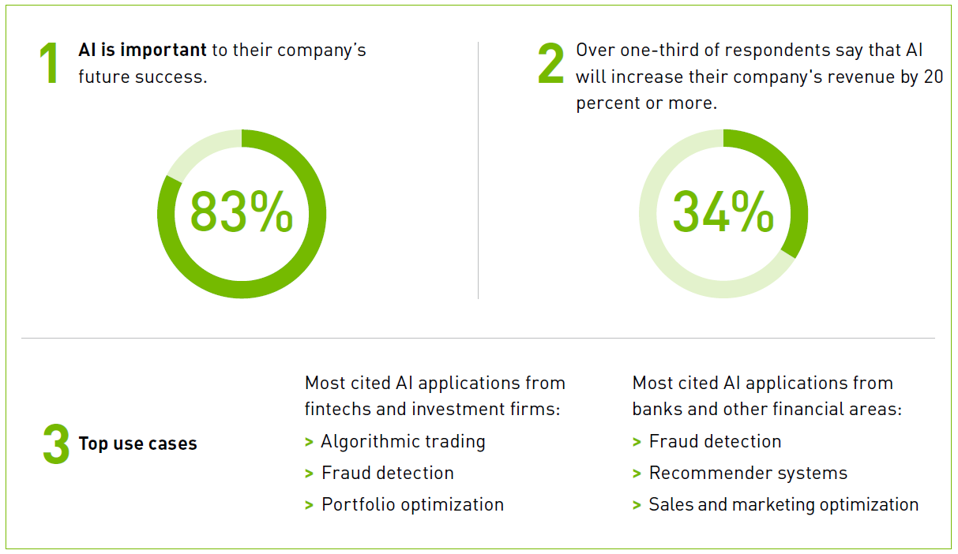

AI is enabling digital transformation across the financial services industry, from fintech and investment firms to commercial and retail banks. With AI, banks can better protect their customers’ accounts, secure payments, improve return on investments, and personalize content, investments, and next-action recommendations for their customers. These AI-enabled services were also the top use cases for AI found in the NVIDIA “State of AI in Financial Services” survey of C-suite leaders, managers, developers and IT architects in the global financial industry: fraud detection, portfolio optimization, and sales and marketing enablement.

The growing capabilities of AI and increase in available data mean that financial firms need to execute an AI strategy, or risk being left behind their competitors.

Banks View AI as Key to Future Success

Leaders are building enterprise AI platforms because they understand the significant impact it will make on their organization. The financial services professionals surveyed by NVIDIA stated the biggest impacts of AI include yielding more accurate models, creating a competitive advantage, and building new products. For example, 83 percent of respondents, of which 81 percent were from the C-suite, agreed that AI was important to their organization’s future success.

In addition, one out of three financial services professionals believe AI will increase their company’s annual income by at least 20 percent. AI enabled services help to reduce operating costs by automating insurance claims processing, augmenting call center agents with speech recognition for call transcription and carrying out other manually intensive services.

NVIDIA

Financial institutions are embracing AI and projecting significant levels of investment to unlock its potential. NVIDIA’s survey found that one out of two C-suite respondents plan to increase spending on AI infrastructure by greater than 10 percent in 2021, compared to 2020. Financial firms are also looking to invest in AI technologies by identifying more use cases, hiring technical experts, and optimizing AI workflow and production cycles.

Scaling AI across financial organizations, however, means overcoming challenges with data silos between internal departments and industry regulations on data privacy. Legacy banking infrastructure lacks the accelerated computing platform needed to train, deploy, and manage AI models that enhance existing applications and enable new use cases. Add to this list issues with a lack of data scientists, minimal budget, and difficulty with model explainability.

AI-Enabled Customer Agents and Processes

With accelerated AI deployment utilizing NVIDIA and VMware, banks, insurers and asset managers can reduce their costs using technologies such as conversational AI, robotic process automation (RPA), and recommendation systems to automate manually intensive tasks. RPA relies on document processing as the enabling technology. AI and computer vision enable a financial services application to “read” a digitized document, such as a loan or mortgage, and automatically analyze its content.

Quantiphi, an NVIDIA partner, uses AI in tandem with deep learning, statistical machine learning, and data solutions to speed up processing of large volumes of loan requests and overcome LIBOR transition challenges.

In call centers, AI-powered virtual assistants help consumers manage financial transactions, from bill payments to opening a new account to transferring money. Customer service agents that are augmented with AI assistants are able to focus on higher value assignments, which improves employee efficiency and enhances customer experience.

Analysis: This article discusses how AI is taking over the banking industry because of its ability to reduce costs and more accurately and efficiently complete tasks, or solve issues, like fraud detection. I think this is interesting to think about from the perspective of the older population, in knowing that many are concerned with the digital banking transformation and fraud. It makes me wonder how AI can be used to better personalize the virtual banking experience to feel like the emotionful human interaction one gets at a bank branch. I question how we can better inform different populations about AI capabilities from an unbiased point of view. More than anything, I want to challenge the ethics of banks and AI – yes AI is reducing costs but is it ethical for certain programs and banking services? How often does AI make errors or shut down? Overall, I think it will be important to consider AI in banking solutions but from a more critical/unbiased perspective of someone looking out for both the customer and the banking business.

Citation:

Ashley, J. (2021, July 26). VMware brandvoice: How ai is powering modern banking transformation. Forbes. https://www.forbes.com/sites/vmware/2021/07/26/how-ai-is-powering-modern-banking-transformation/?sh=6e1bc8485700