Introduction:

Over the past few centuries, the primary functions of a bank have not changed much, but the many products and services a bank has to offer, along with the methods by which they carry out these services have changed immensely. Specifically, within the past decade, banks have transformed nearly all their services to be accomplished digitally, through a bank’s website or mobile app. In doing so, banks have switched their focus from their branches and have pushed their investment of time and money into the digital sphere. In fact, banks have invested well over $1 trillion dollars in evolving digital technology in the past 6 years alone (McIntyre, 2021). Between investment in new technology and the aftermath of the global pandemic causing many businesses and people to switch to remote services, bank branches have continued to close. From nearly 100,000 branches in 2009, the number has fallen to fewer than 80,000 locations in 2023 (Dobbs, 2023), with more than 4,000 of those closures having occurred since the pandemic heightened in March 2020 (NCRC, 2022). As closures remain on the rise, digital banking is becoming increasingly successful for its convenience and data analyzing methods, saving customers time, and allowing them to learn about issues like their spending habits in the click of a button. The number of digital banking users in the United States is expected to increase greatly in the following years, “starting from roughly 197 million users in March 2012, the number of digital banking users in the country is forecasted to reach almost 217 million by 2025” (Statista Research Department, 2023).

Is everyone being accounted for in this transition?

The Problematic:

Many older adults are obligated to rely on digital banking services due to vulnerabilities, such as physical disabilities or issues surrounding bank proximity and closures, preventing them from being able to go in-person to their bank branch. However, many older adults do not feel confident in digital banking because they prefer to bank with humans and have concerns about technological ability and security, which leads them to troubleshoot frequently. In troubleshooting through a digital format, older adults often wind up stuck in an ill-fitted customer service journey without a resolution to their issues.

How did we get here? Follow along…

Secondary Research and Analysis:

Through learning about banking history, regulations, and innovation, it became apparent that certain groups of people are increasingly vulnerable to changes in technology and banking business models. It was discovered that many older adults and their needs and wants are being overlooked, not just in banking but in changes to business models everywhere. Within this focus, it was important to look at information from all angles, accompanying business, science and technology, and the arts. In learning about the artistic and emotional side to technology and banking, a quote by author Douglas Adams sets the tone for older adults in stating:

“Anything that is in the world when you’re born is normal and ordinary and is just a natural part of the way the world works. Anything that’s invented between when you’re fifteen and thirty-five is new and exciting and revolutionary and you can probably get a career in it. Anything invented after you’re thirty-five is against the natural order of things” (Becher, 2014, para. 4).

