https://www.wsj.com/articles/the-financial-gurus-millennials-listen-to-11584104190

Resources pulled from this article:

- Ryan Scribner on Youtube and his website, Investingsimple.com

- Mrs. Dow Jones (I am familiar with this) Haley Sacks on Instagram and of Finance is Cool

- Jessica Ghaney, 25, runs Instagram- Forex Tips 101

- Bank of America has worked with Instagrammer Sarah Herron to advertise its Advantage Savings account.

- In November, Instagrammer Leena Snoubar posted about how the Wells Fargo credit-card can earn holders rewards points for ordering food from a restaurant and streaming music.

Bits of research I found unique and helpful-

“These wannabe investors are more comfortable learning about finance online than at bricks-and-mortar banks. The WSJ survey found that 46% of millennials prefer to learn about finance on a website, while 18% prefer social media. That compares with the 25% who say they would opt to go to an in-person expert like a financial adviser.

In similar fashion, 38% of millennials say they follow financial influencers on social media to keep up to date, compared with 16% of Gen-Xers and 12% of baby boomers. And 22% of millennials say social media and blogs have shaped their outlook about money, compared with 12% of Gen-Xers and just 4% of Baby Boomers.”

How does this data look for Gen z?

“Chris Smith, enterprise social media executive at Bank of America, says the bank has research that suggests millennials and Gen Zers rely on influencers just as much as they do family and friends for advice.”

Should Huntington be doing this?

Ms. Sacks, for her part, says in an emailed response to a question about how banks are using social media, “The #1 goal of the partnership should be integrity! If this is not a priority and millennials are swayed by influencers who don’t really know the financial product they are selling and they end up misrepresenting it or it ends up being bad—it will only further the distrust millennials have in financial institutions (stemming from the financial crisis in 2008 that shaped the job market we came into) which is exactly what we DON’T want.”

Sponsorships grow distrust.

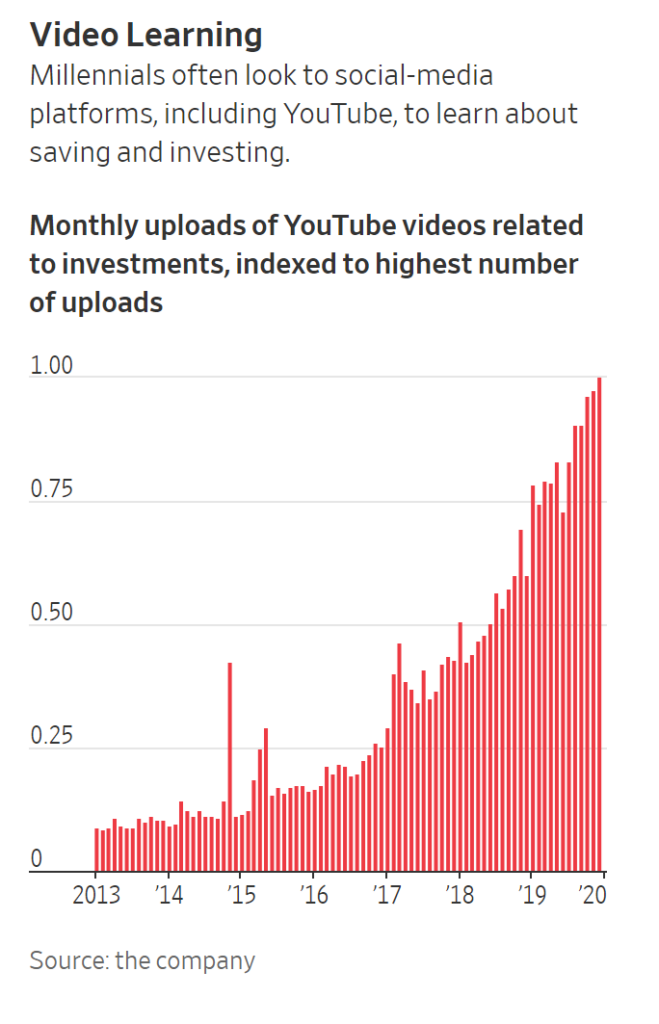

But online financial influence is growing:

How can Huntington advise young people to seek unbiased, smart financial education?