“People with disabilities are a large and diverse community. One in four adults in the United States has a disability, totaling 67 million people1—and counting, as the US population ages and chronic conditions among the nonelderly are becoming more common.2 For many people with disabilities, financial insecurity can compound the challenges they face. As of 2021, the median earnings for people with disabilities were more than 37% lower than people without a disability.3 Also, people with disabilities are twice as likely to be unemployed than people without a disability,4 and the poverty rate among people with disabilities is two times higher.5

To understand the challenges people with disabilities may face in their banking experiences and what banks can consider to better serve their needs, the Deloitte Center for Financial Services conducted a survey of 1,000 people with disabilities and 1,000 caregivers in May and June 2022. Our research shows that, by adopting an equity-centered design philosophy and channeling the experiences, sensibilities, and perspectives of their employees with disabilities and their allies, banks can create more targeted products and more customer-friendly experiences. Here’s what they can do:

Elevate financial well-being with innovative products and tools

People with disabilities are often hit by a double whammy of higher expenses and lower income. Our survey shows nearly half (42%) of respondents with a disability struggle to pay their health care and living costs. For many of these respondents, long-term goals such as saving for retirement, investing money, or taking out a mortgage to buy a home do not feature among their top goals.

Banks can play a key role in helping people with disabilities save more and improve their financial well-being. In addition to tailoring their existing products to better serve this population, banks can collaborate with health care providers to expand their debit and credit card offers to reward spending on health care.6 They could also offer personal financial management tools tailored to people with disabilities, and look for ways to bolster the financial well-being of their caregivers.

Empower through information and advice

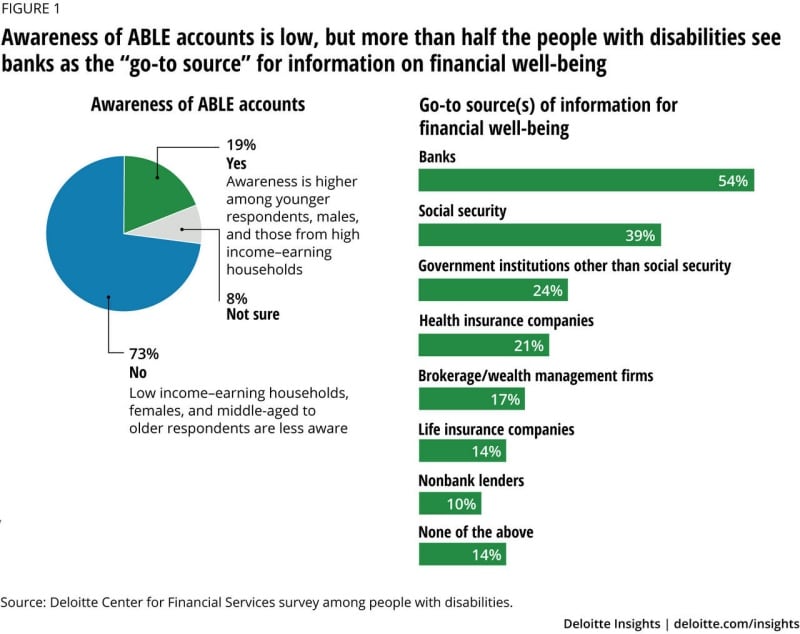

Financial empowerment is not likely to happen without financial knowledge. Take ABLE accounts, for instance: Nearly three-quarters of respondents with disabilities in our survey are not aware of ABLE accounts, let alone their eligibility as a beneficiary of one (figure 1).

Banks have an opportunity to amplify their financial literacy programs for people with disabilities and their caregivers. Currently, 54% of respondents with disabilities in our survey consider banks to be their go-to source of information for most things related to financial well-being. This ranks higher than other institutions, including government agencies or insurance, or wealth management companies. Enabling financial knowledge through digital channels should be a key priority to help maximize reach, and also minimize costs. Banks can work on demonstrating greater empathy and deliver more personalization by making the day-to-day customer interactions at the branch or via the call center more “human.””

Analysis: This Deloitte article is both informative and insightful as it provides statistics about people with disabilities and their surveyed banking experiences, along with some great insights on what can be done to improve it. People utilize banks to handle their money, learn about their money, get loans, and so much more. These experiences are heavily impacted if a person is able-bodied or not. As this article teaches, many of those with disabilities have negative experiences with the bank whether its discrimination for being considered for a line of credit or being able to go in-person to interact with bankers and take out money. It poses the question of how we as designers can better inform those with disabilities about their finances, along with how we can nudge banks to be more inclusive with their customers and their money. Overall, it emphasizes the need to create a better, more equitable relationship between customers and their bank.

Citation:

Valenti, J., Davis, C., Srinivas, V., & Wadhwani, R. (2023, May 9). How-and why-banks can

better serve people with disabilities. Deloitte Insights.

https://www2.deloitte.com/us/en/insights/industry/financial-services/accessible-banking-

for-disabled.html