The city’s schools may be increasingly cash-starved, but at one high school in Harlem, the money is flowing in: Capital One Bank and the Abyssinian Development Corporation have opened a student-run bank inside it.

The branch at Thurgood Marshall Academy on West 135th Street is the third of its kind for Capital One, with the others in high schools in the Bronx and in Newark. The mission of the program is to give students real-world money management experience, offer them life skills and put them on the fast track to college.

“Before I obtained this position I wasn’t really good with money,” said Matthew Reyes, 17, who was working behind the branch’s lone customer service desk the other day. “Now that I’m dealing with checks, my own personal money and not just my mom’s, you know if you earn it you spend it wiser. I’ve learned how to save my money.”

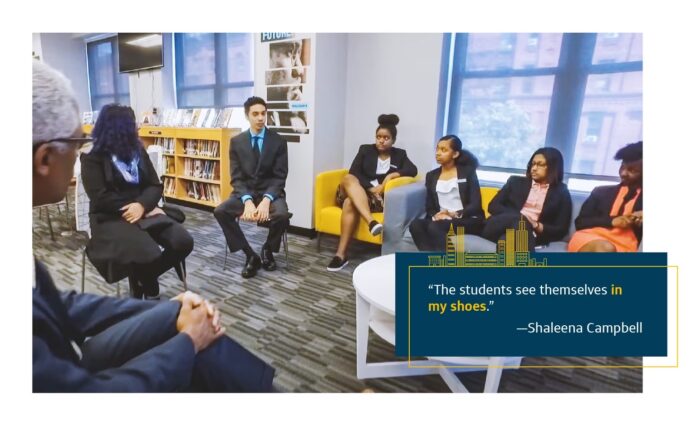

The Marshall branch, like the others, is staffed by students who are managed by a Capital One branch manager and a bank associate who is always on site. The branches are fully functioning banks, with a limited menu of services for students and teachers at the school. Savings accounts are the preferred accounts (the bank does not offer debit cards, to steer teenagers away from the lure of plastic).

So far, 77 Marshall Academy students have gone through the bank training program.

The Marshall Academy, which also incorporates a middle school, is a public school sponsored by the Abyssinian Development Corporation. The church’s pastor, the Rev. Calvin O. Butts III, who is also the chairman of the corporation, said the bank was a terrific addition.

“It feels very good. It’s exhilarating,” Mr. Butts said. “We know that one of the major challenges for areas where poverty is concentrated is financial literacy. And you don’t start developing financial literacy at 25. You’ve got to start that early on.”

Lynn Pike, the president of Capital One Bank, said the hope was that the financial lessons imparted to the students would spread to their families and friends.

“Through our investment in financial education and our in-school branch, which provides the opportunity for workplace training and mentorship, we hope to lay the groundwork that will allow our student bankers, their classmates and the broader Harlem community to benefit,” Ms. Pike said.

Michael Booker and Christopher Rowe, two 17-year-old tellers at the bank, said that working there had changed their relationship to money.

“My work ethic was low,” Mr. Booker said. “I didn’t really meet deadlines nor did I come to school on time because I really didn’t care for school because no one ever showed me the importance of school. But after the internship program they really showed me the importance of it, and being around so many important people and them giving me that knowledge, I took it back to school. And I just started bringing it to my grades, I started to get to school on time and I started meeting deadlines.”

Mr. Rowe, the eldest of four siblings, said he was passing along what he had learned about money management and financial responsibility to his three younger siblings.

“I didn’t know about these things until last year, so now that I have a chance to teach them while they’re young, they can build their savings as they get older and help my mother with college,” Mr. Rowe said.

Before his internship at the bank, Mr. Rowe said, “I didn’t even have an account of my own. But going through the program I realized that soon I’m going to be on my own and these are concepts that I’m going to need in the real world.”

Analysis

I find this article incredibly interesting. How better to teach and encourage financial literacy than by putting the students on the other side of the desk? I’ve always held the belief that you learn better and faster if you’re learning to teach. Because you are no longer the only person reliant on what you do or do not learn, you’re more apt to pick up and master the subject than you would have had you not been responsible for teaching another. These high school students are getting exposed to learning about financial literacy in a way that requires them to remember the basic rules, enough for them to teach those rules to others, at least. It’s awesome for the students, since they have a job that’s educating them as they go, and awesome for the bank, now with extra labor to go around. This design solution is a win for both sides of the problematic, not just the end-user.

Source

Lee, T. (2010, May 6). Teaching financial literacy at a student-run bank. The New York Times. https://archive.nytimes.com/cityroom.blogs.nytimes.com/2010/05/06/teaching-financial-literacy-at-a-student-run-bank/?searchResultPosition=17