Digital banking technologies — including artificial intelligence, analytics, personal financial management software, internet of things, voice banking, banking as a service and fintech innovation — are converging toward one end goal: invisible banking.

This is banking you don’t have to think about. You tap to pay. You drive out of a parking lot and the car pays the parking fee. You tell the bank you’re saving for your daughter’s college tuition and money is automatically moved from your checking account to a special tuition savings account at appropriate intervals. You’re offered a loan or a discount at the moment you need it, at the time you’re making a purchase.

In five years, banking will be behind the scenes, embedded in everyday activities.

“You want to get all the hassle away, so banking is becoming invisible,” said Benoit Legrand, chief innovation officer at ING. That change will not be overnight, but the seeds of it are already sprouting in a number of different areas:

Internet of things

The internet of things has long been promised as the next tech breakthrough, although many efforts — such as Google Glass — have fallen short. Yet wearable devices appear to be gaining ground again (Amazon is launching its own version of tech-enabled eyewear that can access Alexa along with a ring that does the same), and promise to make banking and money movement seamless.

By 2025, Alan McIntyre, senior managing director for banking at Accenture, expects payments to move completely away from cards and phones toward wearables and biometrics.

“Whether it is tapping a ring that you wear or facial recognition, the payment will become more seamless,” he said. “The idea of taking the card out of the wallet will seem archaic. What you think of as transactional banking will disappear.”