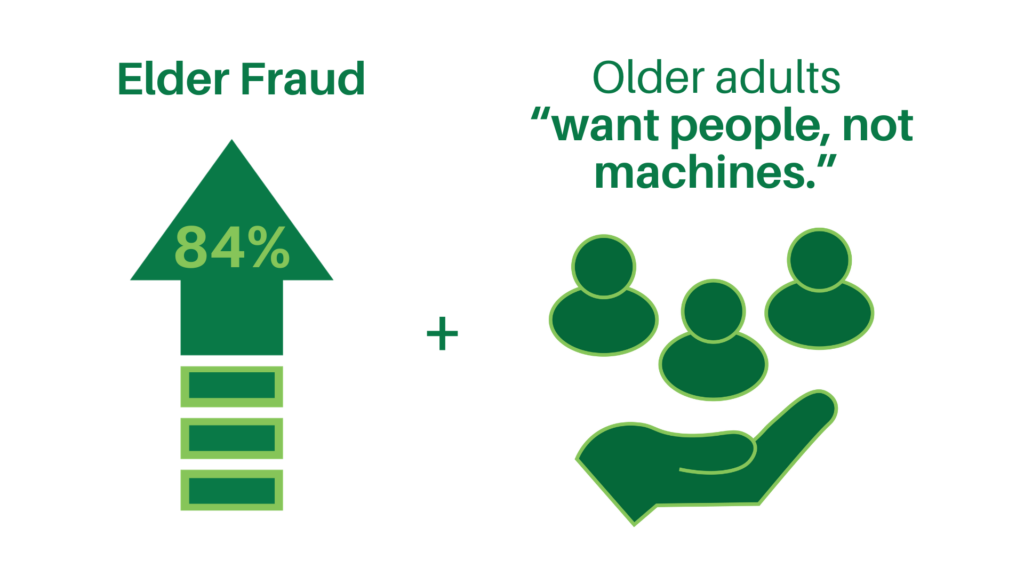

The idea that innovation, specifically innovation in technology, can feel earth-shattering and confusing for older adults has been echoed greatly in both this secondary and primary research. Throughout history, companies and people in general have had a tendency to believe that older people are not interested or capable in keeping up with technological innovation, and in doing so regret to include them in the design process (Manjoo, 2023). Because of this exclusion, it was quite difficult to find secondary information and statistics on banking with adequate representation on older adults, in comparison to younger consumers; this was echoed by participants later in the research, as one co-design participant expressed that he’s taken multiple surveys where once he said his age, the surveys ended. From the information found, it revealed that many older adults are insecure about digital banking because they do not understand the technology or trust its security because they have fears surrounding new technology and financial fraud. This is not surprising given they are a targeted population for scams. For instance, the FBI reports that losses from elder fraud cases rose 84% from 2021 to 2022, with the most common cases surrounding tech and customer support schemes (Eller, 2023). In addition to security concerns, many older adults believe there is insufficient human input in digital services as the Finance Foundation found that “86% of seniors opt out of digital banking because they “want people, not machines”” (Levant, 2020, para. 11).

So, are older adults banking digitally?

Based on this information, the goal for primary research became to better learn and understand the banking habits, concerns, journeys, preferences, and hopes amongst older adults.

Primary Research and Analysis:

- Survey (Analysis of those ages 75+)

- Interviews (10 older bank customers + 7 employees)

- 3 co-design sessions with (12 participants total) each including: A banking concerns and hopes projection, a bank app discovery + usability review, prototyped banking conjecture analysis.

