While customers have changed the way they interact with banks, the same does not hold true for the inverse.

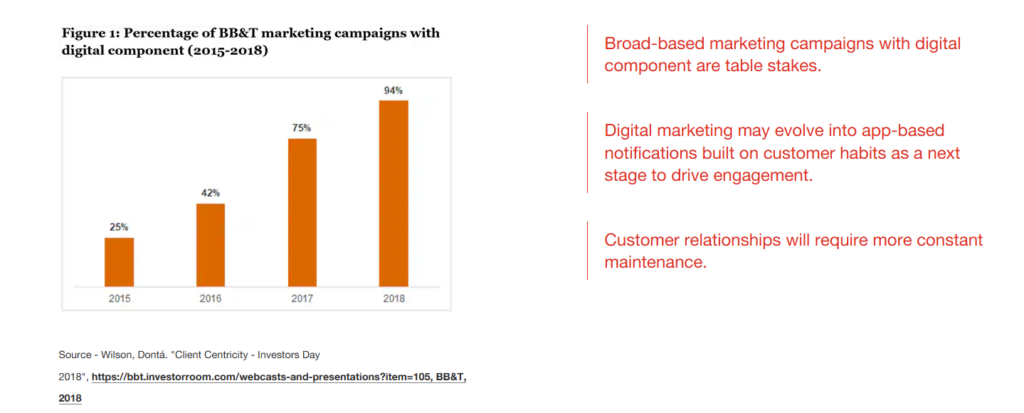

With digital expansion becoming a primary focal point for major banks in the United States, a reevaluation of marketing and customer outreach strategies is needed. Changes in customer engagement strategies are essential to retain or recapture growth.

- For many banks, investment in defining more appropriate digital-first marketing strategies is required. Customer tolerance for digital marketing has risen, but personalization of marketing campaigns has lagged.

- To generate new revenue, banks should consider incentivization of established behavior as a tool.

- Acceleration of the adoption of data analytics is a prerequisite for banks to more effectively provide relevant services and solutions to customers in a digital framework.

Larger banks have widely sought to improve user experience and expand product offerings in the digital channel. For example, banks have sought to improve application times, reduce customer compliance pain points, and offer instant virtual cards. But few have even begun to evaluate how to evolve their marketing and outreach strategies despite the fact that the way in which customers interact with banks is shifting. A redesign is necessary alongside bank products themselves, as the way banks design products and market them is no longer effectively captured by a one-size-fits-all approach. This ‘personalized advice’ approach goes beyond long-term financial goals. It incentivizes known customer behavior in order to facilitate a financial partnership. Marketing strategies centered around supplemental incentivization of ongoing customer behavior is a probable evolution to current digital marketing campaigns. This is likely the new path for relationship building between bank and customer as digital increasingly becomes the primary point of contact in the industry.

Digital channels, and specifically mobile apps, provide customers with a high level of access to banking services. As such, a strategic shift to take advantage of this access seems only prudent, and banks pursuing digital expansion opportunities might want to consider remapping their traditional engagement tactics. Such a change could recapture growth from direct digital banks which, while growing their share of retail deposits from 14% to 28% between 2014 and 2017,1 have demonstrated a limited ability in establishing primary banking relationships. This new data-driven, proactive approach to customer outreach could help build loyalty and increase engagement in an environment where a large number of financial institutions are competing for wallet share. Traditional marketing campaigns could face diminishing returns as more targeted, customer-centric campaigns take their place.

Analysis: As banks continue to shift their services to digital platforms, they need to make sure they are keeping up with customer needs. This article looks at digital banking from a critical perspective and offers up different strategies that will take banking back to a more customer-centric experience. It encourages data-driven insights and personal outreach, along with a refined marketing strategy to increase quality interactions, and therefore growth within the bank. In the big scheme of banking, customer loyalty seems to revolve around how cared for the customer feels and how personalized and affordable their experience is in comparison to competing banks. If banks utilize technology to capture and study customer habits, they will be able to use that data to come up with incentives or alternate more personalized products for their customer. The key is to reward behaviors and keep the customer engaged. Overall, this article makes me question what behaviors make the Huntington customer stand out; what services are keeping them the most engaged and what technology we can use to further track this data and make the digital experience even better than it has been. I also think about ethics and what data-capturing practices are truly helpful and wanted, versus what might feel invasive to the digital customer.

Citation:

PricewaterhouseCoopers. (n.d.). Digital Intelligence: Banks are evolving customer engagement strategies to recapture growth. PwC. https://www.pwc.com/us/en/industries/financial-services/library/customer-engagement-strategy-evolution.html