At Texas Tech University, when walking through the hallways of the College of Human Sciences building where the School of Financial Planning holds classes, conversations about money are common. James Zugg, who earned his bachelor’s degree in personal financial planning in December 2021 and has since moved into the graduate student assistant role in the university’s Red to Black Peer Financial Coaching department, says one might overhear students trading stock purchase or performance stories.

Students across the university are talking about finances with each other in a more formal sense via Red to Black’s individual coaching sessions or presentations led by peer financial educators, explains Zugg, who has served as a student coach since 2019. The model allows students to learn about money matters through someone likely to have a similar financial situation (although coaches are all majoring in personal financial planning or a related program and have undergone special training).

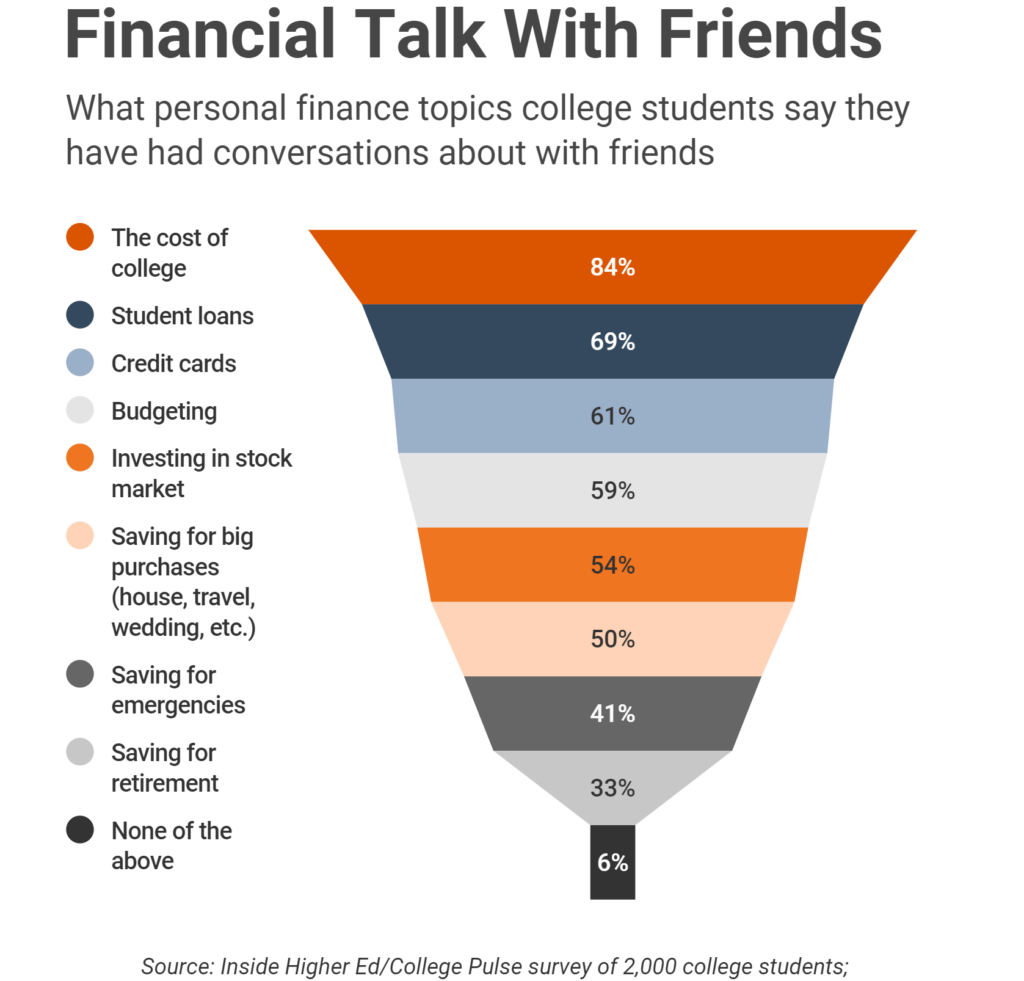

More than half of Student Voice survey respondents have talked with friends about investing in the stock market. But even more popular topics for such conversations are budgeting, credit cards and student loans, and the top topic is the price of college (84 percent.) Community college respondents (250 of the full sample) are less likely than their four-year peers to be talking with friends about stock market investing, budgeting, credit cards and student loans. These students are also less likely to have student loans; two-thirds had them, compared to three-quarters of those surveyed from four-year institutions.

Pandit is happy to see budgeting and savings discussions taking place, especially during the pandemic, he says. “Young people have to learn the importance of properly allocating their income between savings and expenses.” He also likes that retirement came up, considering it’s so far away for most students. And regarding credit cards, he hopes discussion was about how to use them responsibly rather than how to acquire several or increase credit limits.

His program used to work intently on reducing the amount of loans taken out, “but we’re realizing the focus might need to be less on student debt and more on overcoming financial barriers,” he says. “There is a sweet spot—you don’t want students borrowing too much, and you don’t want them borrowing too little, because they may work too much, and that takes away the ability to focus on academics.”

Regarding investment chatter, Schuman says he sees it most in sessions with business school students, who are more fluent and seek assistance on building portfolios. But basics must come first. “We’re getting people to slow down and establish a solid financial baseline.”

