We all know examples of bad product and service design. The USB plug (always lucky on the third try). The experience of rushing to make your connecting flight at many airports. The exhaust port on the Death Star in Star Wars.

We also all know iconic designs, such as the Swiss Army Knife, the humble Google home page, or the Disneyland visitor experience.

Despite the obvious commercial benefits of designing great products and services, consistently realizing this goal is notoriously hard—and getting harder. Companies need stronger design capabilities than ever before.

So how do companies deliver exceptional designs, launch after launch? What is design worth? To answer these questions, we have conducted what we believe to be (at the time of writing) the most extensive and rigorous research undertaken anywhere to study the design actions that leaders can make to unlock business value.

We tracked the design practices of 300 publicly listed companies over a five-year period in multiple countries and industries. Their senior business and design leaders were interviewed or surveyed. Our team collected more than two million pieces of financial data and recorded more than 100,000 design actions. Advanced regression analysis uncovered the 12 actions showing the greatest correlation with improved financial performance and clustered these actions into four broad themes.

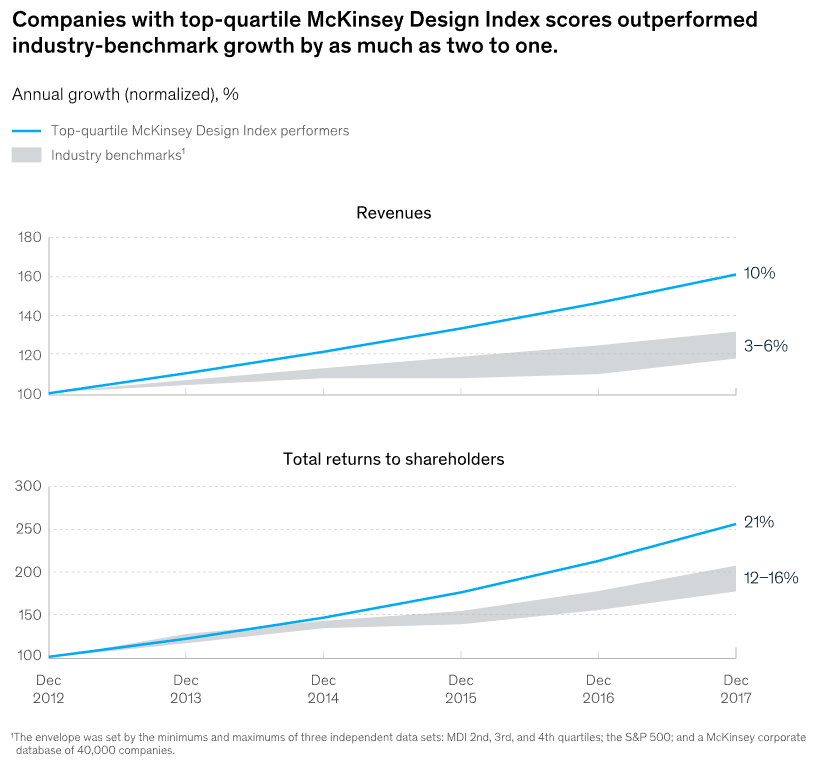

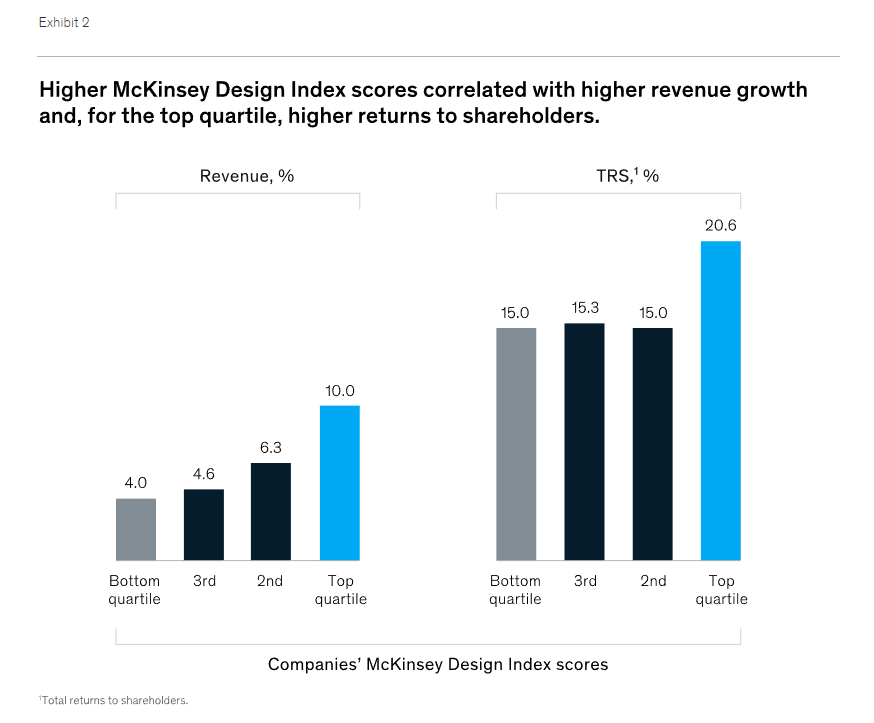

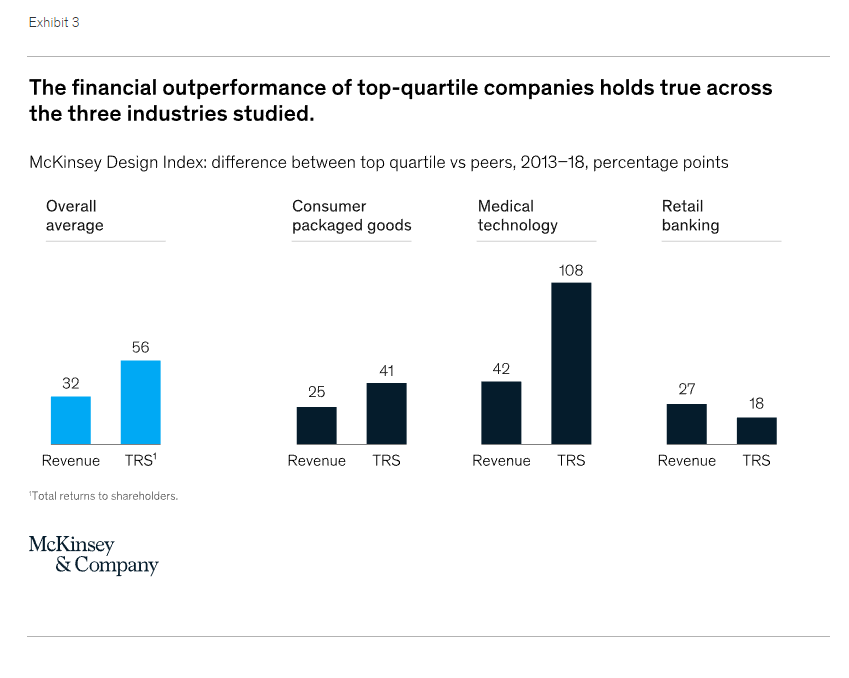

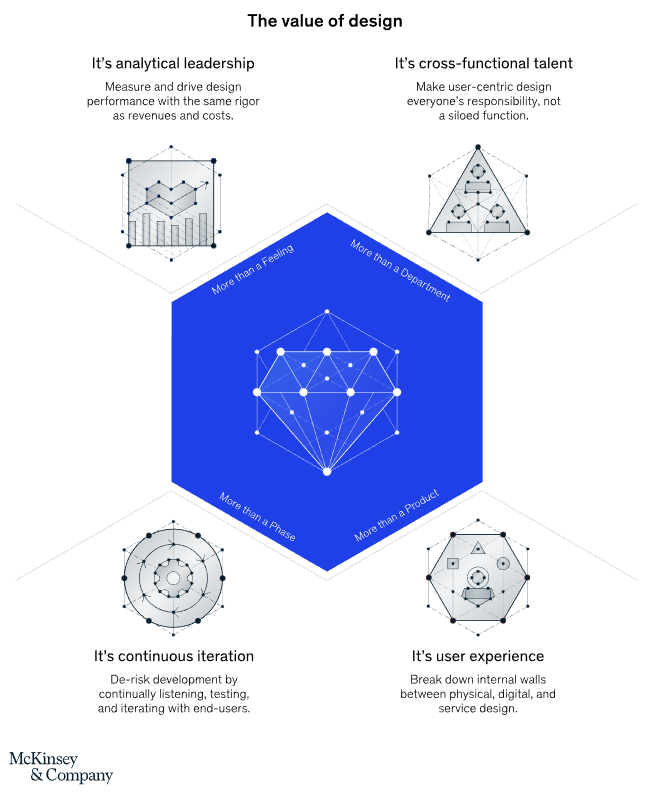

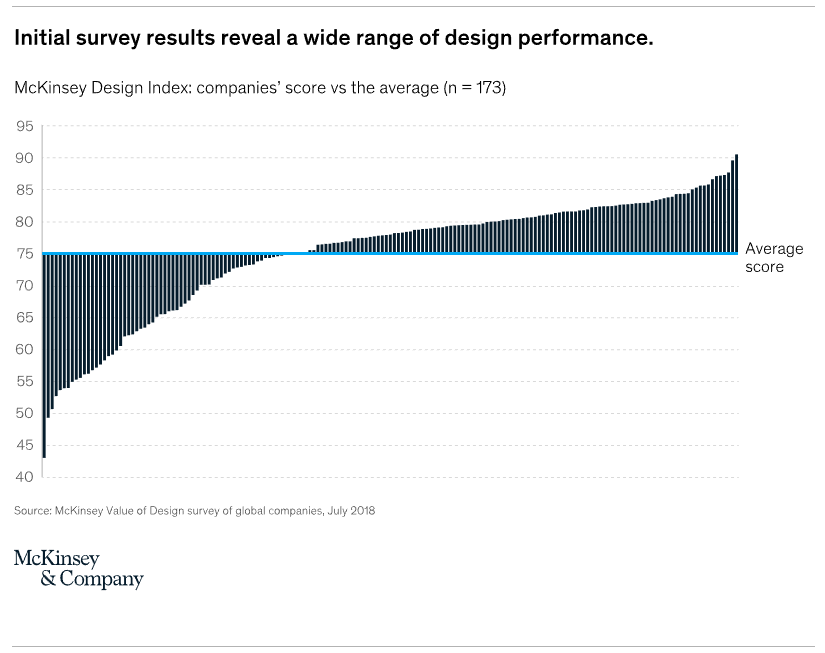

The four themes of good design described below form the basis of the McKinsey Design Index (MDI), which rates companies by how strong they are at design and—for the first time—how that links up with the financial performance of each company (Exhibit 1).

- We found a strong correlation between high MDI scores and superior business performance.

- The results held true in all three of the industries we looked at: medical technology, consumer goods, and retail banking.

- TRS and revenue differences between the fourth, third, and second quartiles were marginal.

In short, the potential for design-driven growth is enormous in both product- and service-based sectors. The good news is that there are more opportunities than ever to pursue user-centric, analytically informed design today.

Over 40 percent of the companies surveyed still aren’t talking to their end users during development. Just over 50 percent admitted that they have no objective way to assess or set targets for the output of their design teams.

