Three methods are given on how subscription-based models are influencing banks:

1. Neobanks like Monzo are remarketing “fees” as “subscriptions” and putting customer needs at the heart of their tiered value proposition.

Traditional banks typically have a large number of accounts on offer, with customers asked to choose from as many as six or seven account types. Often, these accounts are not clearly differentiated, with complexity introduced by overlapping price points, inconsistent naming and unclear benefits.

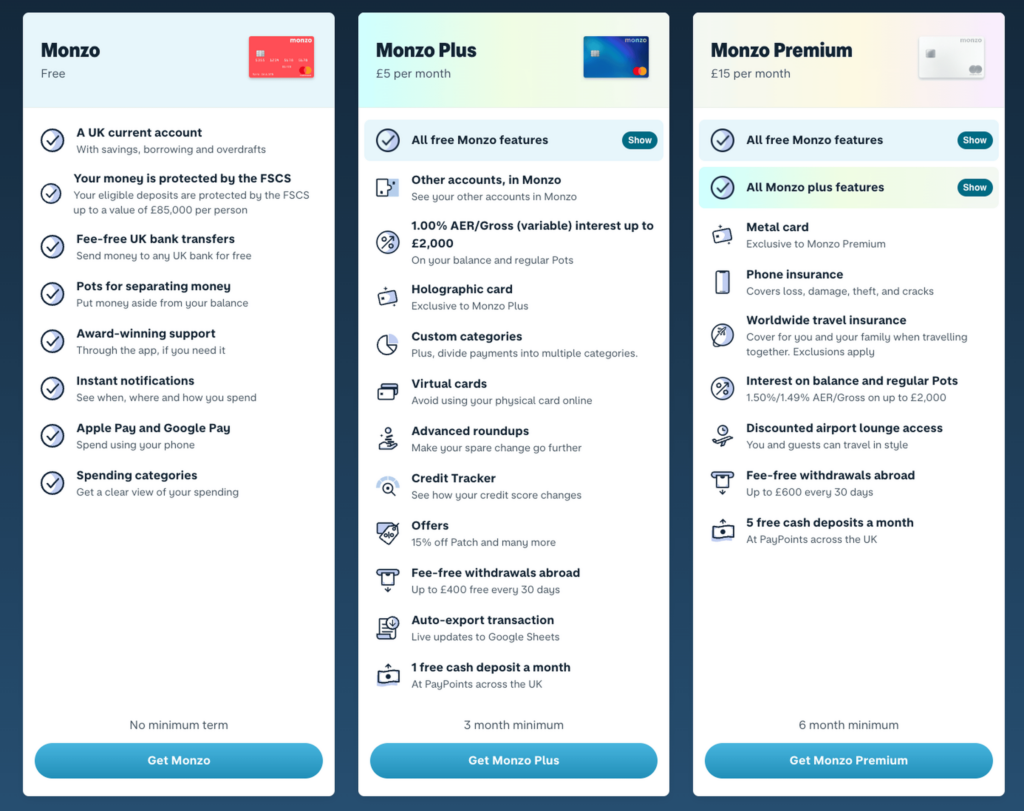

In contrast, Monzo clearly presents three tiers of progressive value, at a smart range of price points (free, £5 and £15). Each tier is clearly differentiated, with premium benefits added to those offered in the tier below.

Traditional banks typically base their premium value proposition on additional services bundled with the bank account itself (e.g. travel insurance, breakdown cover and mobile phone insurance). Conversely, Monzo has built tiers largely around product features central to a customer’s banking experience. These include: seeing third-party bank balances in Monzo, a holographic payment card, the ability to create custom categories, fee-free withdrawals abroad and an auto-export to Google Sheets function.

Customer-centric subscription businesses like Monzo focus more on the value their product can add to someone’s life, and much less on the cost savings they can offer by providing discounted access to unrelated services.

2. Corporate banking services like Nordea’s AutoFX show how technology-driven innovation can change transactional customer relationships into ongoing outcome-based ones.

Automated services like AutoFX are one way that Nordea has started to focus on long-term relationships with customers. Rather than a big upfront fee, payments flow in a pay-as-you-go manner. And by focusing on helping customers achieve an outcome, Nordea’s forex business is shifting from a product-centric business model to a customer-centric one.

3. Financial services are expanding their traditional core products by offering new ecosystems of services, often via subscriptions.

We’ve seen several financial businesses create ‘one-stop-shop’ bundles that aim to provide value beyond the scope of a traditional core product.

For example, neobanks like Tide and Holvi offer subscription-based services for self-employed and small business owners. Their offerings bundle banking with additional functionality that solves specific challenges faced by small businesses. For example, both services allow customers to create, send, track and store invoices online.

Traditional banks have also started to move in this direction, creating value-add ecosystems that cross over into non-financial services. For example, Singaporean bank DBS has started to offer SMEs a wider package of digitalization as part of its Start Digital offer. Start Digital is a subscription bundle offering customers a wide range of support, including tax services, online HR and cybersecurity tooling. This support is delivered via an ecosystem comprising third-party partners and DBS’s own products.

Service ecosystems provide financial service businesses with a unique opportunity to monetize and differentiate their offerings. Reimagine your role as one of a “trusted partner,” and focus on providing services that meet your customer’s wider needs. Partnerships offer a simple way for financial organizations to broaden their offer beyond their own specialisms. (Sofiykov & Adelman, n.d., paras. 5, 7-10, 13, 15, 19-22, 24)

I can sometimes be unfamiliar with the vernacular used in banking, but when I have a subscription attached to most things, that I understand. Hearing about banks remarketing “fees” as “subscriptions,” and reconfiguring inconsistent account types into tiers, won’t be enough to garner the solution I’m looking for, but it does confirm the need for clarity among bank’s complexities.

I had done some research into mega-platforms unrelated to banking, but this article provides some context of how banks could turn into these one-stop-shops. Specifically, some banks offer small business owners subscription-based services where they can create, send, track and store invoices. Could advanced Ai be leveraged to personalize these subscriptions to each customer? Could it promote new hobbies to amplify selfgrowth or enable connections between people? Would people feel safe fostering a community through banking?

This is an opportunity to monetize and differentiate offerings, balancing both business and user needs.

References

Sofiykov, S., & Adelman, G. (n.d.). Three ways financial services are taking inspiration. FT Strategies. https://www.ftstrategies.com/en-gb/insights/three-ways-financial-services-are-taking-inspiration-from-the-subscriptions-world/