Student Voice respondents were most likely to say they’d learned about money and finances from a parent or guardian (62 percent), with white students more often identifying a parent than students of color, and private college students doing so more often than public college students. Personal research, the second most common response, shows an active interest in learning about their finances, says Pandit.

One in five students identified a friend as having taught them, a finding that’s “a little scary” to Amy Glynn, who was a financial aid administrator for a decade before joining the financial aid software company CampusLogic, where she is currently vice president for student financial success.

“You have to wonder about the accuracy of the information,” she says. “Financial literacy is so personalized. I worry that a student will get the wrong information because their friend Sally got told, No, you are not eligible’ for work-study, a Pell Grant or any of a number of other programs. Her situation may be very different, and maybe they don’t see the small differences in the details that could lead them down a completely different path.”

Students leave with homework: track all spending. “We live in a society now where we swipe or tap or hold up our phone to the payer, and it’s that instant thing. People aren’t realizing how much they’re spending,” he says. In a follow-up session, where a student might see, for example, $150 more than assumed was blown on eating out, Zugg will see “aha moments” that prompt behavior change.

About four in 10 students surveyed rate their financial knowledge as either excellent (7 percent) or good (35 percent), while only 12 percent rate it as poor.

Being involved with investing may equate with financial confidence for some students. Nearly three in 10 students have stock market investments, and 16 percent have dipped into cryptocurrency; 12 percent of these respondents rate their knowledge as excellent, and 47 percent as good.

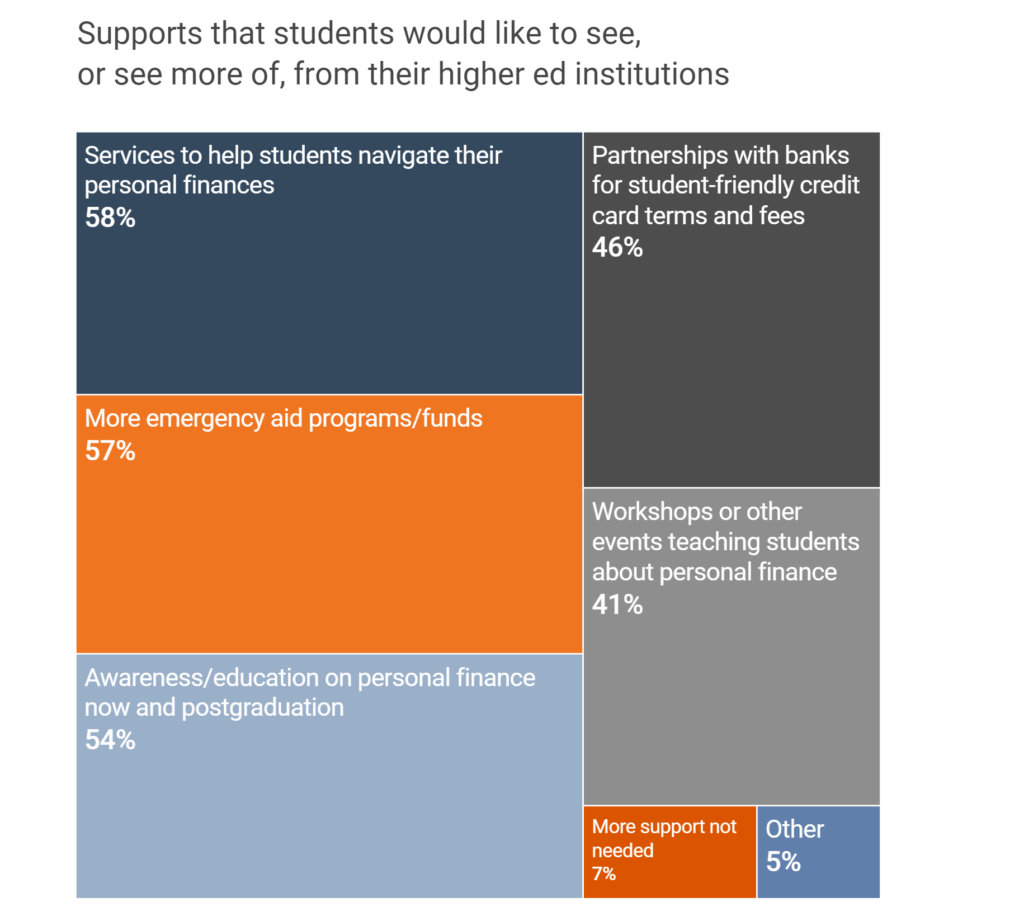

When asked what types of financial wellness supports they would like to see, or see more of, from their institutions, students selected services to help in navigating personal finances, more emergency aid funds and education on personal finance now and after graduation the most.

Nearly half of students want more partnerships with banks for student-friendly credit card terms and fees. “It’s ironic,” says Schuman. “There’s so much focus on debt students have, but we’re getting indications that students want to borrow more money. It’s being told to them through marketing, ‘Hey, you should build credit,’ but it’s a slippery slope.” Hearing students bragging about their credit scores, he will emphasize that scores are “an indication of borrowing health, not an indication of financial wealth.”

https://www.insidehighered.com/news/2022/02/25/survey-college-students-need-help-financial-literacy