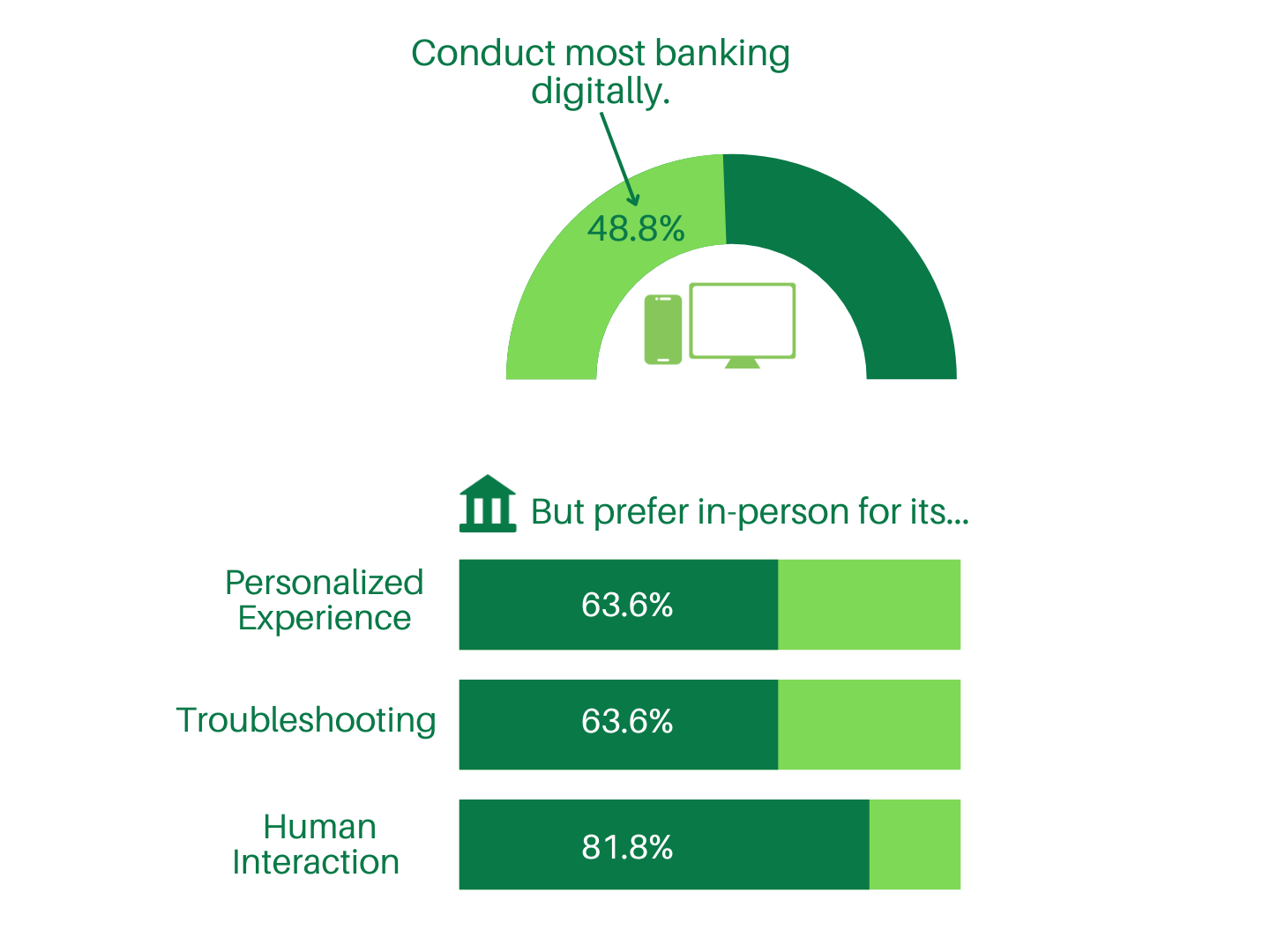

Primary research began with a survey and analysis of day-to-day banking habits and preferences in older adults ages 65 and above. The survey was offered in an online, physical, and verbal format to include those with vision or hearing issues, those who do not have internet access, and those who do not know how to complete an online survey. Within 13 days, there were 116 responses to the Financial Questionnaire. In analyzing it by age range, it uncovered that there is a decent difference in the habits and preferences of those in the 65-74 age range versus those who are 75 and up. For instance, 74% of those in the 65-74 age range conduct most of their banking transactions digitally, whereas only 48.8% of those 75 and older conduct most of their banking transactions digitally. Based on this consideration, the analysis of the survey focuses only on responses from people ages 75+, along with the rest of the research. In looking at the survey results from those who are 75 or older, of those who conduct most of their banking digitally, 63.6% prefer in-person banking for its personalized experience and troubleshooting, and 81.8% prefer in-person banking for its human interaction.

So, for what reasons are older adults banking digitally?

