Through my research on science & technology in and outside of banking, I discovered that many technological processes, such as AI, data analytics, VR, biometrics, and much more are “revolutionizing” our world and the banking industry. What I also discovered is that many older adults have differing needs and opinions surrounding this technology. For instance, data analytics within banking mobile apps are efficient and exciting, but what if an older adult cannot understand how to work their mobile banking app to begin with? Or what if they do not have access to their own technology for whatever reason (affordability, knowledge, confidence etc.)? It made me want to design something utilizing the technology but in a more inclusive format for older adults. So that I can bring them into the future, without them falling behind.

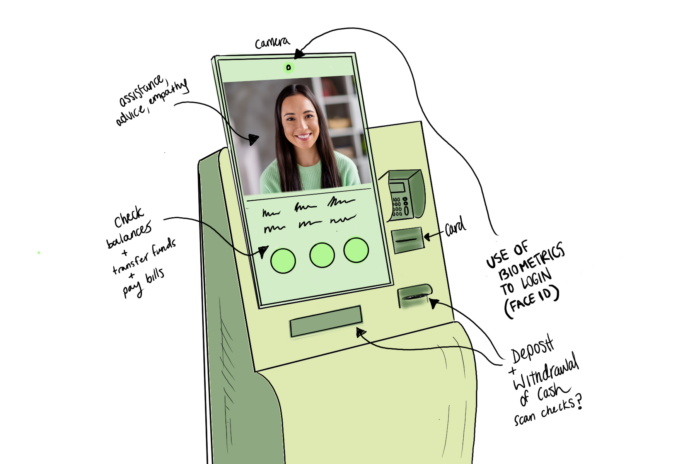

What this led to is a Community Banking Kiosk. As in a banking kiosk that could exist in a private environment within a place or community, and not require the user to have to purchase the technology on their own. This kiosk would allow older adults to complete any task that they can in-person, online, or through an ATM, such as receiving financial advice, transferring funds, making deposits/withdrawals, scanning/uploading documents, and troubleshooting. It would use biometrics to log them in, such as Face ID, so that they can get in easy and then receive assistance from a teller. They can interact with the teller face to face and have them complete specific tasks for them. If there are no tellers available at the moment, which we would do our best to prevent, the user can be contacted by call/text/email when there is an opening. The language and user interface would be enlarged, and simplified, with voice/text-to-speech options to accommodate those with vision or hearing impairments and those who are overwhelmed by current options. It will be to allow the user to complete only the things they want to accomplish, without being overwhelmed by all other products/services out there.

Analysis: In presenting this conjecture to older adults, it is recognized that many factors need to be fleshed out with this option. For instance, security, and making sure the banking kiosks will be safe and private where they are, along with cost of installment and operation will need to be considered. Just as important, we will need to consider the onboarding process, and if that should occur in an in-person format and how that will realistically look. We will also need to determine scheduling, and how users will know when and if tellers are available.