As banks rush to transform their customer experience, it’s easy to trip up. Here’s how to execute a step change that moves ahead of competitors.

Regulation. Fickle customer loyalties. Nontraditional competitors. As if a decade of razor-thin margins and reputation issues weren’t enough, the mix of challenges facing global banks makes it easy to see why so many now voice a commitment to improved customer experience as a legitimate differentiator in an increasingly competitive environment. Of the 50 largest global banks, three out of four now pledge themselves to some form of customer-experience transformation.1

The benefits of such a strategy have been increasingly clear for some time across sectors and geographies. As practitioners like Amazon and Apple have demonstrated, real value resides not only in the products and services a company provides but also in the way that it delivers them. A seamless customer experience can be worth at least as much as a superior product or efficient process—building customer loyalty, reducing costs, making employees happier, and boosting revenues significantly. One bank that undertook a customer-experience transformation concluded that the lifetime profitability of a satisfied customer willing to actively recommend the bank to his or her friends was five to eight times greater than one who had a negative perception.

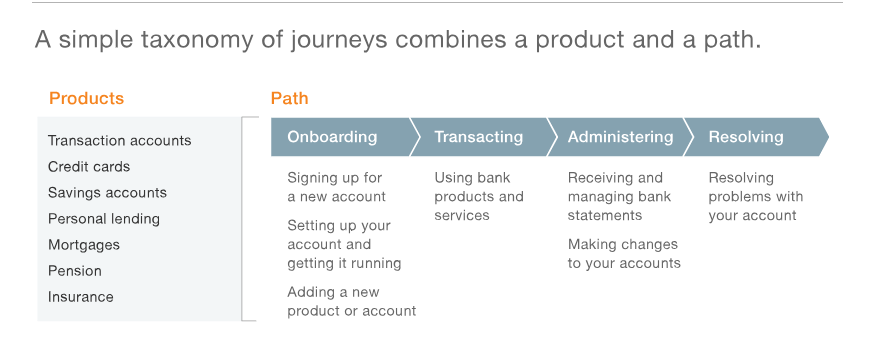

Many leading banks are pouring tremendous resources into transforming the customer experience, often with mixed results. This is understandable. A customer’s banking relationship includes key journeys that range from onboarding and transacting to maintenance and problem resolution. Effective transformations must not only recognize the complexity of these relationships but must also make a priority of the parts of the experience that matter most—in order to manage the cross-functional, end-to-end nature of customer needs rather than deferring to existing organizational structures.

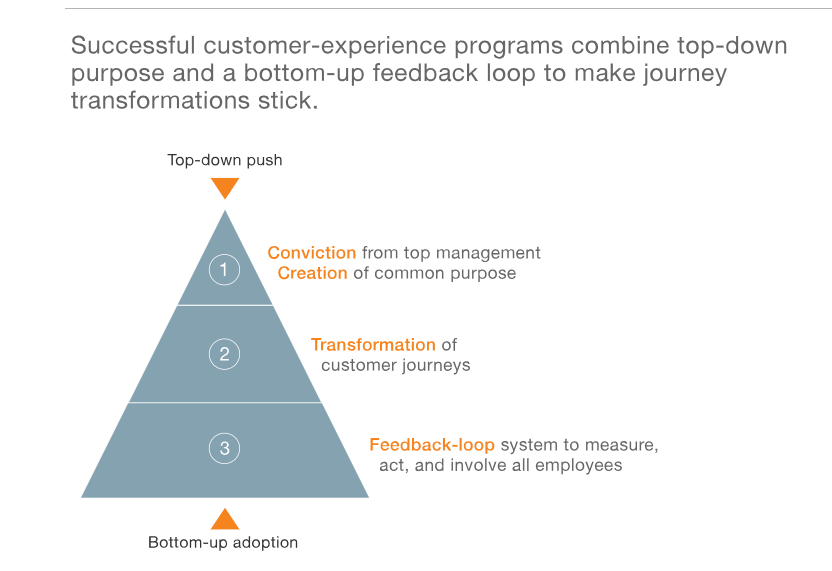

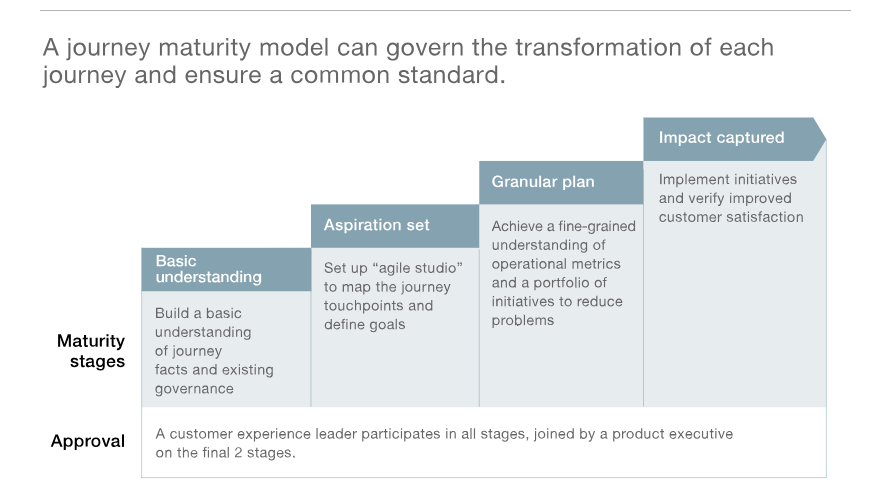

Depending on a bank’s customer-experience goals, transformations can vary in regard to the time and resources required. In our experience, a handful of elements are necessary to execute any program that will deliver durable impact. These include, among other things, a consistent focus on value, ensuring the customer’s central role in any transformation, and the ability to scale a program. This article explores the ways that some banks have implemented these and other critical steps in constructing successful customer-experience transformations.

Analysis: This article provokes a lot of debate on how banks can better work with and for their customers. As innovative financial products and processes grow, such as decentralized banks, and fintech companies, banks risk losing their customer loyalty, so how can they improve it and stay relevant? Often banks assume they know the customer more than they do, getting rid of “pain points” that were not even the problem in the first place. This reading puts emphasis on taking a more holistic view of the banking experience and pushing banks to work better cross-functionally, to not overcomplicate small user-experiences or lose sight of progress and feedback. It is causing me to realize the importance of understanding a customer’s whole journey with a bank, rather than narrowing to a specific transactional touchpoint in the customer’s banking experience. In utilizing bottom-up feedback and involving employees of all functions, my research will be better able to address the problematic. In analyzing this article from a critical, design research lens, but also from the perspective of someone that has little experience in the banking industry, I feel better about approaching my research and reimagining the customer journey.

Citation:

Maechler, N., Michael, J., Schiff, R., & Smith, T. R. (2018, October 9). Managing a customer-experience transformation in banking. McKinsey & Company. https://www.mckinsey.com/industries/financial-services/our-insights/managing-a-customer-experience-transformation-in-banking