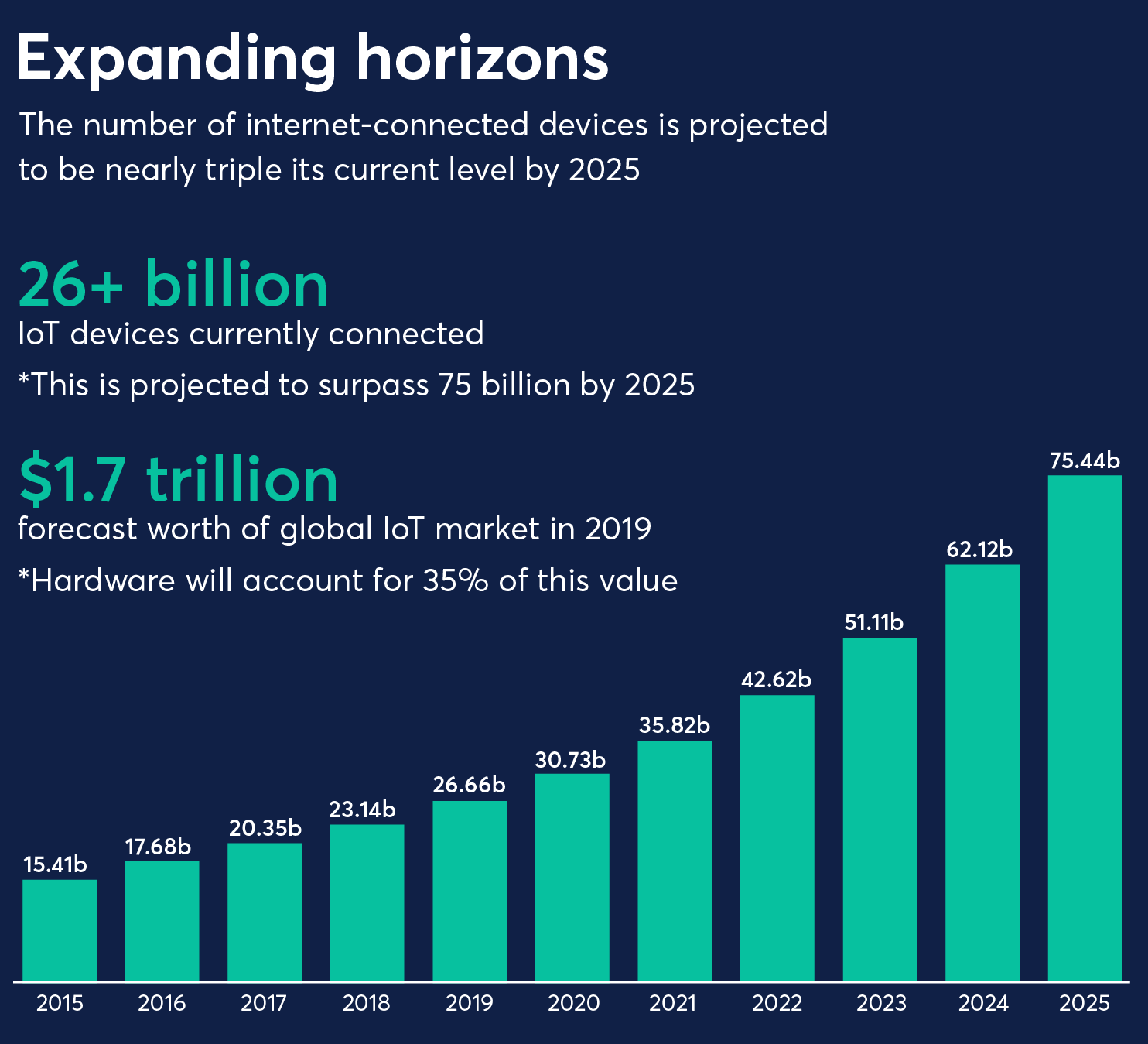

Source: https://ipropertymanagement.com/iot-statistics

An ING startup initiative, FINN-Banking of Things, develops software that lets smart devices make autonomous payments on behalf of the user. It can be embedded in smart bottles, so that when a bottle is close to empty, it reorders. It can be installed in a car, so that at a gas station or tollbooth, the payment is made automatically.

“You can load your car with 100 euros or dollars and the car pays whenever it’s put in those conditions,” Legrand said. The bank has been piloting the technology with BMW.

NS, the public transportation system in the Netherlands, uses this technology for invisible tickets.

“You walk in, we know where you are, where you entered, on which train you stepped in and where you stepped out, and you’re charged for your trip automatically,” Legrand said. “This is what you want.”

Financial wellness

The personal financial management aspect of digital banking also appears on track to be more seamless and effortless in five years. Kristen Berman, a behavioral scientist and co-founder of Irrational Labs and Common Cents Lab, a Duke University initiative dedicated to improving the financial well-being for low- to middle-income Americans, said that the overarching trends in money have had mixed results for financial wellness.

“It’s wonderful for people to have access to money, and decreasing the amount of time ACH payments will take us is good,” she said.

At the same time, it’s easier for people to rapidly spend the money in their accounts, she said. To cope with this, many PFM or financial wellness apps try to show people where their money is going through visuals like pie charts and traffic lights, so they can start to see where they might be spending too much on going out to dinner or on coffee at Starbucks.

These spending views rely on accurate categorization, which is not always a given.

“I always joke, we can put a satellite in space … but we can’t get our transactions categorized correctly,” Berman said. “Transfers are still being categorized as spending in apps, which makes people not trust these types of apps to give you insights, which makes this useless. No kidding people aren’t taking action. We don’t trust the insights that we’re being given.”

Berman sees this going in two possible directions. Either the technology gets better and people start to trust it or consumers are given the tools to make better decisions using heuristics and a lot of the work is done for them.

She would prefer the latter: Instead of presenting people with categorizations and hoping they form better habits because of it, the customer is helped to make changes.

For instance, a customer could sign up for a goal, such as taking a vacation at the end of the year, and the bank would make automatic deductions from their checking account to a vacation account, based on their income and expenses. A few fintechs and banks offer such automated savings tools already, including Digit, Chime, Qapital, Acorns, Fifth Third and Bank of America.

“I would love a behavioral economics method that would help people to do this,” Berman said.

McIntyre of Accenture said that in five years, banks will be giving consumers more in-the-moment advice on things like which payment mechanism to use, who to pay when, how to split payments. Such small decisions can add up to financial wellness.

U.S. Bank and Huntington Bank are already experimenting with this, using technology from Personetics. Bank of America’s Erica virtual assistant also is beginning to provide this type of advice.

Analysis

This article gave a great look into the future of banking, and how before we know it, the service will be all but invisible. The process is already starting – think about tap-to-pay or automatic subscription payments. We are spending without realizing that we are spending! And there is technology being developed to make this process even more seamless: biometrics. The article mentions tapping your ring to pay, or relying on facial recognition for your purchase to go through. Having a physical credit card will be a thing of the past. However, as virtual banking becomes more prominent, I (and this article) worry about the humans caught up in this process. The role of the teller is quickly being replaced with technology, though the role of customer service agent will only grow as more and more tech is introduced to the banking world. As the article put it, the more technology we’re using, the more human touch we need. I consider this a bit of a dangerous slope.

For a more positive take, this article delves into several ways in which banks are currently using technology to help their customers make smart financial decisions, working to give them more “in the moment” advice on best next steps, what payment mechanisms would be best, things like that. While technology might make banking difficult in some ways, especially by taking the humans away, there are some positives that come with additional virtual help and reassurance during the banking process.

Source

Crosman, P. (2020, January 5). The rise of the invisible bank. American Banker. https://www.americanbanker.com/news/the-rise-of-the-invisible-bank