In my initial research exploring several general pain points of day-to-day banking, I discovered that obtaining foreign currency is a process that could greatly be improved. This is something I experienced firsthand this past summer when studying abroad in Greece. Before I left the country, I had to physically go to an AAA to trade in my dollars for euros. While abroad, I ran into the problem of my credit card not being accepted in every location, and ran out of euros quickly. But then ATMs wouldn’t accept my credit card, or their fees were insane enough I couldn’t bring myself to pay them.

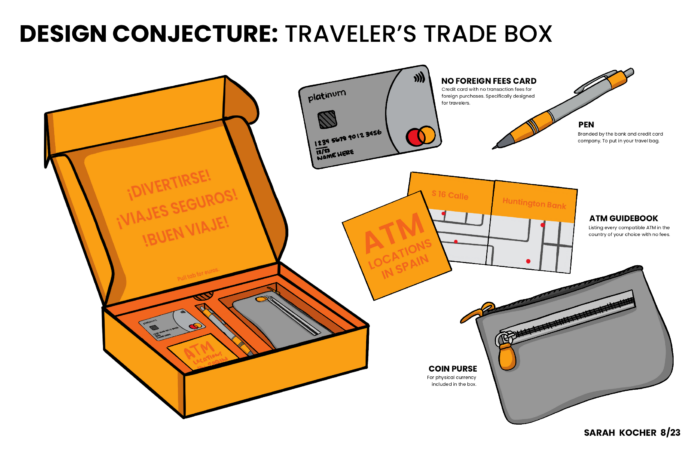

Many of the articles I read were guides for travelers to figure out the best way to handle spending while abroad. Tips suggested using credit cards, debit cards, prepaid currency cards, traveler’s checks, sticking to paper money, completely avoiding paper money, etc. Everyone has different opinions on the best way to handle international currency. I’ve sort of summarized and addressed all of these in The Traveler’s Trade Box. Think of it as a subscription box program through your bank that you only receive once, personalized to what you’ll need to most economically spend your money while abroad. The box is delivered to your door with physical foreign currency, a no-foreign-transaction-fee credit card (through a partnership with a credit card company), a guidebook listing out several recommended ATM brands and locations, a pen for your travel gear, as well as a coin purse to store your physical currency. The purpose of this box is to cover all the bases of obtaining foreign currency while relieving the stress of the user, enhancing their overall travel experience.

When you order the box through your bank, you can personalize your intended location and your length of stay, and the site (with an algorithm) will suggest how much currency is recommended based on what you’re doing. This isn’t once-size-fits-all, however, and the amount that you’re asking to receive is customizable as well. By providing both a credit card and physical currency, travelers are covered on all fronts. They also avoid pesky fees at the front end of their trip from either ATMs or airport currency stations. For returning travelers, smaller Trade Boxes can be purchased without the credit card if they already have one.

This conjecture helps to streamline much of the clunky process that puts foreign currency in your hand, without the outrageous fees. Throughout my research in the focus section, the processes in place today are mainly retroactive when it comes to easing the currency problem (how to spend while in-country). This conjecture helps travelers get everything planned and out of the way well before they embark on their journeys. It definitely focuses on today’s problems, but in exploring what banking might look like in the future, I’m excited to delve further into how we might begin to handle foreign currency as we slowly transition into a cashless society.

Takeaways

Developing this conjecture introduced me to several pain points in the process of obtaining foreign currency. While many high-tourism countries are pretty much entirely cashless (think France, England, Italy), there are still situations where you have to have paper money (small purchases, bathrooms, less developed countries). Credit cards seem to be the way to go when possible, but only certain credit cards are accepted, and sometimes they’re not accepted at all. Using debit is always a risk, too, because of fraud. And when you go to an institution that might have a lower exchange fee, there’s always a delay on receiving your currency. As I guide my research to focus more on international banking, these are good insights to have in my back pocket.