. Near-instantaneous data transfer is one of 5G’s main benefits. For banking, this means that transactions, especially international ones, can be carried out in real-time, improving the effectiveness of financial procedures and cutting down on consumer wait times. Applications that require a lot of bandwidth, like AR and VR, will profit from 5G. This might be used by banks for immersive financial planning experiences, virtual financial counseling, or property tours for house loans. Quicker authentication procedures result from faster data transfer rates. By enhancing security measures, such as facial recognition or real-time fraud detection, 5G can make sure that transactions are quick and secure. Essentially, the entry of 5G into the banking industry opens the door to technologies that could make banking more rapid, effective, immersive, and secure.

Altynpara, Evgeniy. “Council Post: Mobile-First as a Prevailing Strategy of Banking Digital Transformation.” Forbes, Forbes Magazine, 7 Nov. 2022, www.forbes.com/sites/forbestechcouncil/2022/11/04/mobile-first-as-a-prevailing-strategy-of-banking-digital-transformation/?sh=604fdf1e4c82.