Published by: The Organization for Economic Cooperation and Development (OECD)

Date: May 07, 2020

Link: https://www.oecd.org/education/pisa-2018-results-volume-iv-48ebd1ba-en.htm

Source: OECD (2020), PISA 2018 Results (Volume IV): Are Students Smart about Money?, PISA, OECD Publishing, Paris,

https://doi.org/10.1787/48ebd1ba-en.

Introduction

Before delving into the results, OECD states that, in general, financial literacy is closely related to the user’s ability to navigate general subjects and matters of knowledge. Users will not be able to take the first steps in understanding their financial affairs without proficiently being capable of understanding their relevant subject work such as contracts or transactions.

Introducing financial literacy in school

In 2005, OECD provided a recommendation that emphasizes the importance of introducing essential life skills of handling and understanding money into their regular curricula as early as grade school before they enter the finance world of adulthood. Since this proposal, schools in countries such as Australia, Canada, Estonia, Finland, Georgia, and Indonesia have already been taking steps to implement these subject matters into their curriculums. Although some countries such as Estonia have introduced new optional economic or entrepreneurship courses, other countries such as Australia, to avoid overloading their curriculum, have extended other coursework such as Mathematics and Social Science to connect them with finance-related content.

How did students perform in financial literacy in PISA 2018?

This study closely examines the performance of 15-year-old students across 20 countries and economies that took part in the PISA (Programme for International Student Assessment) 2018 financial literacy assessment. The assessment is scored based on the difficulty of the problem and how proficiently the test taker answers the questions.

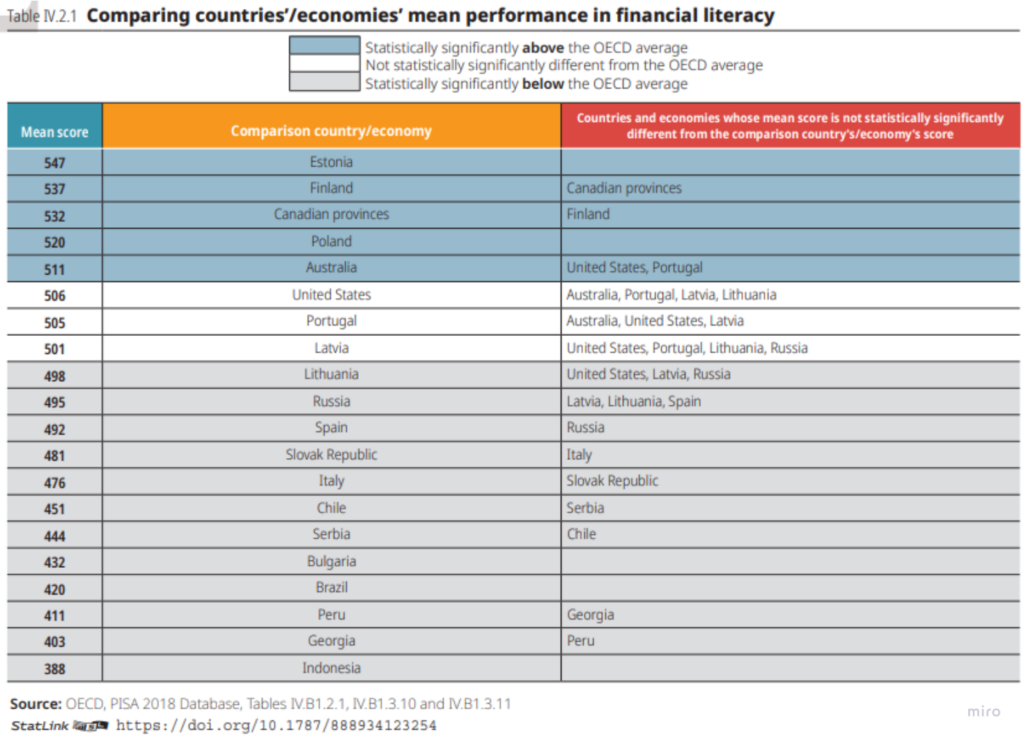

Below in table IV.2.1 are the results of the assessment: the left row of numbers represents the average score between each country as a whole. The average financial literacy score among the 20 countries was 478 with Estonia scoring the highest and Indonesia the lowest with a difference of 159 points.

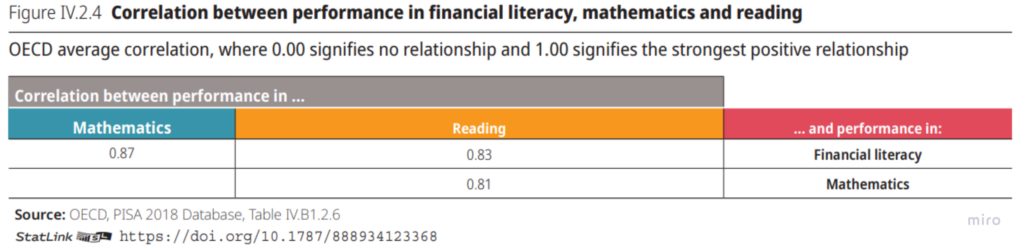

Tracing back to the correlation between general education (mathematics and reading in this case) and the financial literacy performance in each country, the two subjects show a highly positive relationship (Figure IV.2.4). OECD points out an observable pattern between this correlation with the 15-year olds with high performing financial literacy also top performers in mathematics (top 60%) and reading (top 51%).

Analysis

As this reading dealt with a diverse list of countries, it was insightful to understand the range of how different countries implement finance courses into their curricula. It also strengthens my hypothesis of with how finance being such a relevant topic, students shouldn’t have to wait until older to be educated on the topic but it should rather be something closely invested from an adolescent age. Additionally, understanding that there is a close relationship between other academic factors such as mathematics and reading can greatly translate into how successful the final outcome of our project might be. Either these factors will need to be an essential factor in the final product to indirectly improve financial literacy or by going out of my way to omit these factors, students with weaknesses in these areas could still effectively carry out the activities.