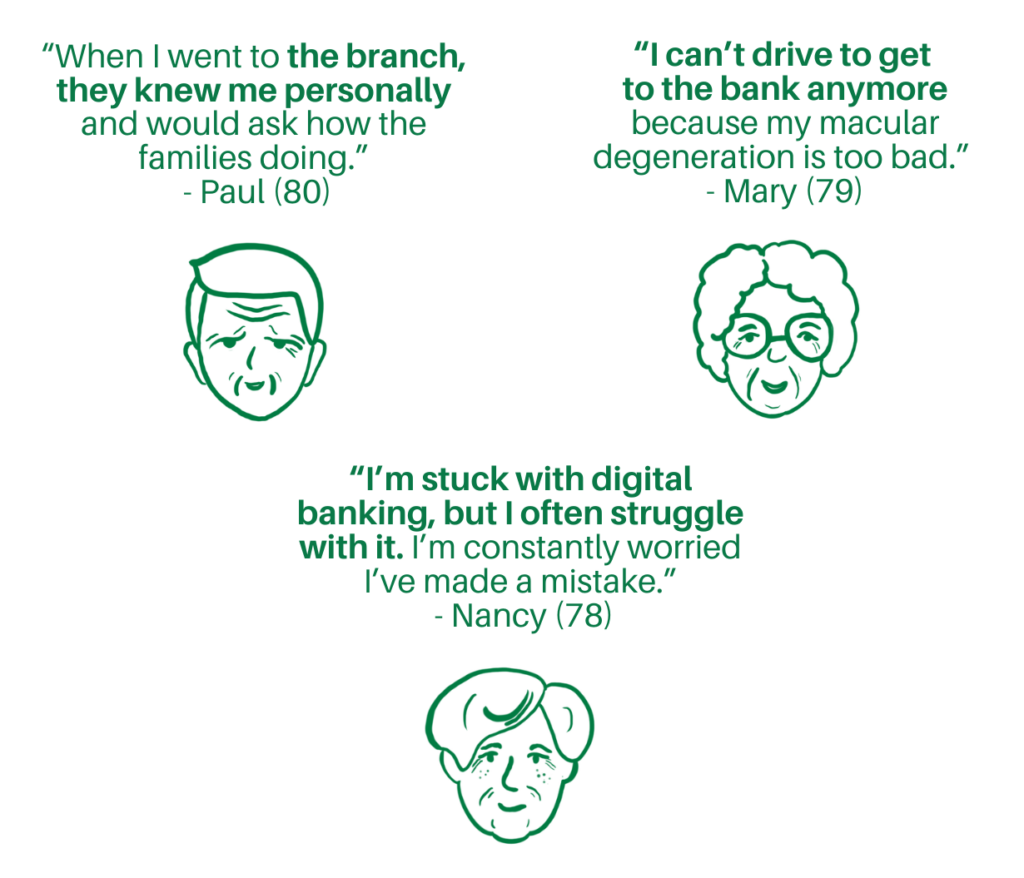

The next step was interviewing older adults to find out why they bank digitally and how they feel about it. Quickly in this process, it became apparent that banking can be very emotional for older adults, as many of them told stories about the enjoyment they used to have going into their local bank branch, or the frustration and sadness they felt when they no longer could. They were asked questions about their banking habits, and as opposed to the survey, they also explained “why” these are their habits and preferences as well. For instance, many of the people explained that they now are obligated to bank digitally because they can no longer get to their bank branch due to a physical disability or a proximity issue (typically based on bank closures). For instance, one woman with vision impairment due to age-related macular degeneration explained how she used to love going to her local bank branch to interact with tellers who knew her by name and carryout banking transactions with in-person human assistance. She no longer has the option of going in-person because she cannot see well enough to drive and her bank is no longer close enough to walk to. In banking digitally, many of those interviewed expressed that they do not understand how to accomplish certain functions and they struggle getting assistance. When they try to troubleshoot or ask a question it leads them down a rabbit hole of having to explain their problem to multiple customer service representatives, and often they tell them they will just have to go into the bank’s branch.

In hearing how many older adults find their relationship with bank employees to be crucial to their experience, interviews were conducted with bank employees from Huntington, Key, PNC, JPMorgan Chase, Civista and Dollar Bank with various expertise in bank telling, bank management, client engagement, private banking, internal banking systems, and banking fraud education, to gain their perspective. It was uncovered that the digital transition has also had a very heavy impact on them. In asking them about the many shoes they have filled as a bank employee, they told various stories about how bank telling often reflects a social service. For many tellers, connecting with their customers and learning about their lives and families is just as important in assisting them with banking tasks. They explained how it is especially important for them to connect with their older clients because for many older adults it can be their only point of social interaction in the day or week. When asked what it was like for these employees as their banks began transitioning to digital formats, many expressed the pain they felt in training customers to do something that would eliminate their own job. Amidst the pain and frustration, these employees have not hesitated to try and educate and support their customers within their digital transition. When asked how they assist older customers, a big theme is that they try and sit down with them in-person, work with them together in a collaborative way, and provide them with real world examples they can comprehend and relate to.

To get more of a hands-on perspective from older adults, 3 separate co-design sessions at independent living facilities of varying economic status were completed. The first at the Knickerbocker Apartment Community in Bay Village, Ohio (a senior low-income housing department that is subsidized by the federal government), the second at StoryPoint Senior Living in Powell, Ohio, and the third at the Ohio Living Westminster Thurber in Columbus, Ohio. Among the three sessions, there was a total of 12 participants with ages ranging from 75 to 88.

