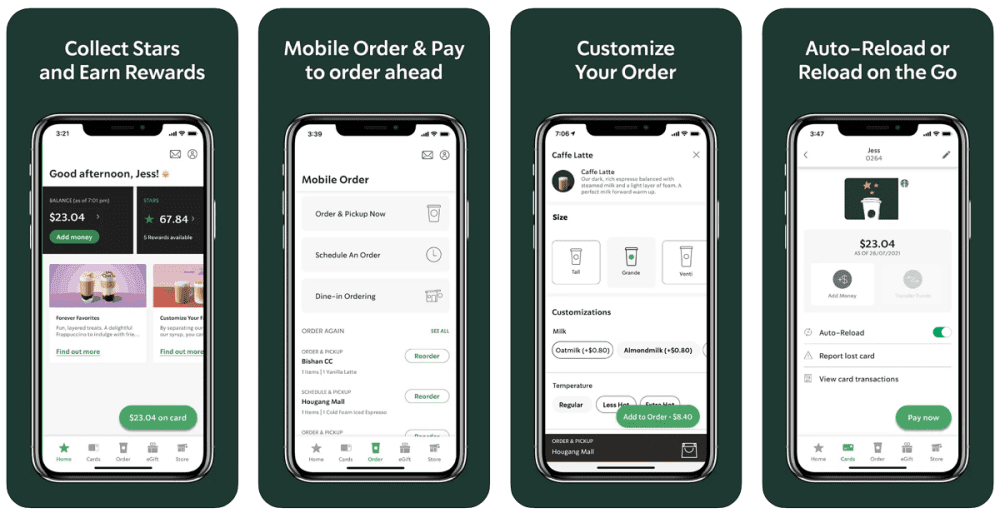

As a Starbucks customer, you might have come across its loyalty program called Starbucks Rewards. If you’re new to how it works, you can add money into your Starbucks Rewards account via a credit card or Starbucks gift cards. The prepaid funds in the app can then be used to make payments to earn loyalty points (known as Stars) which can then be redeemed for complimentary food/drinks or discounts.

According to Starbucks’ Q3 2022 report, there are 27.4 million active Starbucks Rewards members in the U.S. alone. This is almost double the 14.2 million members at the end of 2017. The company revealed in a 2016 conference call that Starbucks Rewards members spend three times as much as non-members. Fast forward to 2022, it’s not surprising that Starbucks rewards members now comprise 53% of revenue in U.S. company-operated stores.

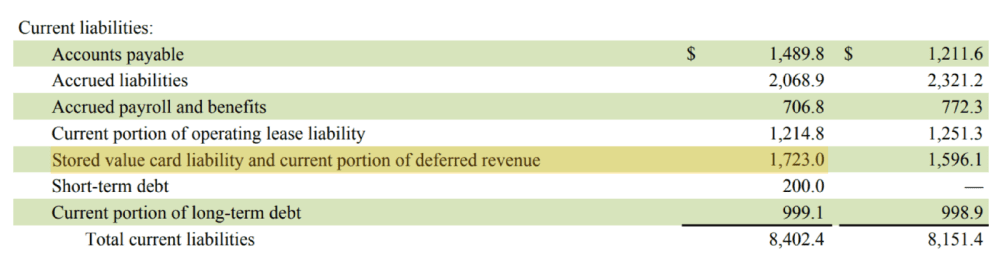

Within the customer loyalty space, Starbucks has consistently been credited with having one of the best rewards programs with a loyal customer following. Because of the company’s reputation, customers are not afraid to keep money in their Starbucks account, knowing that they can use it anytime. In fact, in its Q3 2022 earnings report, Starbucks reported that it had US$1.7 billion loaded on Starbucks accounts/gift cards waiting to be spent in its stores.

