https://www.ellevest.com/magazine/your-goals/what-goes-into-your-goals

Ellevest has definitely done some solid research on what women’s (probably of a much older age range than my research) financial goals are. However, just because these are the goals of women, doesn’t mean women are making the goals out of their own self-interest. Men are taking risks on investments while women are saving more money safely for their future home and family – and this is a fact I can back up.

Ellevest wants to help women save for a home, kids, and a big splurge. The big splurge I have seen on other websites is often a wedding. Its not that women shouldn’t know how to save, they definitely should, but there should be even more push to save since women just don’t make as much money as men. And since they won’t even be able to make as much in savings, there should be even more incentive to make money investing, right?

Over the course of their lifetime, Men will save over three times as much money as women do. “The problem is that, while women are saving a larger share of their earnings, those earnings are smaller than men’s. If a woman making $30,000 saves 10% of her salary, while her male coworker with a $40,000 salary saves only 8%, he’ll still end up with $200 more in his account each year. That’s not a huge difference, but thanks to the power of compound interest, it will add up to much bigger savings over time – especially if he continues to earn more and save more than she does year after year.

Adding to the problem is the fact that women are more likely than men to take time off from work while their children are young. Even if they’re only away from the workplace for a few years, that’s a few years during which their salaries – and their savings – drop to zero. By the time they return to work, they lag behind their male peers in both income and retirement savings, making it difficult to catch up. In a 2017 survey by GoBankingRates, over 40% of women said that not saving enough was their biggest financial regret, while only 33% of men said the same.”- https://www.moneycrashers.com/men-women-money-sexes-differ-finances/

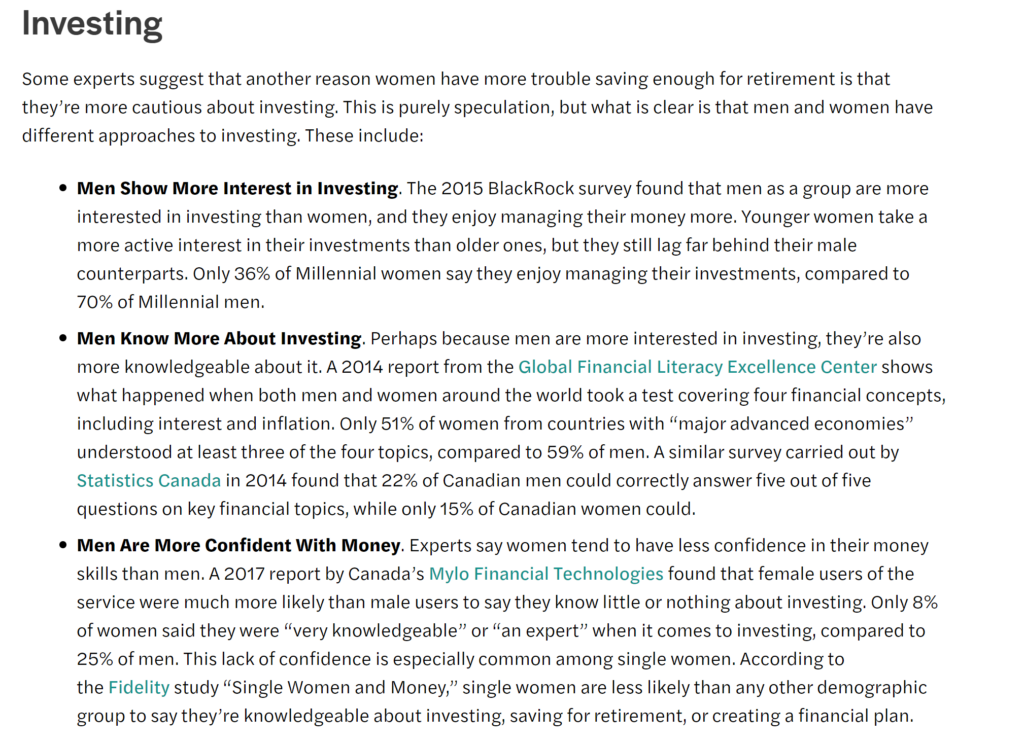

This whole screenshot summarizes some important differences

So why are men so interested in investing?

Can investing be presented in a way that piques the interests of women?