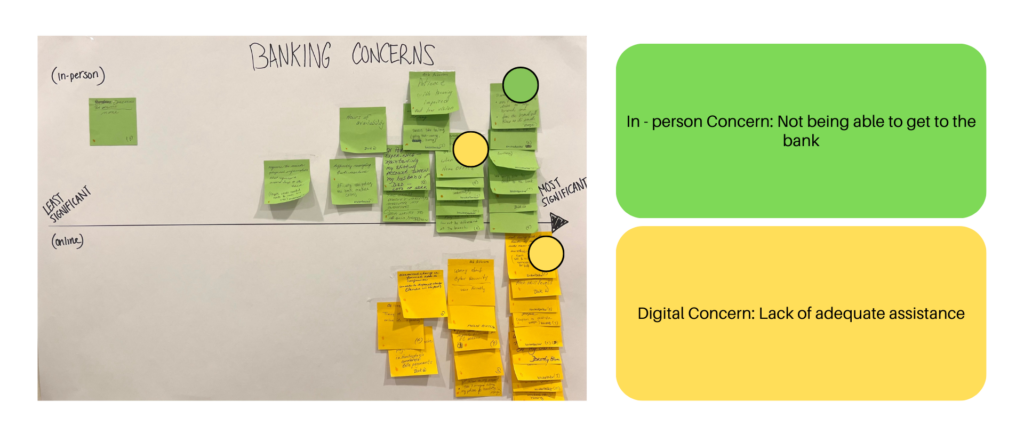

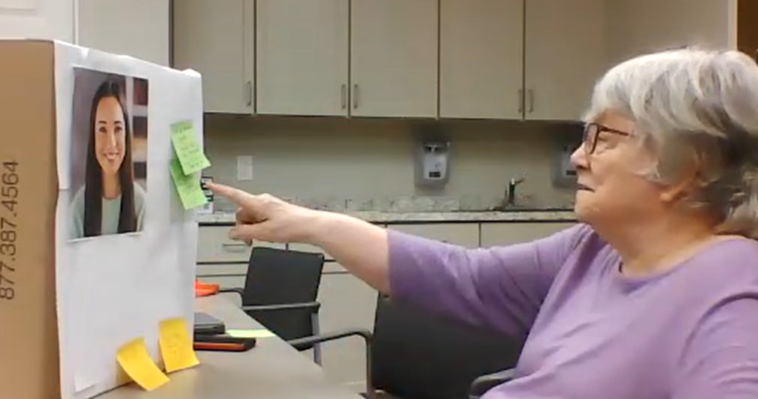

During each co-design session, participants were given sticky notes to write out their biggest in-person and digital banking concerns, along with their most prominent banking hopes, then they would have a collective conversation about them, listen to each other’s stories and project them along a scale of importance, which was a collective decision. There was a great deal of insight from the collective storytelling – what was most prominent is that the groups said the biggest in-person banking concern was not being able to get to the bank branch. Not so much the in-person experience but wanting to go there and not being able to. How can you worry about anything else concerning the in-person experience if you can’t even get there? One participant explained how she used to love to go in-person because the relationships she had built with the staff made the bank feel like family, and she felt she could truly trust them to manage her money. Within the in-person concerns, they also spoke of frustration with the “messy in-between” of in-person and digital banking where they are told they need to go in-person and accomplish certain tasks physically and others digitally, making it hard to delegate seeking assistance from the bank’s branch or its digital assistance methods. Speaking of assistance, the most significant digital banking concern was the lack of adequate assistance for troubleshooting with their technological skill level. Many participants feel stuck when they do not know how to complete banking tasks digitally and cannot get the help they need. Another participant explained how when her husband passed away, she had to reset up her digital accounts and bill pay, and when she had trouble getting the customer service she needed, it made the situation more frustrating and sadder than it already was.

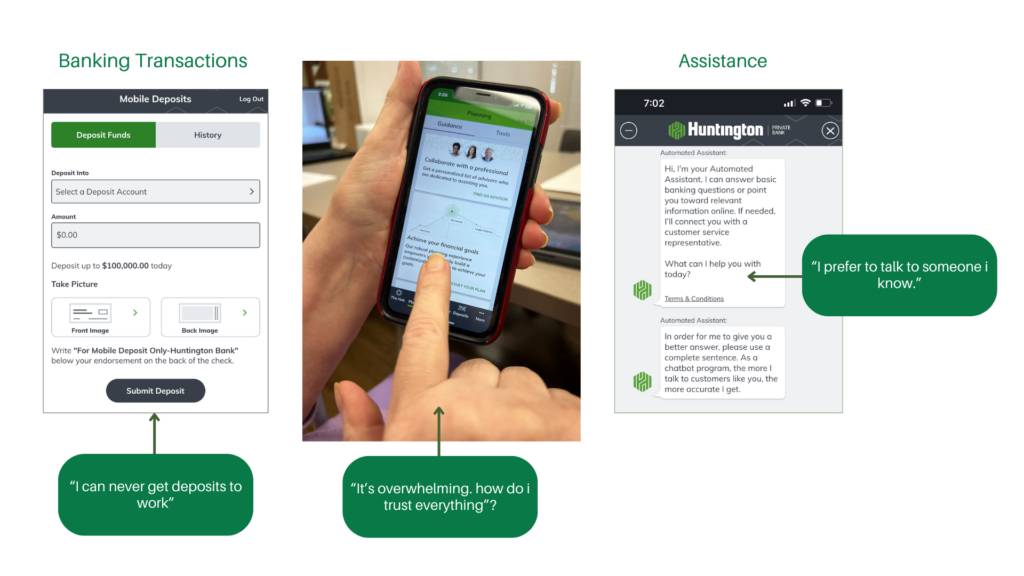

In keeping those collective concerns in mind, a heuristic evaluation of mobile banking apps was done (Huntington, Chase, and Citizens Bank), where the biggest takeaway for this research is that with mobile banking apps you can accomplish anything from banking transactions, troubleshooting, and receiving personalized financial advice on items such as spending. As part of each codesign session, participants took a closer look at the Huntington Bank App. What was interesting is that something that looked like a straightforward process, such as depositing checks, because it has visual and worded instructions, brought up many questions from participants. Questions of “how would I do that”, “I would need someone to help me learn and make sure I did it right” came up which created a bigger conversation about the journey they take to troubleshoot through digital banking.

