Many older LGBTQ+ people have experienced discrimination in employment, education and housing during their lifetimes that has impacted their earning potential and retirement savings. Many do not believe they will be financially stable enough to stop working beyond retirement age. In fact, 51% of LGBTQ+ older people are very or extremely concerned about having enough money to live on, as compared to 36% of non-LGBTQ+ older people.

SAGE is the world’s largest and oldest organization dedicated to improving the lives of lesbian, gay, bisexual, transgender, and queer and/or questioning (LGBTQ+) older people. Founded in 1978 and headquartered in New York City, SAGE is a national organization that offers supportive services and consumer resources to LGBTQ+ older people and their caregivers. SAGE also advocates for public policy changes that address the needs of LGBTQ+ elders, provides education and technical assistance for aging providers and LGBTQ+ community organizations through its National Resource Center on LGBTQ+ Aging, and cultural competency training through SAGECare.

In honor of the two-year anniversary, SAGECents is adding a new feature – the Financial Health Playbook. Users who complete the initial financial health assessment receive a Financial Health Playbook, a personalized financial wellness plan with step-by-step guidance designed to help reach unique financial goals.

Afraid of discrimination? Fear no more. There is an abundance of resources on finding an LGBTQ+-friendly financial planner and/or lawyer. The Wells Fargo guide, Tailored Investment Planning Solutions for Same-Sex Couples and Domestic Partners, will help you find a financial planner with ease.

How do you plan your estate?

Create a will. It can be tough to talk about, but it’s one of the most important steps you should take as an older adult. Did you know that an estimated two-thirds of people die without a will?

Talk to your partner(s), family and friends

Sure, it’s hard to talk finances, but keeping the communication clear between you and your loved ones will make things easier. These Must Read Tax Tips for LGBTQ+ Couples explain the difficulties of talking about finances with a partner. “Schedule some time with your significant other to sit down uninterrupted and share a nice bottle of wine. Discuss your financial goals and where you are financially, both as individuals and as a couple. Put this in writing.”

Analysis

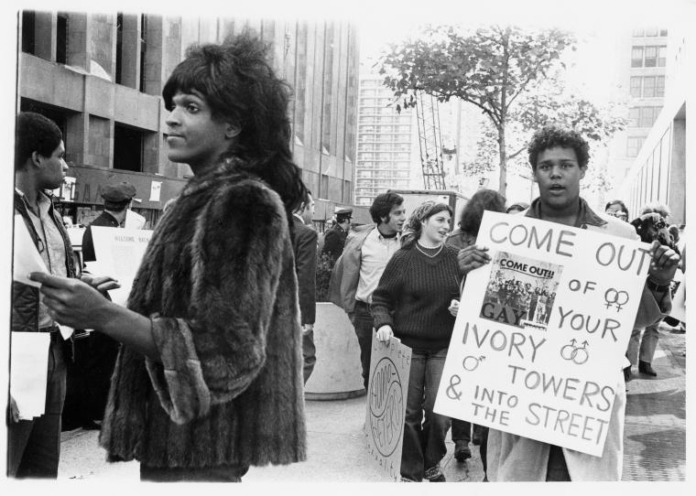

This article covers an existing technology called SAGE that is tailored to older Queer people. Older queer people are less likely to be able to retire. Older people are an interesting demographic because I feel as if their community has lived through much more prejudice than queer kids in 2022. Although current community members have very real problems, the problems of older people born in the 1920s-1990s obviously have a lot more trauma and faced a lot more obstacles. Along with the Aids Epidemic, I’m curious to research the history of homophobia and its impact on financial literacy.