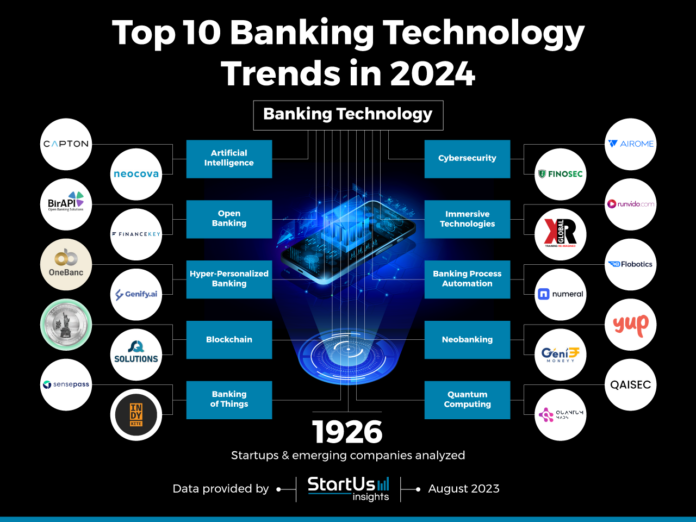

1. Artificial Intelligence

AI banking provides high-quality banking services to customers and saves operating costs. AI-powered tools, such as virtual assistants and chatbots, automate customer service interactions. Additionally, they provide customers with account information and resolve account-related queries. AI-based biometrics detect fraud and improve security, as well as enhance AML applications and KYC checks.

Further, machine learning (ML) algorithms power alternate credit score modeling that aids banks in making better lending decisions. Computer vision-enabled tools also simplify document analysis, which assists banks in customer onboarding and compliance management. Moreover, AI analyzes massive financial datasets to improve risk assessment and financial forecasting, improving investing decisions.

Capton offers a Non-performing Loans (NPL) Warning System

US-based startup Capton develops NPL EWS, an early NPL warning system. It is an enterprise software application that allows banks to predict NPLs with high accuracy. For this, the software combines AI, machine learning, and behavior analytics on banking and dynamic external data.

Additionally, the system provides banks with global, regional, and branch-level NPL insights. As a result, the software enables banks to make faster loan decisions while reducing risks and increasing profitability.

Neocova simplifies Transaction Data Analysis

Neocova is a US-based startup that facilitates transaction data analysis. The startup’s AI and cloud-based platform streamlines customer data management. Moreover, it allows banks to better match customers with specific financial products, enabling highly-targeted cross-selling and driving revenue.

2. Open Banking

Open banking connects non-banking financial companies (NBFCs) and banks to provide customers with custom and more accessible financial services. Banking application programming interfaces (APIs) enable third-party developers to securely access customer financial data without compromising data compliance. Open banking also includes account aggregators that allow customers to manage all their banking accounts through a single platform.

APIs from banks also allow NBFCs to integrate banking functionality into their apps and services. This embedded banking enables NBFCs to verify customer information automatically, reducing the need for manual verification and accelerating customer verification. Moreover, open banking enables banking-as-a-service (BaaS) that allows banks to reach new customers through third parties and increase their revenue.

3. Hyper-Personalized Banking

Providing a personalized banking experience improves customer retention. That is why banks now leverage various strategies and technologies, such as buy now pay later (BNPL), omnichannel banking, and financial advisory tools, to tailor their offerings. For instance, omnichannel banking provides a unified, customer-centric view of their financial information while allowing them to interact with banks via multiple channels.

Additionally, wealth management and financial advisory tools provide customized advice and investment guides, improving investor and customer satisfaction. Banks thus leverage AI and machine learning to provide such real-time personalized financial recommendations.

4. Blockchain Banking

Blockchain provides tamper-proof records of all financial transactions and improves transactional transparency and security. Further, it improves trade efficiency through transaction automation as well as streamlines manual and paper-based operations. Smart contracts automate financial transactions and improve the performance of financial contracts.

Smart contracts also eliminate the need for intermediaries and enable peer-to-peer (P2P) payments. This greatly enhances the speed and efficiency of transactions, especially cross-border payments. Moreover, decentralized finance (DeFi) leverages blockchain to make financial services more accessible while lowering transaction fees.

5. Banking of Things

The banking industry is adopting IoT for efficient data collection. This automates data acquisition for streamlining banking processes, such as KYC and lending, to enable real-time event response. For example, IoT-enabled smart automated teller machines (ATMs) send alerts for low cash levels and malfunctions, ensuring timely maintenance.