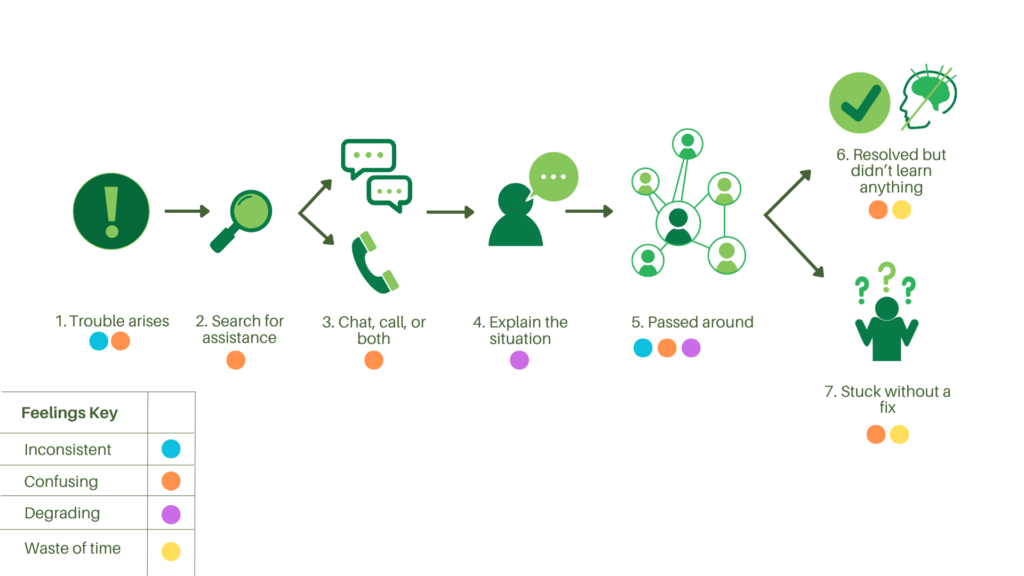

Through bucketing from specific stories within codesign sessions and interviews it became possible to visualize what that journey looks like for them, and where specific pain points are within an overall painful process. It starts off with an issue, like they cannot understand how to complete a task, something doesn’t look right, or they are afraid they made a mistake, then they search for ways to get help, and when written direction doesn’t work, they resort to chat or call options, they explain their issue but have to repeat themselves again and again as they get passed around on the phone. Frustration sets in as they wait on hold, and the customer service makes them feel dumb or belittled for being old. As the experience ends, they either have their issue resolved but did not learn anything for how to improve and gain more confidence for next time, or the issue isn’t resolved and they are told they might need to come in-person to the bank, but many of them cannot.

In switching the conversation from concerns to hopes, the biggest collective banking hope was to be able to bank independently for as long as possible. In other words, to keep up with banking methods and be capable of doing their banking on their own, so no one must take over their finances anytime soon. One participant explained how it is up to him to keep up with digital banking because he does not have much family left, and he would not have anyone to take over his finances.

