In exploring the arts, I ended up gravitating towards media for and about children and how they’re exposed to banking, especially in film. It’s funny, because in most movies, the banks are seen as the bad guys. In the Mary Poppins article and video I’ve listed, the head banker quite literally steals young Micheal’s money out of his hands to invest it. Sure, investing it was probably the right move, but in that kid’s eyes, the bank is being mean and the whole ordeal was a bad experience.

Additionally, I did a lot of reading on how our country and parts of the world are slowly but surely transitioning into cashless societies. I’m curious how this might affect children, especially kids like Micheal Banks, who barely understand how cash works before they are asked to make financial decisions. If they don’t understand the basics of spending with physical money, how can they be expected to responsibly spend virtual money?

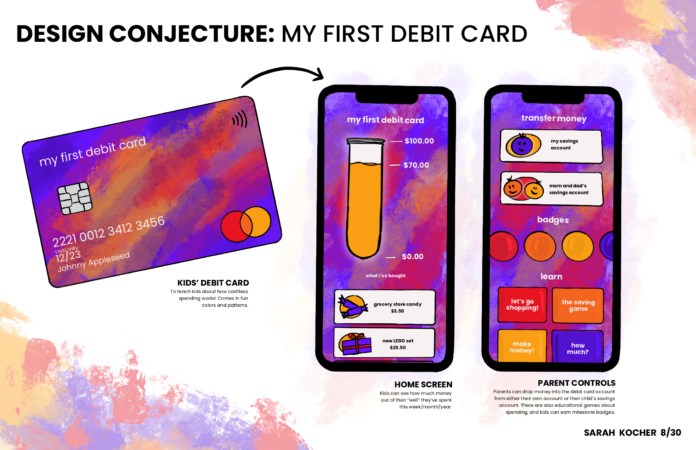

So, how do we fix this? How can we make virtual banking fun, safe, AND accessible for developing kids? I present “My First Debit Card,” a basic, basic debit card provided by the bank to children who are just opening their first savings accounts with their parents. This debit card is fully under parental control, but it gives the child enough spending freedom that they’ll be able to experience virtual currency without having to learn about credit just yet.

Everything is accessed through an app on the parents’ phones. This means that the child cannot accidentally irresponsibly spend anything their parents don’t approve with a password. Parents can deposit money into the bank account created specifically for the card from either their own account or their child’s savings account, creating a “well” of money for the child to use. This is displayed in the app using a test tube with liquid inside, depicting how much money they’ve spent since money was last deposited into the card’s account. This visual representation of how much they’ve spent and how much they have left will help the child understand that money can indeed run out, helping them to learn saving habits as well.

Also in the app are features such as spending tracking, access to each bank account (password protected, of course), and games that help kids learn about spending, from which they can earn badges as well as mark important learning milestones. Most importantly, the child can customize the app colors and background as well as the pattern on their card!

After creating this conjecture, it came to my attention that debit cards marketed to kids already exist, however this specific conjecture is looking far, far into the future. Cash doesn’t exist in this world, and parents are desperate to ensure their child understands how to responsibly spend money. My First Debit Card addresses many of those worries!

Takeaways

Developing this conjecture brought several themes from my article reading to light. Kids need to be learning about banking early on, but the topic is incredibly vast, and the first steps that are taken to introduce them are crucial to ensuring that they accept the process and are willing to learn. Additionally, with the country transitioning into cashless transactions, the standards in learning about banking for future children are going to have to change. How can kids learn about spending and saving without physical bills? How can they learn about credit?