When I began secondary research on the daily banking experience, my primary goal was to understand how banking works, both how it has worked historically, and the many changes the banking industry is seeing today. I have learned that banking has transformed a great deal in the past few decades due to a growing demand for digital services, innovation in technology and business models, changes to public policy and federal regulation, and major social events, like the pandemic changing the way people go about their day-to-day lives.

As a designer, I know that innovation works to solve certain problematics, but it often creates new ones. With this in mind, as a researcher, I have noted that the banking transformation is working for some by making managing finances more efficient, convenient, secure, and personable, but it is doing the exact opposite for others. Through my focus research, I have grown to understand that banking is not a one-size-fits-all experience. It is a diverse process that looks very different for people, depending on their financial needs and social factors, such as socioeconomic status, age, education and more. My goal now is to better empathize with different groups and find out how banking and its many changes can better support them.

The key focus here is customer experience. While almost all banks have transitioned to support mobile platforms, and some banking business models are now completely digital, I question what is happening to keep the in-person banking experience relevant for those who desire it. How can the personal and human experience of in-person banking become more efficient and convenient to keep up with the growing mobile banking apps? How can banking be more accessible for those who struggle with both the in-person and digital banking experience?

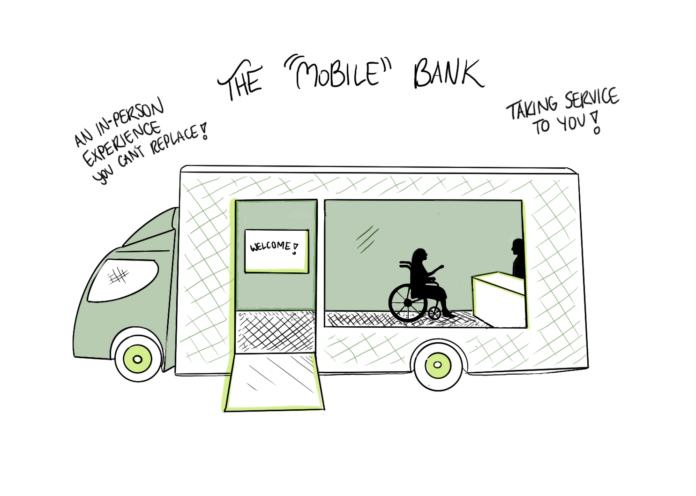

I seek to address these issues and concerns with a new kind of “Mobile Bank” – an accessible banking experience that brings person-to-person interaction to you. Similar to a food truck or a pop-up shop, the mobile bank can bring its services anywhere, taking bank employees and financial technology wherever they are desired. People can get the personable, sociable experience of going to a bank without having to go anywhere, bringing the bank to you! While mobile apps and bank websites can also “bring the bank to you”, they lack the person-to-person interaction that some customers desire or require to understand how to manage their money and to trust in the bank to manage their money. This bus-sized business would be wheel-chair accessible, with room for multiple employees and customers to interact. Customers and communities can request a visit from the mobile bank and schedule times to interact with specific employees. Services could include making deposits and taking out cash, financial education sessions, teaching customers how to use their apps and websites, and so much more. Overall, the mobile bank with a twist is focused on valuing in-person interaction and customer experience. Its redefining in-person banking by making it more convenient and exciting.

Analysis: In order to complete this conjecture, it is also important that I criticize the mobile bank concept, for ways it might not be so successful. For instance, this could be a pretty costly product/service for banks given that mobile banking does not have many operational costs in comparison to physical services like this one. Also, other bank companies, such as PNC have tried a different but similar concept of pop-up banks in banking deserts, making me recognize I would need to innovate this strategy to stand out from its competitors. I think it would do so in being more accessible, with real bank employees involved, for face-to-face interaction, but many more functional features of the “mobile bank” would need to be defined for it to truly be considered. In sharing this conjecture with older adults, they enjoy that it will being the in-person experience to them without them having to go anywhere. They emphasize that we will need to make transportation secure and prove their finances are safe on the go. They also express concern for the operational schedule, what if they need assistance on a day the truck is not coming?