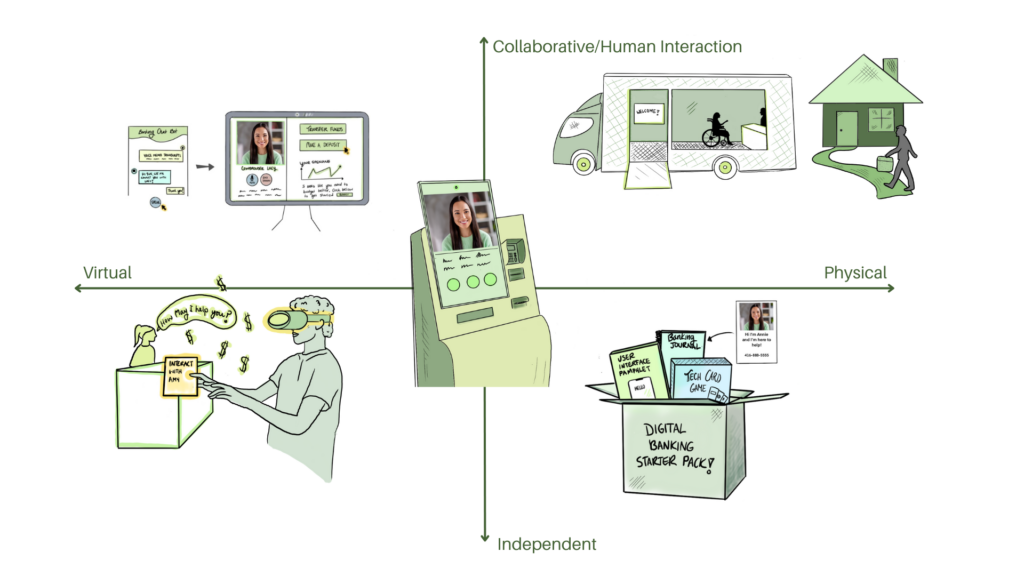

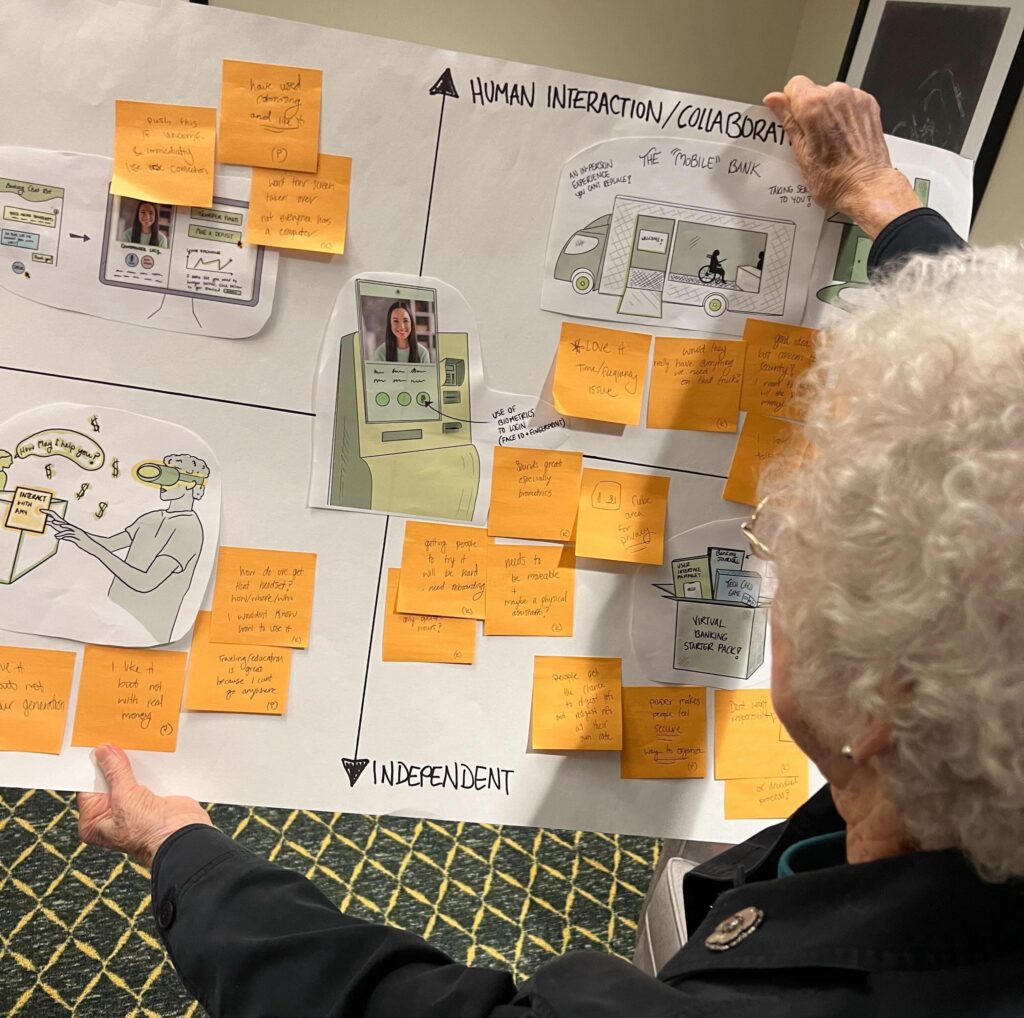

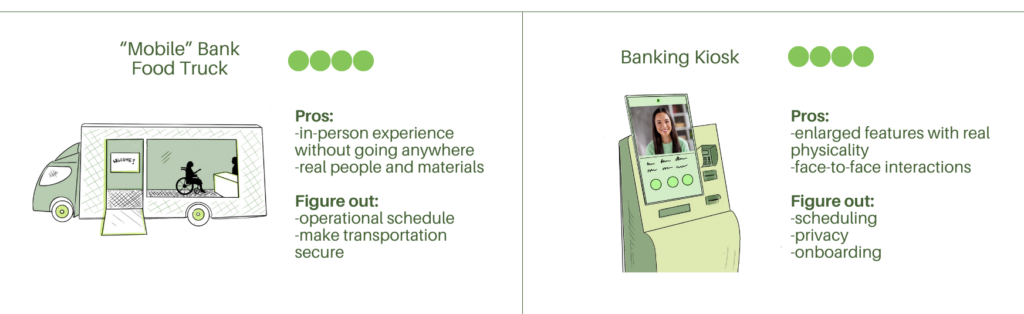

With that hope being said, participants were presented with 5 conjecture concepts of a personalized AI + co-browsing functionality, a virtual reality banking experience, a community banking kiosk, a digital banking start pack, and a “mobile” bank food truck. These conjectures were displayed across a divergent scenario axis of compromise between independent against collaborative/human interaction ideas, as well as virtual versus physical ideas, for the sole purpose of comparing and reflecting upon ideas to spark further intervention.

The participants had a LOT to say about these. Most expressed their liking for more physical and collaborative ideas, like the “mobile” bank and community bank kiosk because of the ability to carry out all their banking needs in one place with the assistance of a human. They also brought up concerns about these conjectures that I did not even know existed. For instance, when dealing with biometrics through the kiosk, many of them explained that because of their age, their fingerprint no longer shows up or works for them. This further proves the need for their feedback to rethink experiences.

It was interesting to hear the features and solutions they desired with these conjectures. For instance, with the banking kiosk, participants were able to work with a cardboard prototype to make sticky notes of specific buttons and features that would need to be available. Participants expressed a desire for as limited of buttons possible, an enlarged and simplified design, and a better journey or schedule of getting in contact with an employee.

What can we do with this research?

Huntington Bank has expressed an interest to increase customer loyalty in the digital financial service space. Their strategists recognize a need to get the basics right, lower customer friction points, and make digital banking more personal to them as a way to make them more worry free about their banking and therefore more likely to utilize Huntington products/services.