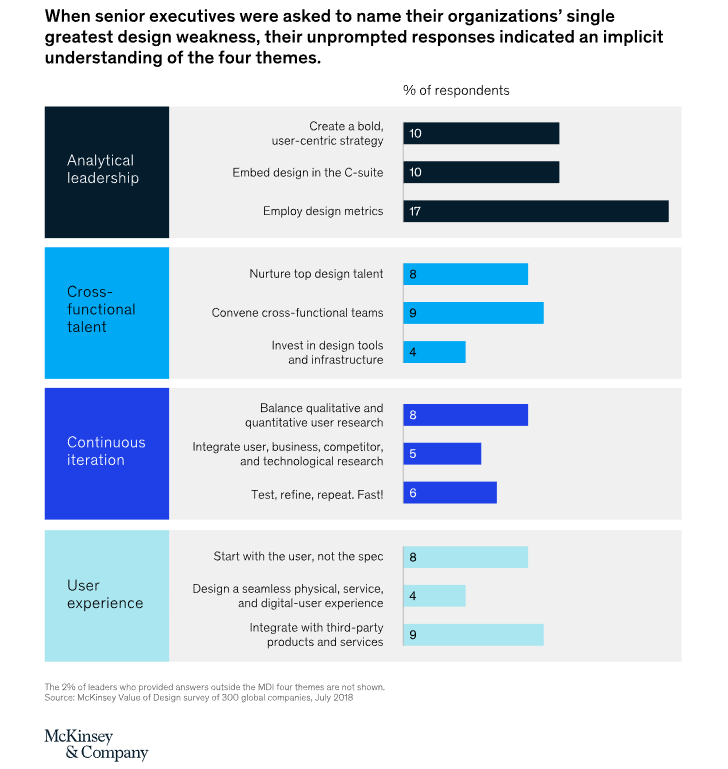

Top-quartile companies in design—and leading financial performers—excelled in all four areas. What’s more, leaders appear to have an implicit understanding of the MDI themes. When senior executives were asked to name their organizations’ single greatest design weakness, 98 percent of the responses mapped to the four themes of the MDI.

We realize that many companies apply some of these design practices—a strong voice in the C-suite, for example, or shared design spaces. Our results, however, show that excellence across all four dimensions, which is required to reach the top quartile, is relatively rare. We believe this helps account for the dramatic range of design performance reflected in the observed companies’ MDI scores, which were as low as 43 and as high as 92.

The diversity among companies achieving top-quartile MDI performance shows that design excellence is within the grasp of every business, whether product, service, or digitally oriented.

The McKinsey Design Index highlights four key areas of action companies must take to join the top quartile of design performers. First, at the top of the organization, adopt an analytical approach to design by measuring and leading your company’s performance in this area with the same rigor the company devotes to revenues and costs. Second, put the user experience front and center in the company’s culture by softening internal boundaries (between physical products, services, and digital interactions, for example) that don’t exist for customers. Third, nurture your top design people and empower them in cross-functional teams that take collective accountability for improving the user experience while retaining the functional connections of their members. Finally, iterate, test, and learn rapidly, incorporating user insights from the first idea until long after the final launch.

Reflexive Analysis

The later half of the article goes into more detail of what these findings may mean, and I will echo them here.

The best performing companies were ones that allowed for designers to be in positions of leadership and decision-making. McKinsey noticed that stagnant companies like T-Mobile had a current CEO with the personal motto: “shut up and listen.” Contrastingly, more loved and successful companies such as IKEA and Pixar are integrating customer feedback sessions with higher-ups, the “dethroning” of the C-suite, and narrowing of the administrative gap.

McKinsey deduced that the user-experience is just as valuable as the product being sold, Walt Disney World being the quintessential example. What’s notable, however, is their emphasis on leaning into the future of smartphones and the digital/automated spaces. Companies must combine physical products, digital tools, and “pure” services to maximize customer retention.

Design departments aren’t treated with the same respect as the engineering and marketing departments, and this gap of haughty pretention isolates the designers as aloof creatives, dismissing their necessity in company-wide systems. Cooperation and collaboration was a sign of success, McKinsey found. We must overcome isolationist tendencies!

A baffling 50 percent of the companies interviewed claimed they had not conducted user research before generating their first design ideas or specifications. McKinsey points out the inherent learning, testing, and iteration phases of design that facilitate good end goals. Despite the value of iteration, almost 60 percent of companies they used prototypes only for internal-production testing, late in the development process (compared to better performing companies prototyping from the start, constantly). The best results come from constantly blending qualitative and quantitative research.

Sheppard, Benedict, et al. The business value of design. Simon & Schuster, 25 Oct. 2018. McKiney Quarterly. McKinsey & Company, www.mckinsey.com/business-functions/mckinsey-design/our-insights/the-business-value-of-design. Accessed 13 Sept. 2022.