How Starbucks is similar to a bank

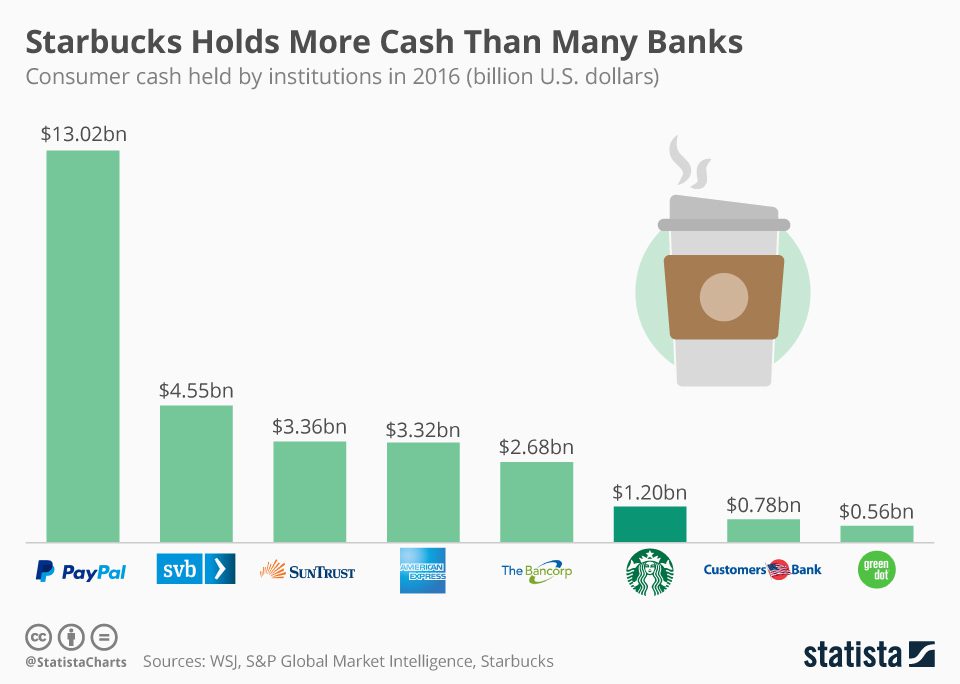

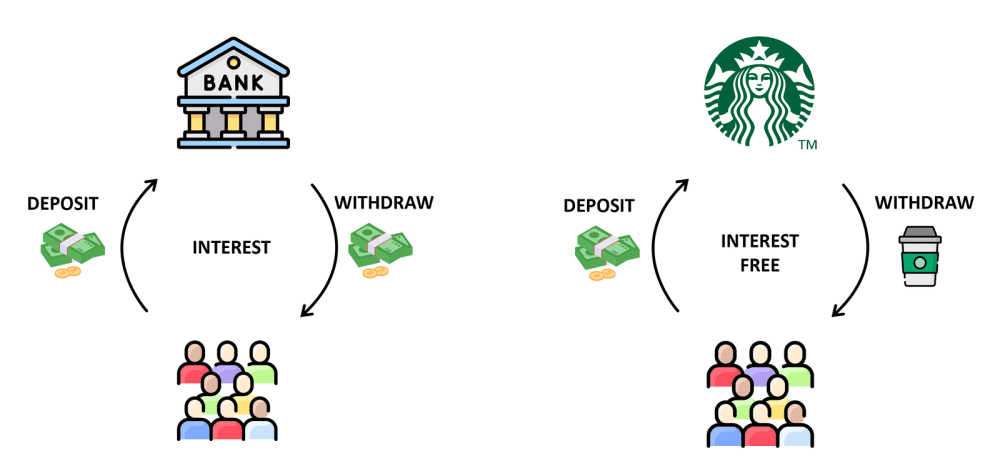

Just like how a bank collects cash deposits from its customers, Starbucks collects large amounts of cash from its members through its loyalty program. Interestingly, this amount is greater than the cash held by some banks. In 2016, Starbucks held US$1.2 billion in customer deposits, higher than banks like Customers bank and Green Dot which held US$0.78 billion and US$0.56 billion respectively.

However, unlike a bank which needs to pay interest on customer deposits, Starbucks does not. As such, Starbucks members effectively provide the company with a US$1.7-billion loan at zero percent interest.

Additionally, Starbucks earns a profit from breakage — the amount that is unused from gift cards every year. This amounted to around US$164.5 million in 2021 or around 10% of all stored value balances. So not only does Starbucks get an ‘interest-free loan’ from its members, but it also earns a roughly 10% return based on breakage!

What’s even better is that as opposed to a bank where customers can withdraw money anytime, Starbucks members can only withdraw coffee. This essentially locks in customers the moment they transfer funds into their Starbucks Rewards account, providing guaranteed revenue for Starbucks.

That said, Starbucks hasn’t mentioned any ambitious plans to utilise these funds and has largely used it for working capital, which leaves a lot of untapped potential for the company. Starbucks could potentially loan these funds to earn higher interest income, make long-term investments, or even expand its own mobile payment system beyond its own stores.

Analysis

This article provides new insights on how non-traditional banking is more common than we think. Companies like Starbucks are able to generate millions in revenue before having to pay anything back to its customers. And when they do cash in on their loan, they’re paid back in coffee, not their original funds. Thus, Starbucks is left with the revenue, losing only a small amount to creating their overpriced drinks Business practices like these (rewards programs) offer lots of incentives for consumers to not only continue using that business, but also lots of opportunities for the “bank” to generate revenue. Thus, Starbucks is making lots and lots of money, just through gift cards and I-O-U’s that may or may not ever be cashed in. Could a system like this be implemented in money-only banks? How might banking change if we adjust how withdrawals are handled, and what gets passed over the counter?

Source

Teo, B. (2022, September 13). How Starbucks secretly operates like a bank. The Fifth Person. https://fifthperson.com/starbucks-operates-like-a-bank/