An age-old model gets turned on its head

The digital revolution has finally come for one of banking’s long-standing foundations.

For years, business models in the industry were as fixed as panes of stained-glass cathedral windows. A bank typically owned each layer of the value chain and would create, package, and distribute its products, whether the bank was a century-old global titan or a neobank offering a digital alternative to traditional offerings. Its models were monolithic, linear and vertically integrated.

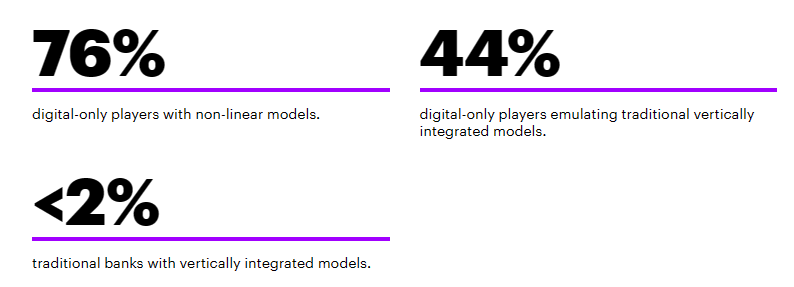

But new waves of digital-only players have unshackled themselves from vertical integration and are fragmenting the banking value chain by choosing which layers they want to play in. They are also unbundling traditional products into micro-products or services and re-bundling their own offerings together with components from other providers to offer better customer propositions.

Many digital-only players are using this non-linear and adaptive business model to attack incumbent banks where they are most exposed. The strategy of each challenger varies, but they are unified in their ability to configure innovative products and propositions quickly and at scale, with lower customer acquisition costs.

The result in most markets? A steady outflow of banking and payments revenues from incumbents to new entrants.

There’s value in going non-linear, our report shows

Our Future of Banking report analyzes the business models of leading incumbent banks and digital-only players to identify how value chain fragmentation and product componentization are reshaping the banking market of the future.

We found that digital-only players with non-linear business models are outperforming those that simply emulate vertically integrated models in the digital world. They can also adapt more easily to product componentization and further value chain fragmentation to respond quickly to future disruption in the market.

The average compound annual revenue growth of banks and competing players in our study that utilize different business models (between 2018 and 2020):

The performance of these digital-only, non-linear challengers offers inspiration for incumbent banks looking for breakout growth and higher market valuations. The billion dollar question is: where to begin?

Crafting a kaleidoscope of business models

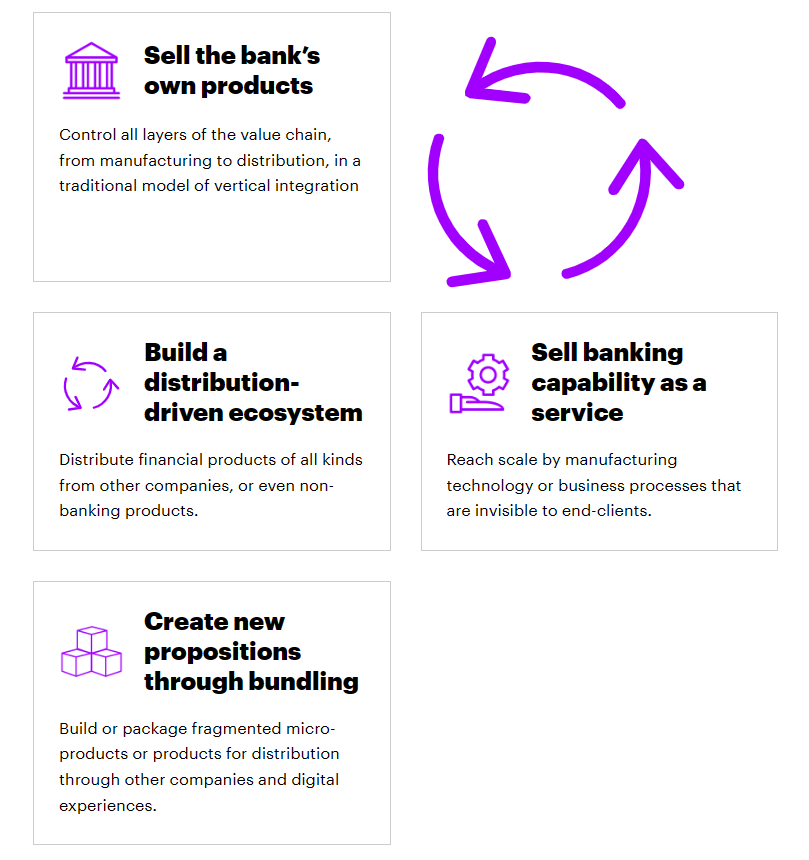

Large banks are understandably reluctant to discard the vertically integrated business models that still drive their profitability. The good news is that taking on non-linear business models is not an all-or-nothing proposition.

The key to success in this flexible, fluid environment is not just to shift from yesterday’s business model to a new one. Rather, it is to evolve from reliance on a single, vertically integrated business model to multiple non-linear models and roles in the value chain.

Owning the value chain end-to-end and selling only your own products are no longer requirements for success. Architecting and creating value for the end-customer or for the next player in the value chain offer new paths to differentiation and growth. This requires having the vision and flexibility to reimagine and “package” compelling propositions that truly focus on customers’ needs and intentions.

Analysis: Accenture’s report analyses the digital-only players in the banking world and how they are utilizing non-linear business models to outperform traditional banks. From a critical perspective, it seems to be saying that the banks that succeed will consider all business models and integrate multiple components to meet their needs. This is telling me that as a Huntington partner it is important that I closely examine what areas we are thriving in, what we do that is outcompeting other companies, but more importantly what parts of our business could be better outsourced from external partnerships. It sounds like collaboration is key, which is something I already knew to be true in accomplishing any design, but this time it will take a more specific look into the realm of digital markets and business plans. Overall, I believe a fresh perspective in banking will benefit me in visualizing these processes in a new light.

Citation:

Accenture. (2023, February 27). Future of banking business models. Accenture.

https://www.accenture.com/us-en/insights/banking/future-banking-business-models