Given that Huntington is looking to increase customer loyalty in the digital sphere…and given that many older adults are now obligated to digital bank due to vulnerabilities, but they lack confidence in the experience and well-fitted forms of troubleshooting…

There arises a project opportunity to design more well-fitted forms of troubleshooting for older adults obligated to use digital banking services in hopes of increasing their confidence in their banking (and therefore their customer loyalty) so they can bank independently for as long as possible.

Stay tuned for Project development!

References

Becher, J. (2014, July 7). SAP brandvoice: Douglas Adams’ Technology rules. Forbes. https://www.forbes.com/sites/sap/2014/07/07/douglas-adams-technology-rules/?sh=5e87706c53e6

Dobbs, J. (2023, September 18). Why banks are closing so many branches. American Banker. https://www.americanbanker.com/news/why-banks-are-closing-so-many-branches

Eller, A. (2023). FBI: Losses from Elder Fraud cases rose 84% in 2022. AccessWDUN. https://accesswdun.com/article/2023/4/1180001/fbi-losses-from-elder-fraud-cases-rose-84-in-2022

Levant, J. (2020, September 16). Council post: Grandma wants digital banking too – don’t ignore her needs. Forbes. https://www.forbes.com/sites/forbestechcouncil/2020/09/17/grandma-wants-digital-banking-too—dont-ignore-her-needs/

Manjoo, F. (2023, September 6). What Mark Zuckerberg doesn’t understand about old people. The New York Times. https://www.nytimes.com/2023/09/06/opinion/seniors-tech-silicon-valley.html

McIntyre, A. (2021, January 6). Banks have thrown $1 trillion at digital. do shareholders care?. Forbes. https://www.forbes.com/sites/alanmcintyre/2019/06/24/banks-have-thrown-1-trillion-at-digital-do-shareholders-care/

Statista Research Department, & 2, M. (2023, May 2). U.S.: Digital Banking Users 2025. Statista. https://www.statista.com/statistics/1285962/digital-banking-users-usa/

The great consolidation of banks and acceleration of branch closures across America ” NCRC. NCRC. (2022a, July 8). https://ncrc.org/the-great-consolidation-of-banks-and-acceleration-of-branch-closures-across-america/#:~:text=Since%20the%20pandemic%20reached%20our%20shor