BANKS around the world are in the midst of a sweeping digital transformation agenda, yet for many, realizing the true potential of these changes remain elusive. What role should bank branches play in this transformation, and why? In our third article in Deloitte’s global digital banking consumer survey series, we highlight the potential value of bank branches in an increasingly digital world.

Bank branches are still relevant in a digital world

Based on a proprietary global survey (see sidebar, ”Methodology” for more details), we found that branches remain the dominant channel for account opening and customer satisfaction with branches is a stronger determinant of overall satisfaction than either the online or the mobile channels. In this article, we explore how these dynamics play out across different countries and customer types, and offer recommendations on what banks could be doing to rethink the branch experience in an increasingly digital world.

Methodology

The Deloitte Center for Financial Services surveyed 17,100 banking consumers across 17 countries to measure a range of banking attitudes, behaviors, and preferences. Among other questions, we asked respondents about their channel usage for various products and services.

Using this data, we built a linear regression model with overall satisfaction with the bank as the dependent variable and satisfaction with individual channels—branches, ATMs, contact centers, online, and mobile apps—as the independent variable. We included responses from only those consumers who had used all the above-mentioned channels (n=8,000).

The R-squared was low (0.18), which is not surprising given that the overall satisfaction with a bank typically depends on a number of factors beyond channel satisfaction. However, the model fit and the coefficients were significant (except for ATM satisfaction) to understand the relationships between channel satisfaction and overall satisfaction. The purpose of the model is not to predict overall satisfaction but to understand the relationships between channel satisfaction and overall satisfaction. Despite the low R-squared, we consider the model results to be quite revealing because of the significant coefficients.

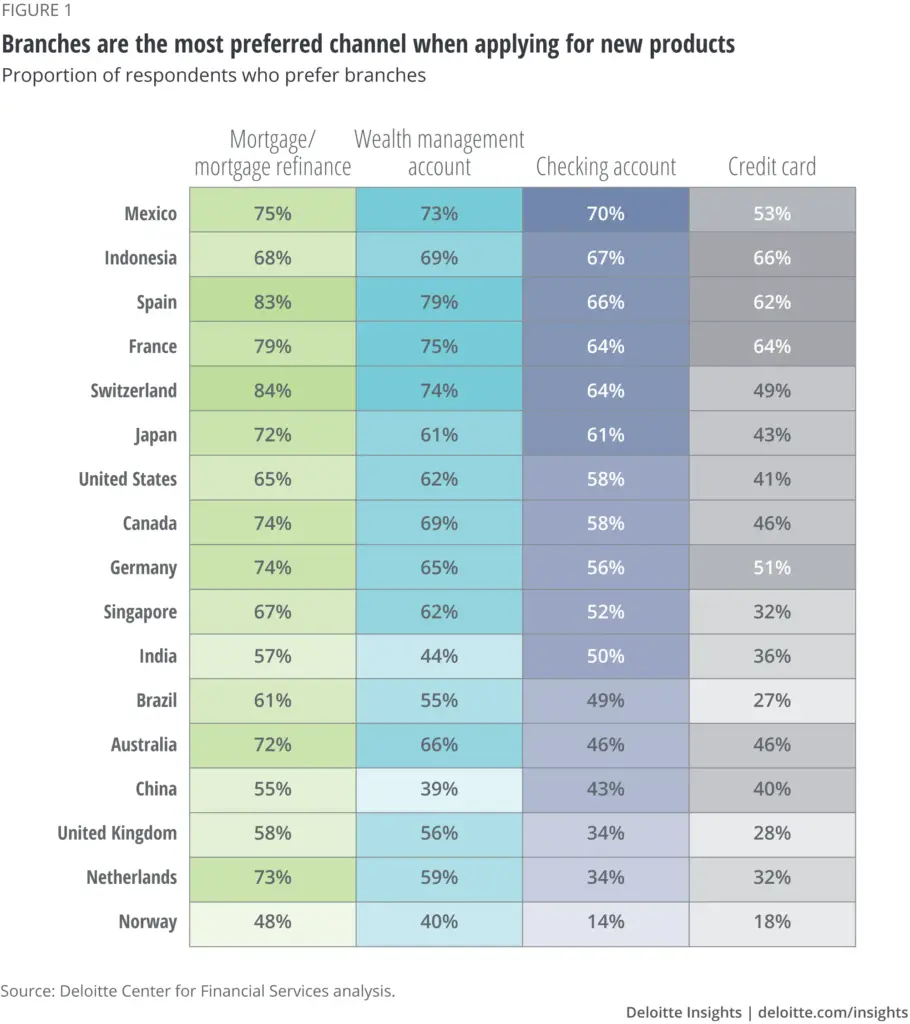

Branches are the dominant channel for account opening

The survey revealed that most customers prefer branches over digital channels when opening new accounts for both simple (such as savings accounts and debit cards) and complex products (such as loans). This was true in developing countries, such as Mexico and Indonesia, as well as in developed countries, such as Spain, France, Germany, Japan, the United States, Canada, and Switzerland (figure 1). However, in Norway, one of the leading countries for digital channel usage, customers surveyed said they prefer digital channels over branches when applying for simple products, such as checking accounts, savings accounts, debit cards, and credit cards (see sidebar, “Digital product application in Norway”).

This preference for branches in opening new accounts is uniform across generations—baby boomers, Gen Xers, millennials, and even the youngest consumers, Generation Z. For instance, 64 percent of boomers, 54 percent of Gen Xers, 48 percent of millennials, and 56 percent of Gen Z consumers surveyed said they prefer to visit branches when opening a new checking account.

Analysis: This article provides a valuable and factual perspective on how the ever-growing digital transformation in banking is changing the way banks operate. However, unlike some articles that emphasizes pushing forth with digital solutions, it puts focus on person-to-person interaction and the customer preference to visit branches in certain instances, such as opening an account, and why keeping customer-banker relationships is so valuable. It brings about questions of balance between the physical and digital world, and what design can do to keep people wanting to visit a branch instead of doing everything digitally. Why do customers sometimes prefer to use their apps to handle their money, but only trust bankers in others? How can designers work with the bank to make changes that will nudge customers to visit the bank more and improve customer satisfaction. Or how can we utilize design to make the digital experience of banking more personable, informative, and interactive? Overall, it encourages banks to consider how valuable person-to-person interaction is in the midst of the digital age.

Citation:

Recognizing the value of bank branches in a Digital World. Deloitte Insights. (n.d.).

https://www2.deloitte.com/za/en/insights/industry/financial-services/bank-branch-

transformation-digital-banking.html