First to Fifth Grade

Source: Junior Achievement

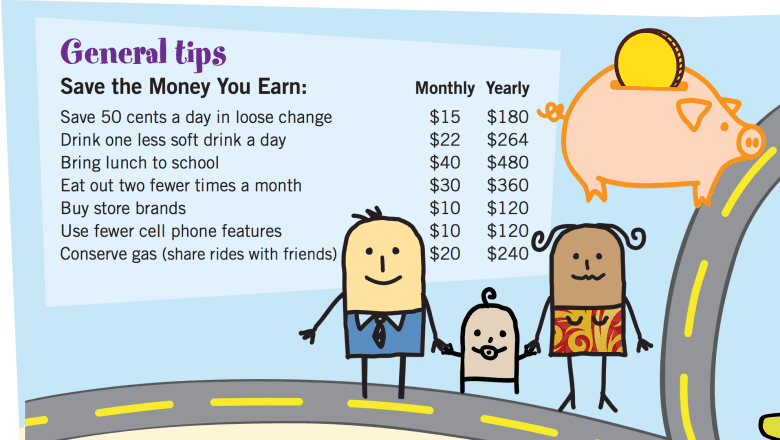

With a basic understanding of the purchasing power of money, your grade-schooler probably now wants more. It’s time to explain how to earn money, save it, and what opportunity costs are. The Federal Deposit Insurance Corporation (FDIC) has classwork suggestions to help teach these principles at school or home.

- Earning money

Unfortunately, your mother was right and money does not grow on trees. It is earned, and for kids at this age, it should be earned with chores. Rather than an allowance, reward work with personal funds. This teaches the ultimate lesson in finance: it takes work to earn money.

Kids who earn their allowance are in the majority. A Junior Achievement USA survey found 82% of the children earned an allowance for doing chores, getting good grades, doing homework and simply being kind to others at school and at home. - Saving

It’s time for a piggy bank or maybe a mason jar, instead. A clear mason jar allows a child to see the money grow over time. It helps reinforce the benefits of saving. It’s also important to introduce children to the benefits of banks. Take them to the bank with you to deposit money, explaining the benefits of saving money there versus at home. Most banks and credit unions offer savings accounts for children — and many pay interest on deposits.

It’s also important to explain why you save: short-term needs, long-term goals and establishing an emergency fund. Provide scenarios to explain how you save and why. Honesty will help them learn and appreciate real-world finances.

Source: American Bankers Association

- Opportunity cost

A fifth-grader should be able to understand opportunity cost, even if you don’t use that term. Opportunity cost is the loss of potential gain from other alternatives when one alternative is chosen. You can help your child understand impulse buying versus long-term goals. It’s a constant battle that we begin learning at this stage. Explain the difference between needs and wants, and how to prioritize them. We all have impulse buys, but we must learn to recognize them and limit them.

Sixth to Eighth Grade

At this stage, you’ve established a lot of great money principles for your middle-schooler. The next stages focus on expanding on those basics concepts with income, budgeting and contentment.

- Income

What do you want to be when you grow up? The question at younger ages elicits a cute response. By middle school, though, it’s a real conversation about the need to find a career that will support you for a lifetime. Explore different job options and discuss both their responsibilities and their paycheck. This is also a good opportunity to explain why your salary isn’t how much you take home. Explain taxes, Social Security, insurance premiums, and other deductions from your paycheck. - Budgeting

While your child doesn’t need a personal budget right now, it’s a good idea to learn how to set one. Include them in your budgeting, asking for input on financial decisions like meal planning for the grocery budget. - Contentment and giving

“Mark got a new iPhone. I need one too!” It’s easy to compare ourselves to others, and for pre-teens and teenagers, the pressure is even greater. Kids at this age need to learn contentment — being satisfied with what they have rather than trying to keep up with the Joneses. Even better, they need to learn to appreciate what they do have. If they don’t already, kids should understand the benefits of giving back and donating to charity. Volunteering or donating items is a good lesson for all of us.

Looking to check your child’s financial literacy progress? Jump$tart Coalition created national standards for educators to set financial literacy goals. It’s a good goal for parents too. The benchmarks by eighth grade include:

- Set spending priorities to reflect goals and values.

- Discuss the components of a personal spending plan, including income, planned savings and expenses.

- Compare saving strategies, including “Pay Yourself First” and comparison shopping.

- Illustrate how inflation and interest can affect spending power over time.

- Justify the value of an emergency fund.

Analysis

This article points out several ways parents can go about teaching their children financial literacy early in life while still having fun and guiding them through the process. And it’s not a hard process! There are several key concepts that children must come to understand as they grow, and more often than not, the responsibility lies with the parent to prepare them. The activities listed in this article provide several benchmarks of understanding that children should reach to be able to achieve financial independence when the time comes. They’re not hard lessons, but necessary ones. Plus, they’re good to keep in mind when considering how today’s youth interact within and outside of banks. How can the banking experience innovate to perhaps facilitate or provide resources for some of this training?

Source

Kiser, D. (2023, May 2). How to teach kids about money at every age. MoneyGeek.com. https://www.moneygeek.com/financial-planning/resources/how-to-teach-your-kids-about-money/