Also, IoT-enabled digital wallets integrated into mobile phones and smartwatches enable customers to make purchases. Since connected devices deliver customer-specific data in real-time, IoT in banking aids fraud detection and, in turn, mitigates loss.

6. Cybersecurity

The banking industry handles massive amounts of sensitive customer and transactional data. This makes its IT infrastructure a popular target for cybercriminals. To tackle this, startups provide security protocols and data compliance management tailored for banking systems. Such cybersecurity solutions enable banks to safeguard sensitive data.

Data encryption tools further extend this, reducing the risks of data leaks. AI-powered fraud detection identifies and prevents suspicious activities such as identity theft and phishing scams. Banks also leverage anti-hacking software to protect networks from unauthorized access. These features help banks in improving threat detection and response.

7. Immersive Technologies

Immersive technologies deliver personalized and interactive customer experience. Augmented reality (AR) and virtual reality (VR) optimize the interactions between banks and customers. VR allows banks to train employees on various banking procedures, products, and regulations in interactive environments. For instance, these technologies power virtual showrooms, where customers explore vehicles in a virtual environment and banks streamline the loan application process.

Moreover, metaverse banks allow customers to interact with banks in virtual environments. By leveraging immersive technologies, banks thus ensure a more engaging customer experience to increase customer satisfaction and loyalty.

Runvido offers AR-powered Customer Interactions

Polish startup Runvido develops an AR-based solution for banks to interact with customers. The startup’s application allows banks to animate static images, such as the image on credit cards, using smartphones. It also detects the user’s phone language and displays content accordingly.

The app delivers interactive content depending on user location and provides customer involvement insights to banks. Banks use the startup’s application for engaging customers with interactive content and improving their marketing efforts.

XRG provides VR-based Training

South African startup XRG makes virtual, augmented, and mixed reality solutions for advancing learning and development in the banking industry. Banks are using the startup’s technology to conduct remote financial training sessions. This results in better-trained employees and therefore improves customer service.

The startup also allows banks to simulate new processes before their implementation and customer service scenarios. This enables banks to enhance the training experience and increase employee retention.

8. Banking Process Automation

Banks automate repetitive and time-consuming tasks through the use of software robots. They provide a competitive advantage to banks as their employees are able to focus on more critical tasks. Further, RPA-based accounts payable solutions automate tasks like invoice processing, payment approvals, and reconciliation. Banking process automation (BPA) also involves automating mortgage processing, including evaluating and disbursing loans to customers.

Banks use RPA to process credit cards to identify fraud and detect suspicious transactions. This reduces application processing times while improving compliance and security. Moreover, RPA streamlines data collection and improves data-driven decision-making.

9. Neobanking

Neobanking enables a digital-only presence for banks, minimizing capital and operating expenses. It offers a seamless and integrated banking experience to customers through cloud computing, open API, and more. Additionally, neobanks support a range of services from automated reconciliation and payroll management to integrated workflow management.

Digital-only banks ensure customer convenience by enabling them to access services on-demand and across platforms. Neobanks also feature lower fees as they require less capital and operational expenses compared to traditional banks.

10. Quantum Computing

With traditional computing, processing huge amounts of data is resource and time-intensive. Quantum computing solves this problem by offering faster, more efficient, and more secure computing. It assists banks in optimizing their portfolios and making accurate financial predictions.

Startups are thus developing cost-effective quantum computers. They assist banks in derivative pricing and improving their cybersecurity programs.

Analysis

This article provides several insights into emerging bank technologies that we’re likely going to start seeing in the next few years. A few are already here! Banks are leaning heavily into AI for many of their services, which reduces operational costs but also costs good employees their jobs. This AI, however, has the potential to give good financial advice at all time and guide customers through the banking process step by step in the comfort of their own home. Pros and cons. I found the immersive experience section incredibly interesting. Using AR and VR to enhance the banking experience is a clever idea that can potentially benefit both sides of the counter, should humans remain on the teller side. Using this immersive technology can make distance problems a thing of the past, especially if we can all interact in a virtual environment together. This could be helpful for teller training, long-distance clients, etc.

I was most intrigued by the use of AR on credit cards. Not for information, access, or data, though. No, this was purely for fun! Customers can scan their credit cards and see the image on the front animate. It doesn’t particularly make the banking experience easier, but it’s a little cherry on top that makes banking just a tad bit more enjoyable, thus creating an overall more pleasant customer experience that leaves everyone from the interaction happy. This really caught my attention! Is there a way to make the banking experience more fun in general?

Source

StartUs Insights. (2023, August 22). Explore the 10 emerging banking trends in 2024. StartUs Insights. https://www.startus-insights.com/innovators-guide/banking-technology-trends/